5 Steps to Master Bank Reconciliation in Excel

The process of bank reconciliation is crucial for ensuring that your financial records align with the statements provided by your bank. By mastering this process in Excel, businesses and individuals can achieve greater accuracy in their financial tracking and reporting. In this post, we'll guide you through five essential steps to master bank reconciliation using Excel, making this potentially daunting task much more manageable.

Step 1: Understanding the Basics

Before diving into Excel, it’s important to grasp what bank reconciliation entails:

- Reconcile: To check and match the transactions listed in your company’s records with the bank statement.

- Bank Statement: A document detailing all transactions in an account over a period.

- Outstanding Items: Transactions that have been recorded in your books but not yet cleared by the bank.

Step 2: Setting Up Your Excel Workbook

To begin, set up your Excel workbook properly:

- Create a new Excel workbook or open an existing one where you track finances.

- On the first sheet, name it “Bank Reconciliation” or something similar.

- Set up columns for Date, Description, Reference, Debit, Credit, and Balance.

📌 Note: Ensure each column has enough width to display information clearly.

Step 3: Importing Bank Statements

Importing your bank statement into Excel can be done in several ways:

- Download and Copy-Paste: Many banks allow you to download statements in CSV or Excel format. Copy and paste this data into your Excel sheet.

- Automated Import: Use Excel’s external data feature to connect directly with your bank’s online statements.

💡 Note: Be cautious with sensitive information and ensure you're complying with data protection regulations when importing statements.

Step 4: Reconciliation Process

Now, you’ll compare your ledger to the bank statement:

- Mark Cleared Transactions: As you compare, mark each transaction that has cleared the bank with a unique identifier like a “C” or checkmark in a new column.

- Identify Discrepancies: Note any differences between your ledger and the bank statement, such as unrecorded transactions or bank charges.

- Add Adjustments: Use formulas to add or subtract any missing transactions or errors found during the reconciliation.

| Date | Description | Amount | Bank Statement | Ledger Balance | Cleared (Y/N) | Difference |

|---|---|---|---|---|---|---|

| 01/10/2023 | Sale | $1,000 | $1,000 | $1,000 | Y | $0 |

| 02/10/2023 | Bank Charge | $15 | $0 | $985 | N | -$15 |

Step 5: Finalizing and Reviewing

After matching entries:

- Check the balance of your bank statement against your Excel reconciliation sheet to ensure they match.

- Adjust for Timing Differences: Sometimes transactions recorded on one day in your books might clear on the next in the bank statement.

- Review any outstanding or unmatched items. These should be investigated further if necessary.

- Make any final adjustments needed to bring the two balances in line.

By mastering these steps, you can ensure that your records are always up-to-date, accurate, and in sync with your bank. This process not only helps in maintaining financial health but also simplifies audit processes and can save you from potential errors or fraud. Remember, regular reconciliation is key to financial integrity and making informed business decisions.

Why is bank reconciliation necessary?

+

Bank reconciliation is essential to detect errors, prevent fraud, and ensure that your business’s financial records are accurate. It also helps in catching discrepancies between what the bank reports and what your internal records show.

Can bank reconciliation be automated in Excel?

+

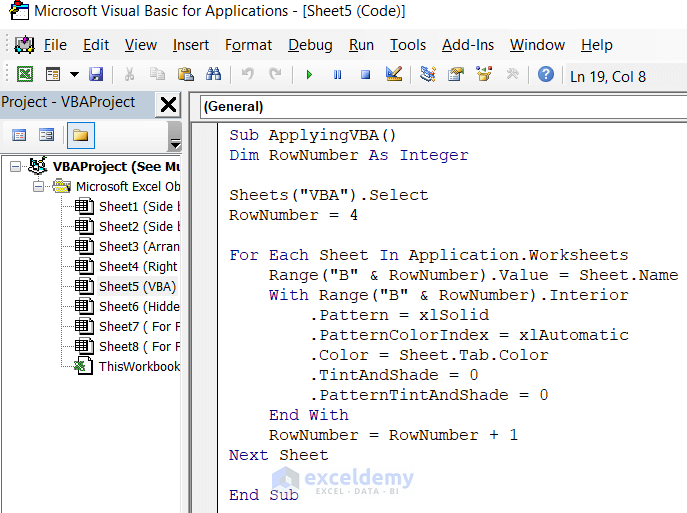

Excel can automate some aspects of bank reconciliation, like matching transactions by date or amount, but human oversight is often still necessary to ensure accuracy and to reconcile discrepancies. Excel macros or additional tools can be employed to streamline this process.

What should I do with outstanding items?

+

Outstanding items should be investigated further to understand why they haven’t cleared. This might involve contacting the bank or reviewing the transaction details to ensure they were not lost or incorrectly recorded.