When Do You Receive COBRA Paperwork? Find Out Now

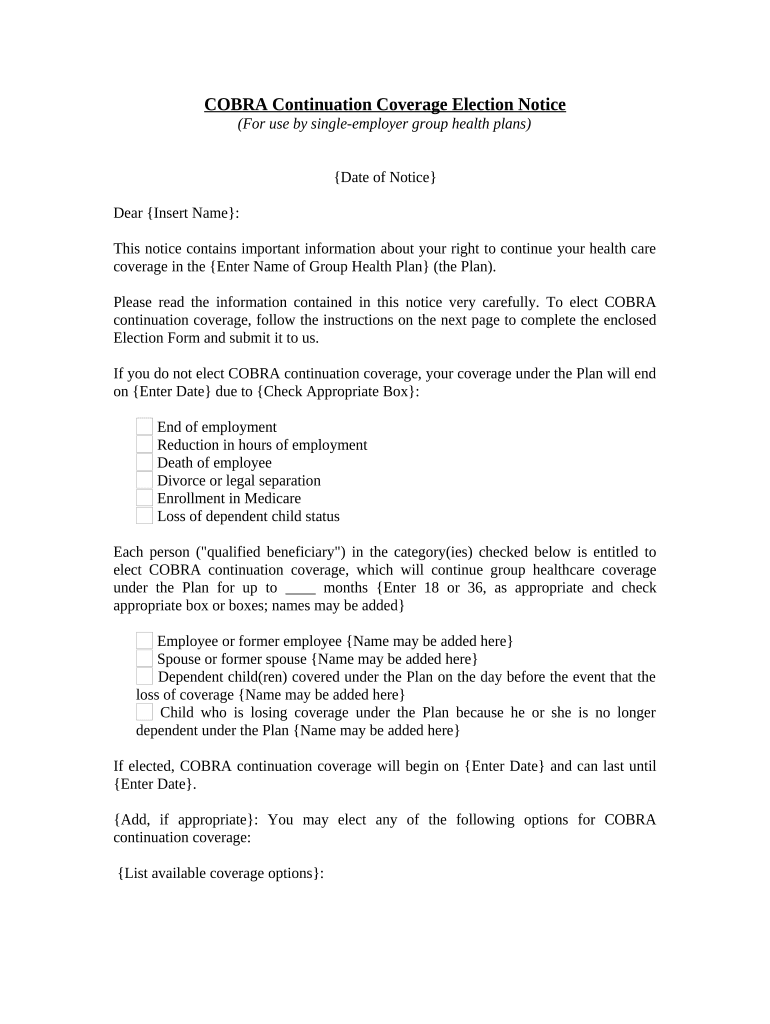

Understanding when you receive COBRA paperwork is crucial for maintaining your health insurance coverage after experiencing a qualifying event like job loss or reduction of work hours. COBRA, or the Consolidated Omnibus Budget Reconciliation Act, allows you to continue with your group health plan under specific conditions for a limited period. This guide explores the timeline, the delivery methods, and what you should do upon receiving COBRA paperwork.

What is COBRA?

COBRA is a federal law that provides the right to temporary continuation of health coverage when it would otherwise end due to certain life events, known as ‘qualifying events.’ It applies to employees, their spouses, former spouses, and dependent children in group health plans sponsored by employers with 20 or more employees.

When Do You Receive COBRA Paperwork?

Here are the scenarios when you might expect to receive COBRA paperwork:

- Termination of Employment: If you are fired or laid off, or if you resign voluntarily, you should receive your COBRA paperwork within 14 days from the date the employer or plan administrator learns of your termination.

- Reduction in Work Hours: Should your work hours decrease to the point where you are no longer eligible for health insurance, you’ll also receive the notice within 14 days.

- Divorce or Separation: If you are divorced or legally separated from an employee, the notice should come within 30 days after the qualifying event or loss of coverage.

- Death of Employee: The notice should be sent to the employee’s spouse or dependents within 30 days of the employee’s death.

- Eligibility for Medicare: If the employee becomes entitled to Medicare, the family members would receive their COBRA notice within 30 days.

