5 Easy Steps to Create a Balance Sheet in Excel

Managing finances is crucial for any business, whether it's a small startup or a well-established enterprise. One of the fundamental tools in financial analysis is the balance sheet. It provides a snapshot of a company's financial position at a specific point in time, showing what the company owns (assets), owes (liabilities), and the value of shareholders' equity. While this may seem daunting at first, creating a balance sheet in Excel can be simplified into five easy steps. Let's delve into how you can effectively compile your financial data into an Excel balance sheet.

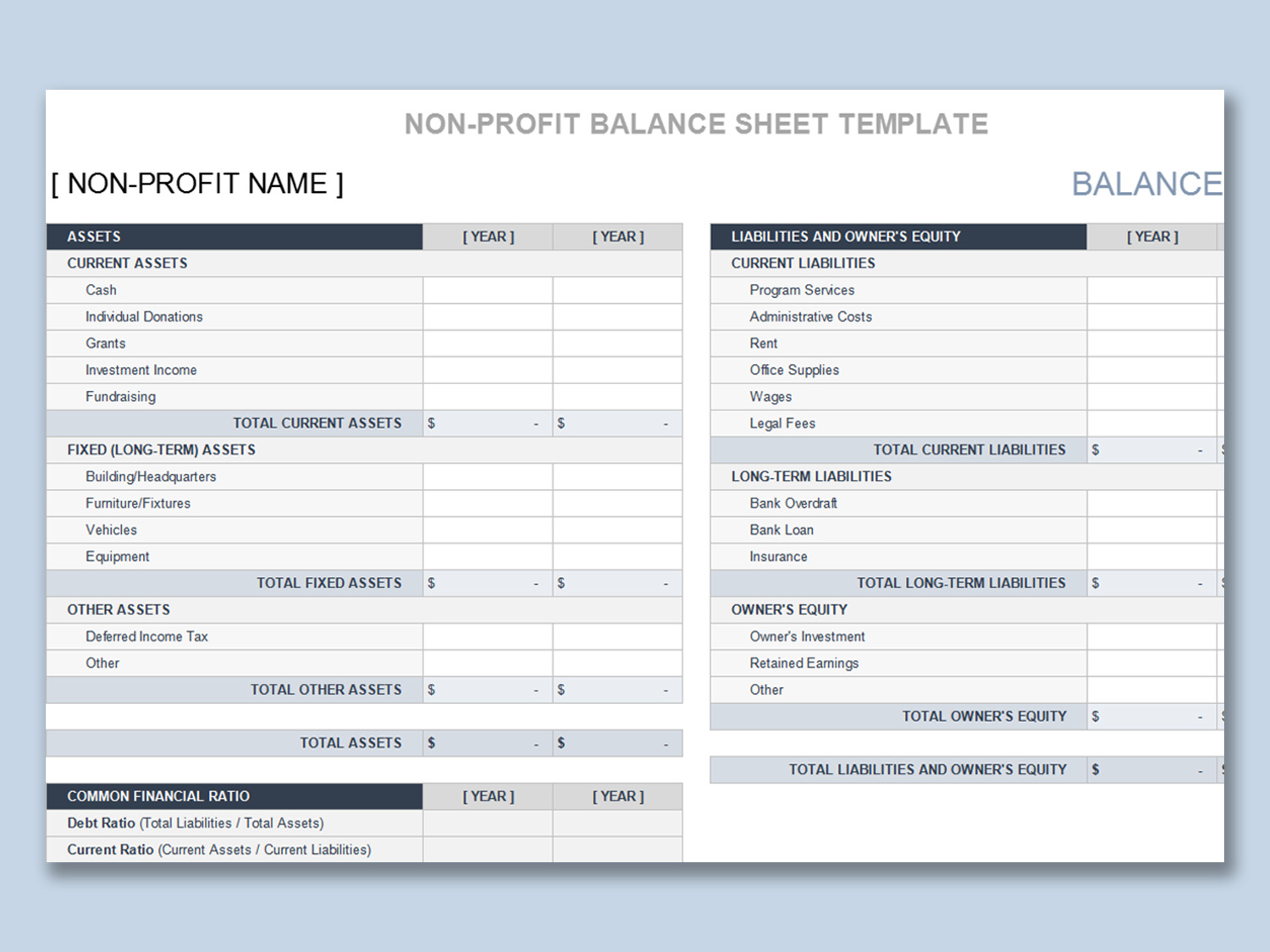

Step 1: Set Up Your Spreadsheet

Begin by opening Microsoft Excel or Google Sheets and setting up the basic framework for your balance sheet:

- Create three columns: one for Assets, one for Liabilities, and one for Equity.

- Add headers to each column to make your document clear and navigable. Use bold formatting for headers.

- Set up rows for each type of item under these categories. For example, under assets, you might list Cash, Accounts Receivable, Inventory, etc.

🛠️ Note: Ensure the balance sheet is formatted consistently with other financial statements for clarity and professional presentation.

