5 Ways to Save Your TurboTax Paperwork Easily

If you're using TurboTax for your tax preparation, organizing and saving your paperwork is a crucial step to ensure accuracy, efficiency, and peace of mind. Here are five effective strategies to manage your TurboTax paperwork effortlessly:

1. Digital Archiving

One of the simplest and most effective ways to save your TurboTax paperwork is by going digital. Here's how you can do it:

- Scan Documents: Use a high-quality scanner or a scanning app on your smartphone to convert physical documents into digital files.

- PDF Conversion: Convert images or documents into PDF format for universal readability and long-term storage.

- Cloud Storage: Utilize cloud storage services like Google Drive, Dropbox, or OneDrive to store your documents securely. Ensure you have enough storage space for multiple years' worth of tax documents.

📁 Note: Remember to use strong, unique passwords for your cloud storage accounts to protect your sensitive tax information.

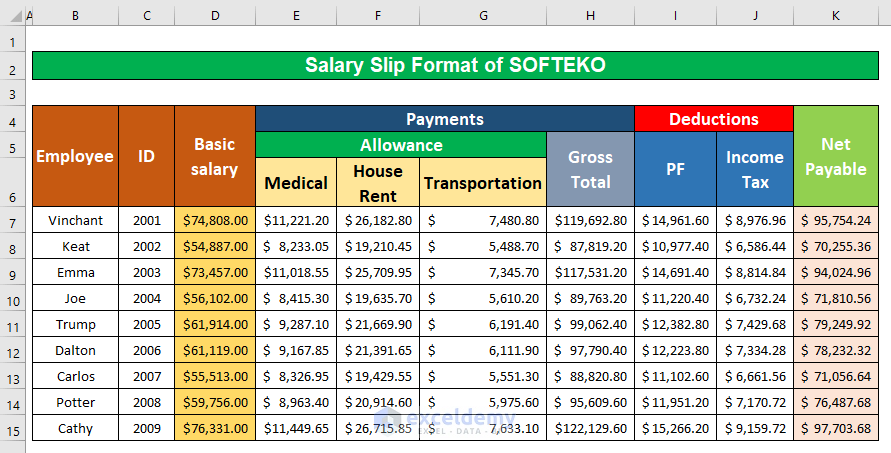

2. Structured Filing

Create a clear and organized filing system to keep your tax paperwork in order:

- Folders by Year: Set up folders for each tax year. Within these, categorize by document type such as W-2, 1099, receipts, etc.

- Naming Conventions: Use a consistent naming convention for your files, e.g., "2023_W2_EmployerName" or "2023_Receipt_PaymentType".

- Indexing: Create an index document listing all your files and their storage locations. This is particularly helpful during audit situations or when retrieving information.

3. Email Integration

Maximize the integration of email with your tax filing process:

- Email Receipts: Many vendors and service providers now email receipts directly. Save these in your designated tax folders.

- Forward Emails: Automatically forward emails with keywords like "tax", "receipt", or "invoice" into your tax preparation folder.

- Label and Filter: Use labels or tags in your email service to categorize emails related to taxes for easy retrieval.

4. Backup and Security

Protect your tax data with rigorous backup and security measures:

- Regular Backups: Ensure your digital files are backed up regularly to an external hard drive or cloud storage.

- Data Encryption: Use encrypted storage solutions to safeguard sensitive tax information.

- Multi-factor Authentication: Enable two-factor or multi-factor authentication for any service holding your tax documents.

🛡️ Note: Never share your password or backup encryption keys with anyone to prevent unauthorized access to your tax documents.

5. Retention Policy

Develop a retention policy to manage how long you keep your tax documents:

- IRS Guidelines: Generally, keep tax records for at least three years from when you file your return or two years from the date the tax was paid, whichever is later. In some cases, keeping records for up to seven years is recommended.

- Digital Retention: Digital storage makes it easier to keep documents for extended periods without physical clutter.

- Paper Copies: While digital is convenient, consider keeping some critical documents on paper as a fail-safe.

By implementing these strategies, you can streamline the process of managing your TurboTax paperwork, making tax preparation and future reference much easier. Efficient document management not only saves time but also ensures you have the necessary paperwork during tax audits or any future financial assessments.

What if my tax documents are already on paper?

+

Scan them using a scanner or a scanning app, then save the digital versions in your organized file structure.

Is cloud storage safe for sensitive tax documents?

+

Yes, as long as you use secure cloud storage with strong encryption, regular updates, and two-factor authentication.

How do I ensure I comply with IRS recordkeeping requirements?

+

Follow IRS guidelines on document retention, and keep both digital and paper copies if you are unsure about the retention period.