5 Simple Steps for Excel Mileage Expense Sheets

In today's fast-paced business environment, keeping track of your mileage expenses accurately can make a significant difference in tax deductions, expense reimbursements, and financial management overall. Whether you're a small business owner, a freelancer, or part of a larger enterprise, understanding how to effectively manage your mileage logs through Excel can save time and money. In this blog, we'll walk through 5 Simple Steps for Creating Excel Mileage Expense Sheets that are not only efficient but also compliant with standard accounting practices.

Step 1: Setting Up Your Spreadsheet

The first step in creating an effective mileage expense sheet in Excel is to set up your spreadsheet correctly:

- Column Headers: Define column headers that will capture essential information. Here's what you might include:

| Date | Starting Point | Ending Point | Purpose of Trip | Distance | Rate | Total Mileage Cost |

|---|---|---|---|---|---|---|

| 10/02/2023 | Office | Client's Location | Meeting | 30 | 0.585 | $17.55 |

🌟 Note: Ensure you set the date format to your local standard for consistency.

Step 2: Entering Your Mileage Data

With your spreadsheet headers in place, you're ready to enter the mileage data:

- Inputting Dates: Enter the date when each trip was made.

- Starting and Ending Points: Note the start and end locations for each journey.

- Purpose: Describe the purpose of the trip for record-keeping and potential audits.

- Distance: Log the total distance travelled.

- Rate: Use the IRS standard mileage rate or your company's rate.

- Total Mileage Cost: This can be an automatic calculation using Excel formulas.

🚗 Note: Some businesses might require additional columns like vehicle used or driver's name.

Step 3: Utilizing Excel Formulas for Calculations

Excel formulas are powerful tools that can streamline your mileage expense tracking:

- Total Mileage Cost Formula: In the 'Total Mileage Cost' column, enter the formula:

=E2*F2where E2 is the distance and F2 is the rate. - Summarizing Total Expenses: Use the SUM function to tally up the total cost for the period.

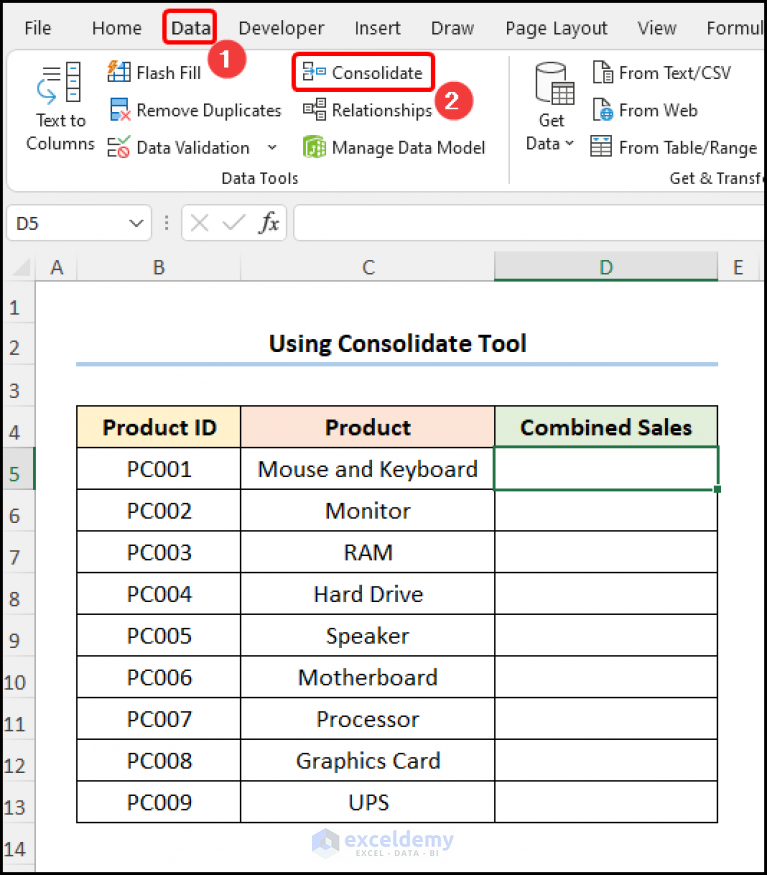

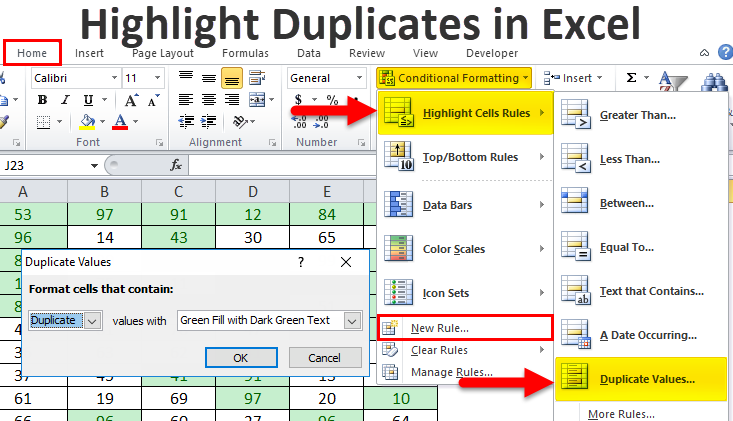

- Conditional Formatting: Apply conditional formatting to highlight important entries or outliers.

📌 Note: Excel formulas can help automate the process, reducing errors in manual calculations.

Step 4: Creating Visual Representations

Once you've entered your data and performed the calculations, visual representations can help you make sense of the information:

- Graphs and Charts: Use pie charts for showing the distribution of trips by purpose or bar charts for monthly totals.

- Geographical Mapping: If you have location data, use a third-party tool or Excel add-ins for mapping your mileage on a geographic scale.

Step 5: Periodic Review and Audit

The final step is ensuring the accuracy of your mileage expense sheet through periodic review and potential audits:

- Regular Checks: Monthly or quarterly reviews to verify data integrity.

- Reconciliation: Cross-check your records with actual fuel receipts or logs.

- Prepare for Audits: Keep detailed records and use Excel's features like data validation and protection to maintain accuracy.

🔍 Note: Periodic reviews can catch errors early, reducing the risk during tax filings or audits.

In summary, by following these 5 Simple Steps for creating an Excel mileage expense sheet, you can streamline your expense tracking process. This not only helps in saving time but also in ensuring that every mile driven for business purposes is accounted for accurately. These steps provide a structured approach to mileage management, from data entry to visual analysis, making your financial records both compliant and insightful.

What is the IRS standard mileage rate for business purposes?

+

The IRS standard mileage rate for business purposes can change each year. For example, in 2023, the rate was set at $0.585 per mile.

Can Excel mileage sheets be used for personal vehicle tracking?

+

Yes, Excel can be used to track mileage for personal vehicles as well. You can adapt the structure to include categories for personal, commuting, and business trips.

How can I make my Excel mileage sheet IRS compliant?

+

Ensure that you record all necessary details such as date, distance, purpose, and use the correct mileage rate. Keep supporting documentation like receipts or logs. Protect the data to prevent unauthorized changes and keep backups for long-term record keeping.

What are some best practices for maintaining accuracy in mileage logs?

+

Use automated tools like Excel’s data validation, record trips immediately, reconcile with fuel receipts, and perform regular reviews.

Are there any shortcuts to quickly enter data in Excel for mileage tracking?

+

Yes, shortcuts like copy-pasting templates, using Excel macros for repetitive entries, or keyboard shortcuts like Ctrl + ‘ (single quote) to repeat the last command can speed up data entry.