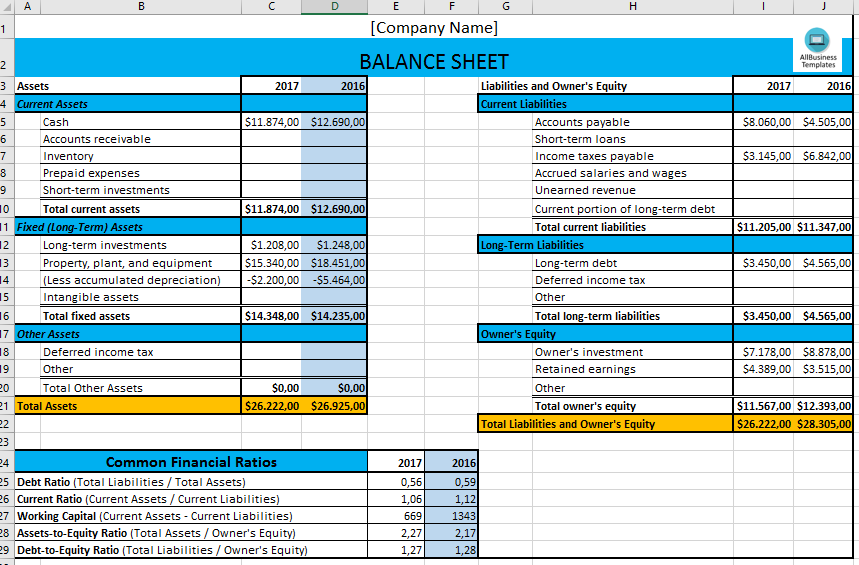

Step 2: List and Categorize Your Assets

Assets are everything your company owns that has value. Here’s how to list them:

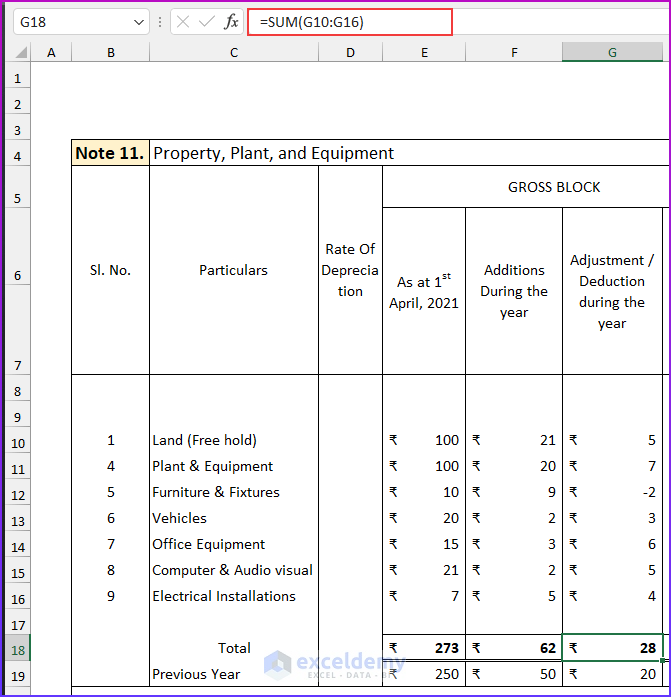

- Start with current assets which are likely to be converted into cash within a year. This includes cash, accounts receivable, inventory, and short-term investments.

- Then move to fixed or long-term assets, which are things like property, plant, equipment (PPE), and intangible assets like patents or copyrights.

- Enter the value of each asset in the Assets column, making sure to separate the current from non-current assets for easier readability.

Step 3: Record Your Liabilities

Liabilities represent what your business owes, which can include:

- Current liabilities: debts due within one year, like accounts payable, short-term loans, taxes owed, or wages payable.

- Long-term liabilities: these are obligations payable over a longer term, such as long-term loans or deferred revenue.

Add these liabilities under the Liabilities column, ensuring a clear distinction between short-term and long-term items for a more precise financial analysis.

Step 4: Calculate Your Equity

Equity is what’s left after liabilities are subtracted from assets. Here’s how to calculate it:

| Formula | Equity = Total Assets - Total Liabilities |

|---|---|

| Steps | 1. Sum up all assets. 2. Sum up all liabilities. 3. Subtract the total liabilities from total assets to find equity. |

Input this value under the Equity column. Remember to account for retained earnings or additional paid-in capital if applicable.

Step 5: Ensure Balance and Accuracy

The key principle of a balance sheet is that it must balance, meaning:

- Assets = Liabilities + Equity

Using Excel’s formula functions, sum your Assets column and your Liabilities & Equity column separately. Then, check if the totals are equal:

- If they’re not, double-check your entries for accuracy. Common mistakes include incorrect categorization, missing entries, or calculation errors.

- Use color coding or conditional formatting in Excel to highlight discrepancies for quick corrections.

⚠️ Note: Regularly updating and balancing your balance sheet is crucial as it reflects the health of your business and influences financial decisions.

In summarizing our journey through creating a balance sheet in Excel, we've not only learned the basic steps but also the importance of accuracy and categorization. By setting up your spreadsheet, listing assets and liabilities, calculating equity, and ensuring balance, you can create a valuable tool for financial analysis and decision-making. This process not only helps in understanding where your business stands financially but also serves as a basis for planning future growth and identifying areas that need attention. With these easy steps, you're well on your way to managing your business's financial health effectively.

Why is it important to separate current and non-current assets and liabilities?

+

It helps in understanding liquidity and the financial stability of the company over different time frames. Current items are those that will be converted or settled within a year, while non-current items are long-term, affecting long-term planning and investment.

Can I use this balance sheet for tax purposes?

+

While a balance sheet provides valuable information for tax calculations, it should be used in conjunction with income statements and other financial documents. Always consult with a tax professional for compliance with local tax regulations.

What should I do if my balance sheet does not balance?

+

If your balance sheet doesn’t balance, review your entries for accuracy. Check for any double entries, incorrect categorizations, or calculation errors. Excel’s error-checking features can help identify these issues.