5 Simple Steps to Create a Balance Sheet in Excel

Maintaining a clear and accurate balance sheet is crucial for any business to understand its financial health. A balance sheet offers a snapshot of your company's assets, liabilities, and equity at a particular point in time. Excel, with its versatile tools and functions, provides an excellent platform for constructing a balance sheet that is both functional and visually organized. In this blog post, we'll guide you through the process of creating a balance sheet in Excel in just five simple steps.

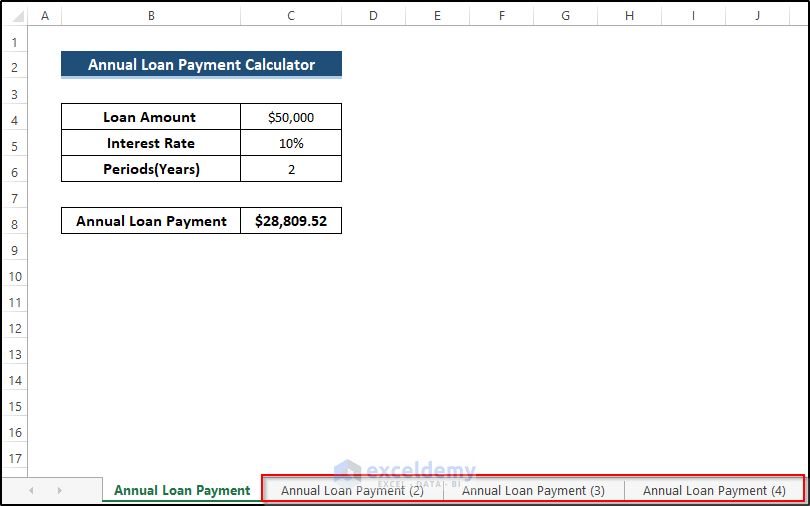

Step 1: Setup Your Excel Workbook

The first step to creating a balance sheet in Excel involves setting up your workbook to ensure that everything is in place:

- Open a new Excel workbook.

- Save your workbook with an appropriate name related to your company or the balance sheet period, e.g., "Q1_2023_Balance_Sheet.xlsx".

- Create three new sheets, naming them "Assets", "Liabilities", and "Equity".

- Consider adding a "Summary" sheet for the final balance sheet overview.

By organizing your workbook into different sheets, you streamline the process of data entry and keep related information grouped together, enhancing readability and reducing errors.

Step 2: Enter Your Assets

Navigate to the "Assets" sheet:

- List all current and non-current assets in columns:

- Current Assets: Cash, accounts receivable, inventory, short-term investments, etc.

- Non-Current Assets: Property, plant, equipment, intangible assets like patents, long-term investments, etc.

- Enter the values for each asset category. Ensure you have correct valuations, perhaps by using book value or fair market value where appropriate.

- Total each section and sum up all the assets at the bottom of the sheet.

| Asset Category | Value |

|---|---|

| Current Assets | $150,000 |

| Non-Current Assets | $250,000 |

| Total Assets | $400,000 |

📝 Note: Be meticulous with the categorization of your assets. Misclassification can lead to an inaccurate balance sheet, potentially affecting financial decisions.

Step 3: Detail Your Liabilities and Equity

Move to the "Liabilities" sheet:

- Categorize your liabilities:

- Current Liabilities: Accounts payable, short-term loans, accrued expenses, etc.

- Non-Current Liabilities: Long-term debt, deferred tax liabilities, etc.

- Enter the amounts corresponding to each liability.

- Calculate the total liabilities.

Then proceed to the "Equity" sheet:

- List equity items:

- Common stock

- Retained earnings

- Additional paid-in capital

- Other comprehensive income

- Sum up these amounts to get the total equity.

💡 Note: The sum of liabilities and equity should equal the total assets. If they don't match, review your entries for discrepancies.

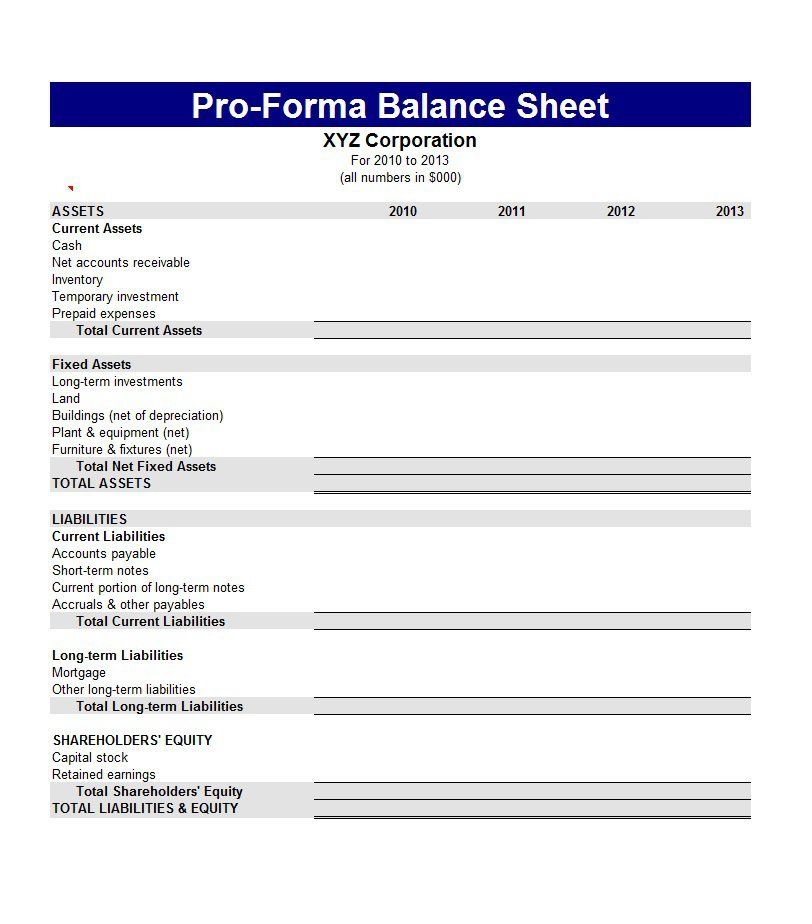

Step 4: Formulate Your Balance Sheet on the Summary Sheet

Now, to bring everything together:

