5 Simple Steps to Create a Balance Sheet in Excel

Keeping track of your financial health is not just essential for businesses but also for personal finance management. A balance sheet, one of the core financial statements, provides a snapshot of your financial position at a specific point in time. It's particularly useful for understanding what you own (assets) and what you owe (liabilities), as well as the equity you've invested in your assets. Let's dive into how you can create a balance sheet in Microsoft Excel with ease.

Step 1: Setting Up Your Excel Workbook

First, open Microsoft Excel on your computer. Start with a blank workbook. To keep everything organized, you can rename the sheets to “Balance Sheet,” “Assets,” “Liabilities,” and “Equity.”

- Right-click on the tab at the bottom and select “Rename.”

- Type in the new name for the tab and press Enter.

Step 2: Gathering Your Data

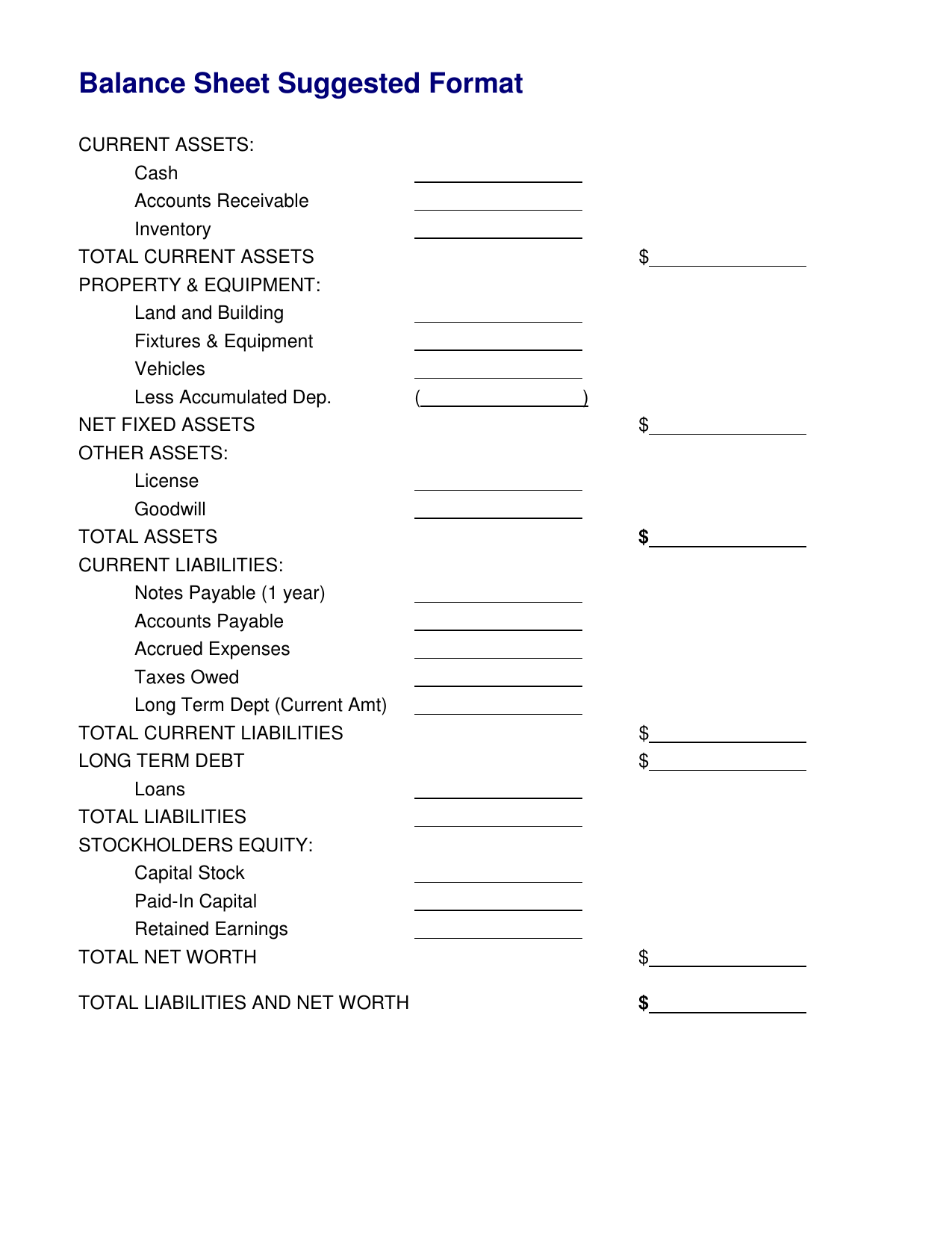

Before you can create the balance sheet, gather all the necessary financial information:

- Assets: Current assets like cash, accounts receivable, inventory, and long-term assets like property, plant, equipment, or investments.

- Liabilities: Current liabilities such as accounts payable, short-term loans, and long-term liabilities like mortgages or bonds payable.

- Equity: Owner’s equity, retained earnings, and any other equity investments.

Step 3: Entering Your Data into Excel

In your “Balance Sheet” sheet:

- Set up your header. In cell A1, write “Balance Sheet.” Style it to stand out, perhaps using bold and a larger font size.

- Below this, in cell A3, write “As of” followed by the date you’re preparing the balance sheet, e.g., “As of 01/01/2023.”

- Start listing your assets from row 5 onwards. In column A, enter categories like “Cash,” “Accounts Receivable,” “Inventory,” etc.

- In column B, enter corresponding values. Use cell B5 for Cash, B6 for Accounts Receivable, and so forth.

- Repeat the process for liabilities and equity.

Step 4: Calculating and Verifying Totals

Ensure your balance sheet balances! Here’s how:

- Sum up the total assets. In the cell where the last asset’s value ends, enter

=SUM(B5:B10)to sum the values (assuming your assets go from row 5 to 10). - Do the same for liabilities and equity.

- Verify that the sum of liabilities and equity equals your total assets. Use an Excel formula like

=IF(C25=D25, “Balanced”, “Check Entries”)where C25 and D25 are the total liabilities + equity and total assets cells, respectively.

