Mastering Excel Balance Sheets: A Beginner's Guide

The use of spreadsheets, especially Microsoft Excel, has revolutionized how we manage financial data, enabling the automation of complex financial calculations like balance sheets. A balance sheet, integral to financial reporting, provides a snapshot of a company's financial health at any given time, displaying its assets, liabilities, and equity. Whether you're managing personal finances or running a business, understanding how to create and analyze a balance sheet in Excel is crucial. This guide will walk you through the steps to set up and master Excel balance sheets, making financial management both accessible and efficient.

Understanding the Balance Sheet

Before delving into Excel, let’s break down what constitutes a balance sheet:

- Assets: Everything the company owns that has value, from cash to property.

- Liabilities: All the financial obligations or debts the company owes.

- Equity: What’s left when you subtract liabilities from assets; it’s the net worth of the business.

The equation to remember is Assets = Liabilities + Equity, which must always balance.

Setting Up Your Excel Balance Sheet

Here’s how to set up your balance sheet in Excel:

- Open Excel: Start with a new spreadsheet.

- Format Your Worksheet:

- Merge cells and apply headers like “Balance Sheet” for clarity.

- Set column headers such as ‘Assets’, ‘Liabilities’, and ‘Equity’.

- Define Your Categories:

- Under ‘Assets’, list items like Cash, Accounts Receivable, Inventory, etc.

- Similarly, list categories for Liabilities and Equity.

- Enter Your Data: Begin inputting the financial figures in their respective categories. This can be manually entered or pulled from other financial data sources.

- Use Formulas: Excel shines with formulas; here are some to use:

- SUM(): To total each category’s figures.

- =SUM(B2:B10): Add up your assets, liabilities, and equity totals.

- =B10-C10: Check if your balance sheet balances.

- Formatting for Clarity: Use formatting tools like bold text, colors, and borders to make your balance sheet easy to read and professional-looking.

Advanced Features in Excel for Balance Sheets

Excel offers numerous features to enhance your balance sheet management:

- Conditional Formatting: Automatically highlight discrepancies or trends in your data.

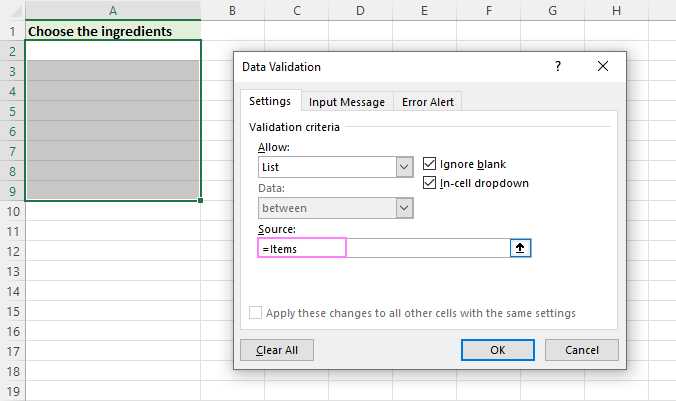

- Data Validation: Ensure the integrity of your data with dropdowns or input restrictions.

- Charts and Graphs: Visualize your financial data over time.

- Macros: Automate repetitive tasks like data entry or formatting.

- PivotTables: Analyze large datasets or compare balance sheets over different periods.

Maintaining and Updating Your Balance Sheet

Your balance sheet should be a dynamic document, reflecting your financial situation accurately:

- Regular Updates: Update your figures regularly to keep the balance sheet current.

- Linking Data: Consider linking data from other sheets or financial software for real-time updates.

- Error Checks: Use Excel’s tools like ‘Error Checking’ to spot and correct mistakes.

📝 Note: Ensure the confidentiality of financial data by protecting sensitive sheets with passwords or restricting access where necessary.

Having a well-maintained Excel balance sheet not only simplifies financial reporting but also equips you with the tools to make informed financial decisions. Excel's versatility and power turn what could be a mundane task into an insightful financial management tool, offering clarity and control over your finances.

What is the basic structure of a balance sheet?

+

The basic structure of a balance sheet consists of three main sections: Assets, Liabilities, and Equity. The balance sheet equation is Assets = Liabilities + Equity, which ensures the balance is maintained.

How do I ensure my balance sheet balances?

+

Your balance sheet balances when the sum of your liabilities and equity equals the total assets. Use Excel formulas like =B10-C10 to check this manually, and ensure all entries are correctly categorized.

Can I automate balance sheet updates in Excel?

+

Yes, you can automate updates in Excel using features like linking data from other sheets, macros for repetitive tasks, or even integrating with external financial software for real-time updates.