- Go to your "Summary" sheet.

- Use formulas to pull data from the other sheets:

- Total Assets from the "Assets" sheet

- Total Liabilities from the "Liabilities" sheet

- Total Equity from the "Equity" sheet

- Create a formatted table on this sheet to display:

- Assets

- Liabilities

- Equity

- Ensure that the sum of liabilities and equity equals the total assets, as this is the core equation of the balance sheet.

Here's an example of how you might format the summary sheet:

| Section | Amount |

|---|---|

| Assets | =Assets!B15 |

| Liabilities | =Liabilities!B12 |

| Equity | =Equity!B8 |

| Total Liabilities and Equity | =Liabilities!B12 + Equity!B8 |

🔍 Note: Formulas should always be checked for accuracy. Any discrepancy can affect your company's financial insights.

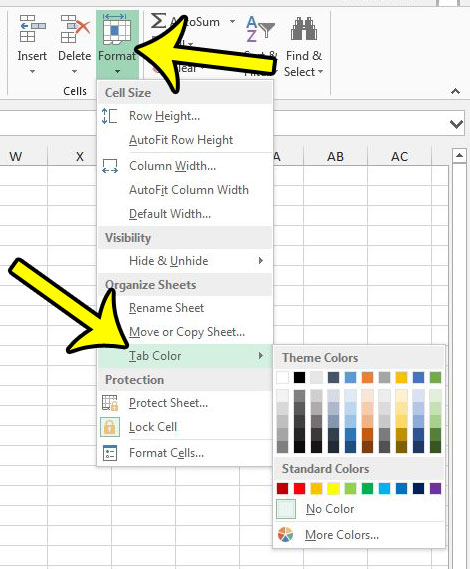

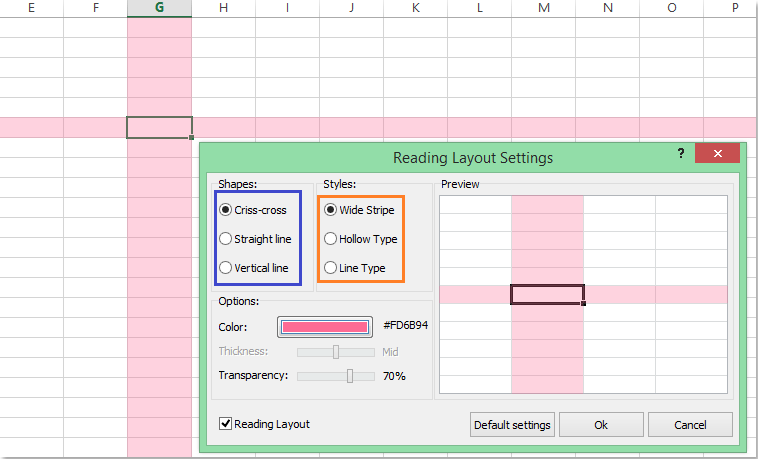

Step 5: Polish and Present Your Balance Sheet

Now that you have the core balance sheet data, it's time to refine and present it:

- Formatting: Apply formatting to make the balance sheet visually appealing. Use fonts, colors, and borders to separate sections clearly.

- Verification: Ensure all figures reconcile correctly. Check for any errors in calculations or data entry.

- Add Headers and Footers: Include company name, the reporting period, and perhaps a disclaimer.

- Print Preview: Review how your balance sheet will appear when printed or shared digitally.

- Save and Share: Save your final balance sheet as a PDF for easy distribution or sharing within your company.

With these steps completed, you have created a fully functional balance sheet in Excel that provides valuable insights into your business's financial health.

Creating a balance sheet in Excel is not just about listing numbers; it's about understanding the financial position of your business at a glance. The process involves meticulous data entry, categorization, and reconciliation. By using Excel for this task, you benefit from its advanced features like formulas for automatic calculations and the ability to organize and analyze data efficiently. This balance sheet will serve as a critical tool in strategic decision-making, financial reporting, and investor communication. Remember, the precision of your balance sheet depends on the accuracy of the underlying data. Regular updates and reviews will ensure that it remains a reliable tool for your business operations.

Why is it important to keep my balance sheet updated?

+

An updated balance sheet reflects the current financial health of your business, aiding in timely decision-making, tracking financial progress, and meeting legal or regulatory requirements.

Can I use an existing Excel template for my balance sheet?

+

Yes, Excel offers various templates for balance sheets. These can provide a starting point or structure, but you should customize them to fit your business’s unique needs and ensure the accuracy of your data.

How often should I create or update my balance sheet?

+

It’s good practice to update your balance sheet monthly for internal management purposes, but for external reporting, it might be quarterly or annually, depending on the size and requirements of your business.