- Dependents Aging Out: When children reach the age at which they are no longer considered dependents under the health plan, they should receive their COBRA notice within 30 days.

How is COBRA Paperwork Delivered?

The COBRA paperwork can be delivered in several ways:

- By Mail: The most common method is through the U.S. postal service. The notice must be sent to your last known address by first-class mail.

- By Email: Some employers may deliver COBRA notices via email, especially if this was an accepted method of communication for other HR documents.

- Hand Delivery: In certain cases, particularly small employers, COBRA paperwork might be personally delivered to you.

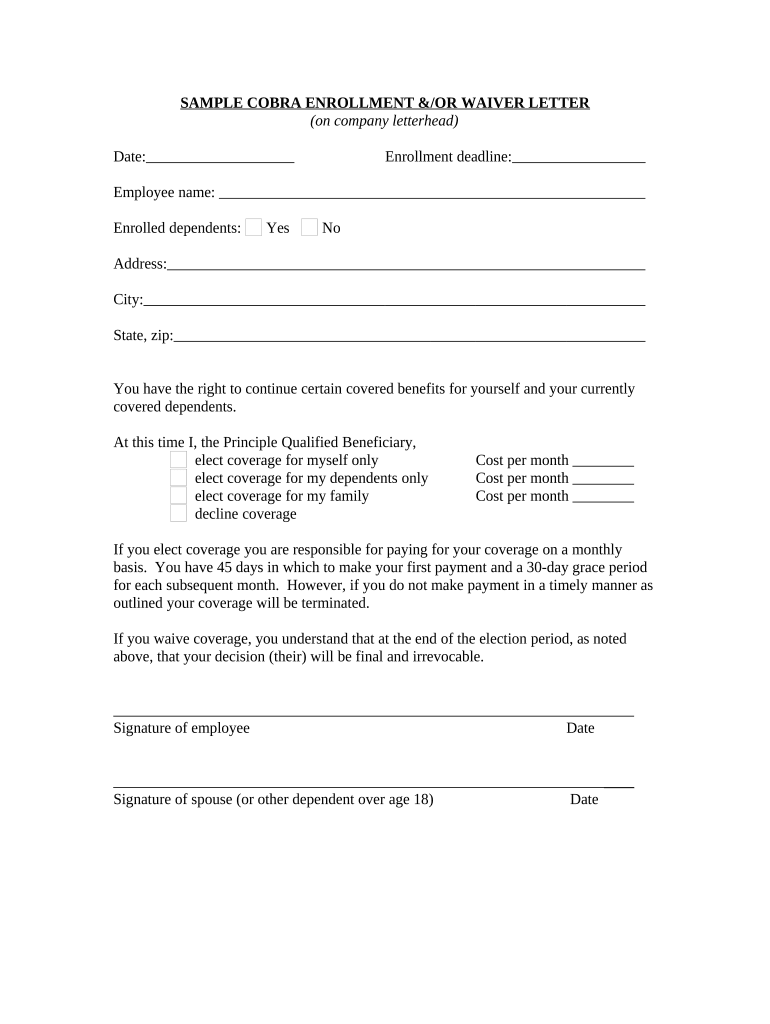

What to Do After Receiving COBRA Paperwork?

Upon receiving your COBRA paperwork, you should:

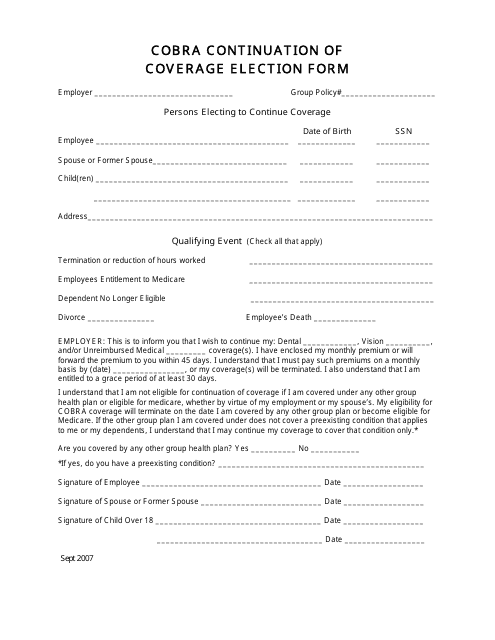

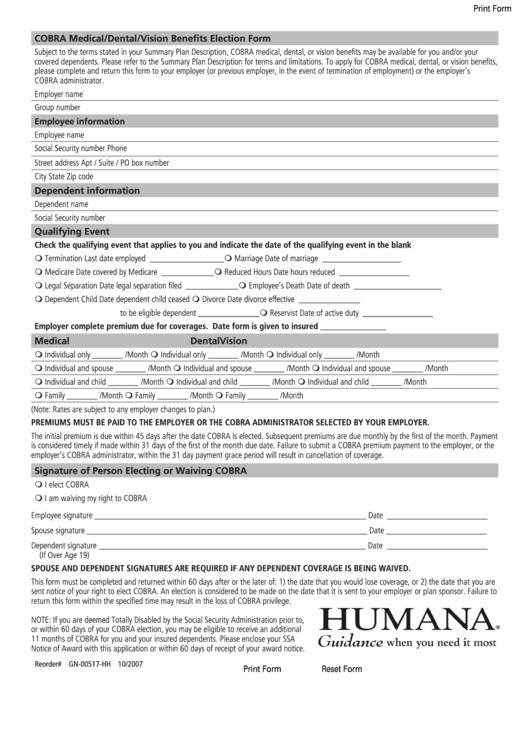

- Read Carefully: Ensure you understand all parts of the document, especially deadlines and premium costs.

- Decide Promptly: You have a limited time to decide whether to elect COBRA coverage, usually 60 days from the later of the date of the qualifying event or the date the COBRA election notice is provided.

- Consider Your Options: Compare the cost of COBRA with other health insurance options like Marketplace plans or coverage through a spouse’s employer.

- Make Payments: If you elect COBRA, you must make your first premium payment within 45 days after the date of coverage election.

📌 Note: Missing the deadline to elect COBRA or to make the first payment can result in a lapse of health coverage. Always mark important dates and follow up if you don't receive your paperwork in a timely manner.

COBRA Coverage Period

The maximum duration for COBRA coverage depends on the qualifying event:

- Termination of Employment: Up to 18 months.

- Disability Extension: If you are determined disabled by Social Security, you can extend coverage for an additional 11 months (29 months total).

- Other Events: For events like divorce, death, or loss of dependent status, coverage can extend up to 36 months.

Wrapping Up

Understanding when and how you receive COBRA paperwork is essential for a smooth transition during significant life changes. While the specifics can vary based on the employer’s size and the nature of the qualifying event, knowing what to expect and how to proceed can significantly reduce stress and ensure you maintain necessary health coverage. Keep track of your eligibility, read your COBRA documents carefully, and make informed decisions within the provided time frames. This approach will help you navigate through the complexities of COBRA and protect your health insurance needs during times of change.

What happens if I don’t receive my COBRA paperwork on time?

+

If you do not receive your COBRA paperwork within the specified time frame, you should contact your former employer’s HR department or plan administrator. There might be a delay, or your employer could be out of compliance. You should request that they send you the COBRA election notice immediately.

Can I still get COBRA if I didn’t receive the initial notice?

+

Yes, if you were not provided with a COBRA election notice due to an error or oversight by your employer or the plan administrator, you can still get COBRA coverage. You should request the paperwork and start the election process as soon as possible.

How much does COBRA coverage cost?

+

The cost of COBRA coverage is generally 102% of the total premium that your employer was paying for your health insurance. This includes both the employee’s share and the employer’s contribution, plus a 2% administration fee.

Can I change my health plan under COBRA?

+

Typically, you must continue with the same plan you had when you were eligible for coverage. However, if there are changes to the plan, like annual enrollment or if you experience a ‘qualifying event,’ you might be able to change plans or add dependents.