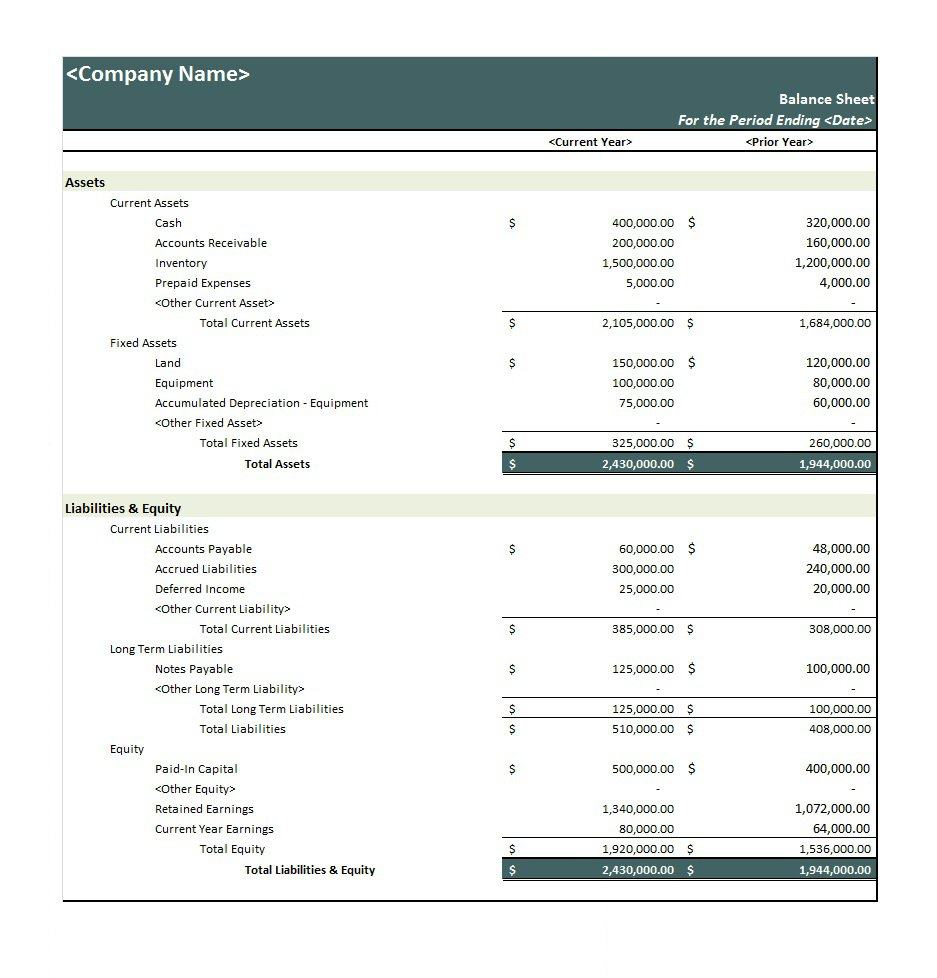

Step 5: Formatting Your Balance Sheet

Making your balance sheet visually appealing can help in understanding and presenting your financial data:

- Use different shades of colors for assets, liabilities, and equity sections for easy differentiation.

- Ensure that your fonts are consistent, using bold where necessary to highlight important figures or headers.

- Create a table with headings “Assets,” “Liabilities,” and “Equity,” and format it with Excel’s table features:

Assets Liabilities Equity Cash Accounts Payable Owner’s Equity Accounts Receivable Short-Term Loans Retained Earnings

📝 Note: To ensure accuracy, double-check all entries and calculations. Small errors can significantly skew your financial outlook.

In the end, summarizing your financial position through a balance sheet provides an invaluable overview that can guide decision-making, be it for business expansion or personal financial planning. Remember, your balance sheet should balance, which means your total assets must equal the total of liabilities plus equity. This simple yet crucial document serves not only for internal reviews but also as a statement to potential investors, creditors, or partners about your financial stability.

With these steps in mind, you can create a clear, concise balance sheet using Microsoft Excel, ensuring your financial health is tracked accurately and transparently.

Why is it important for a balance sheet to balance?

+

A balance sheet must balance because it represents the basic accounting equation: Assets = Liabilities + Equity. If it doesn’t balance, there might be errors in your entries or calculations, which could mislead financial decisions.

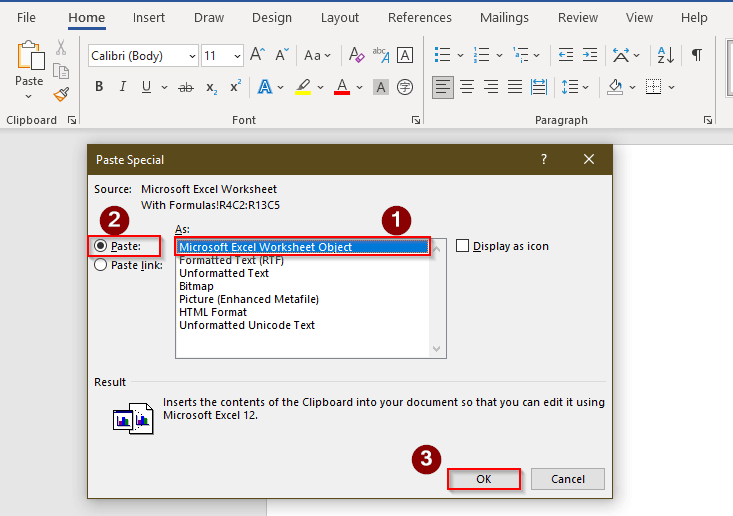

Can I use Excel templates for balance sheets?

+

Yes, Excel has templates that you can use or modify to suit your needs. Templates often come with pre-formatted tables and formulas, making it easier to input data correctly.

How often should I update my balance sheet?

+

It’s recommended to update your balance sheet at least quarterly, but for businesses with frequent changes in assets or liabilities, monthly updates might be necessary.