Essential Old Job Paperwork You Should Retain

Retaining essential documents from your previous job can be beneficial for various reasons, including tax purposes, legal protection, and professional development. Here are some of the key types of paperwork you should consider keeping:

Employment Agreements and Contracts

It’s essential to keep records of all employment agreements and any contract modifications. These documents outline:

- Your job role and responsibilities.

- Compensation details, including salary, bonuses, and benefits.

- Termination conditions.

- Non-compete and confidentiality clauses.

They can be invaluable for:

- Referencing in case of disputes.

- Understanding your obligations post-employment.

⚖️ Note: Always have legal counsel review any contract before signing or resigning.

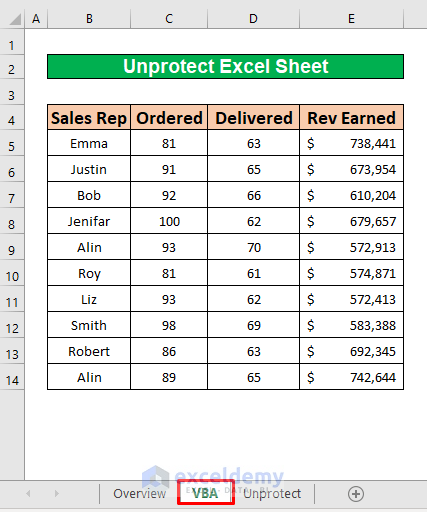

Pay Stubs and W-2 Forms

Keep your pay stubs and W-2 forms for at least three to seven years, as these are critical for:

- Tax filings: Ensure accurate reporting of income and deductions.

- Proof of employment: When applying for loans or social services.

- Discrepancy resolution: In case of any issues with your employer.

💼 Note: Pay stubs also help in tracking your earnings and deductions for personal budgeting.

Performance Reviews and Appraisals

Performance reviews are important for:

- Professional growth: Reflect on feedback to improve skills.

- Reference material: For future job applications to showcase your career progression.

- Evidence of performance: In cases of disputes regarding your work quality or promotions.

Benefit and Pension Plan Documents

If you have or had benefits through your employer, such as:

- Health insurance.

- Retirement plans (like 401k).

- Life insurance.

Keep records of:

- Plan details and your contributions.

- Policy documents.

- Vesting schedules for retirement plans.

🏦 Note: Retaining these documents ensures you know what you’re entitled to, especially for ongoing benefits or retirement.

Termination Documents

In the event of job termination, keep:

- Severance agreements.

- Termination letters or emails.

- Records of final pay or any compensation received.

These documents are vital for:

- Legal defense in case of wrongful termination or disputes.

- Unemployment insurance claims.

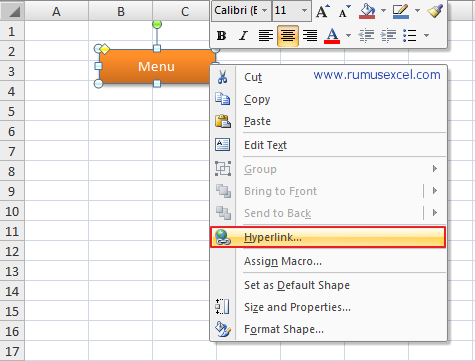

Ensuring that you have these documents well-organized can prevent future headaches, provide necessary proof when needed, and help you make informed decisions regarding your career. Whether it's for tax purposes, legal protection, or personal reflection, these records are valuable. Remember, while the temptation to purge old paperwork can be strong, knowing what to keep and for how long can save you from potential troubles down the line.

When navigating the end of an employment period or transitioning to new opportunities, having the right documentation at your fingertips can make the process smoother, ensuring you're covered for both short-term and long-term needs.

How long should I keep my employment-related paperwork?

+

Most employment-related documents should be retained for at least three to seven years, or indefinitely if they could have long-term implications like pension plans or legal disputes.

What do I do if I suspect my records are incomplete?

+

Contact your former employer’s HR department or reach out to any record-keeping department they might have. Sometimes, digital records might still be accessible.

Can I request a W-2 form from an employer after I’ve left?

+

Yes, you can request a W-2 or an equivalent document for the years you were employed. If they fail to comply, you might need to contact the IRS or local tax authorities.

Are digital copies of documents as valid as hard copies?

+

Yes, digital copies are generally accepted as long as they are clear, legible, and properly labeled. However, for legal or official purposes, some entities might still request physical documents.

What if my former employer refuses to give me my employment records?

+

You might need to escalate the issue to a labor board or consult with an employment lawyer, especially if you believe these records are crucial for legal reasons or benefits.