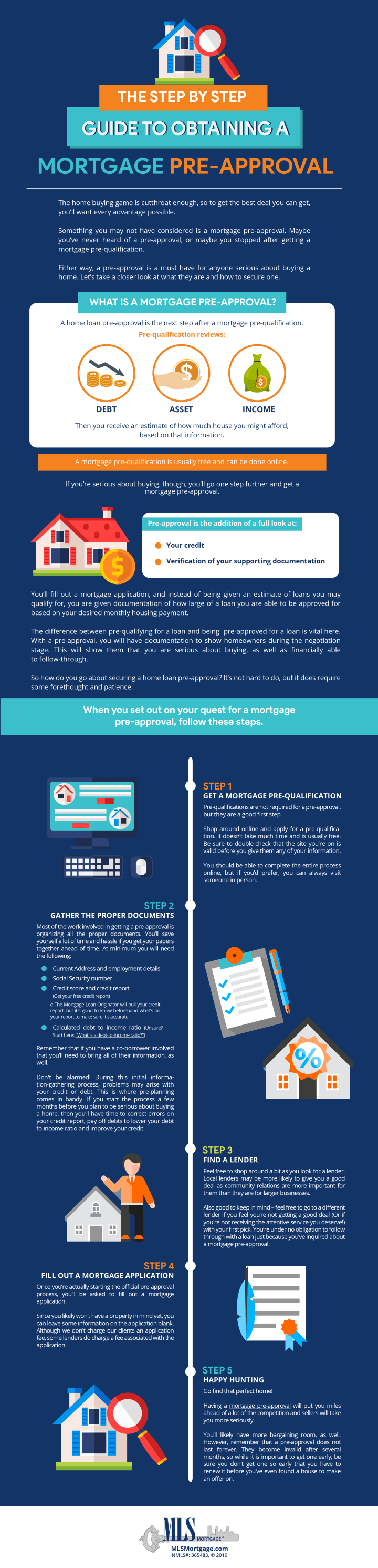

VA Addendum: 5 Key Points to Understand in Mortgage Pre-Approval

Getting a mortgage pre-approval is often the first significant step in the home-buying process. It provides a clear snapshot of your financial standing and how much you can potentially borrow. Understanding the nuances of this process can save you time, increase your chances of getting the home you desire, and ensure a smoother transaction when you're ready to make an offer. Here are the five key points you should understand before you start your mortgage pre-approval journey:

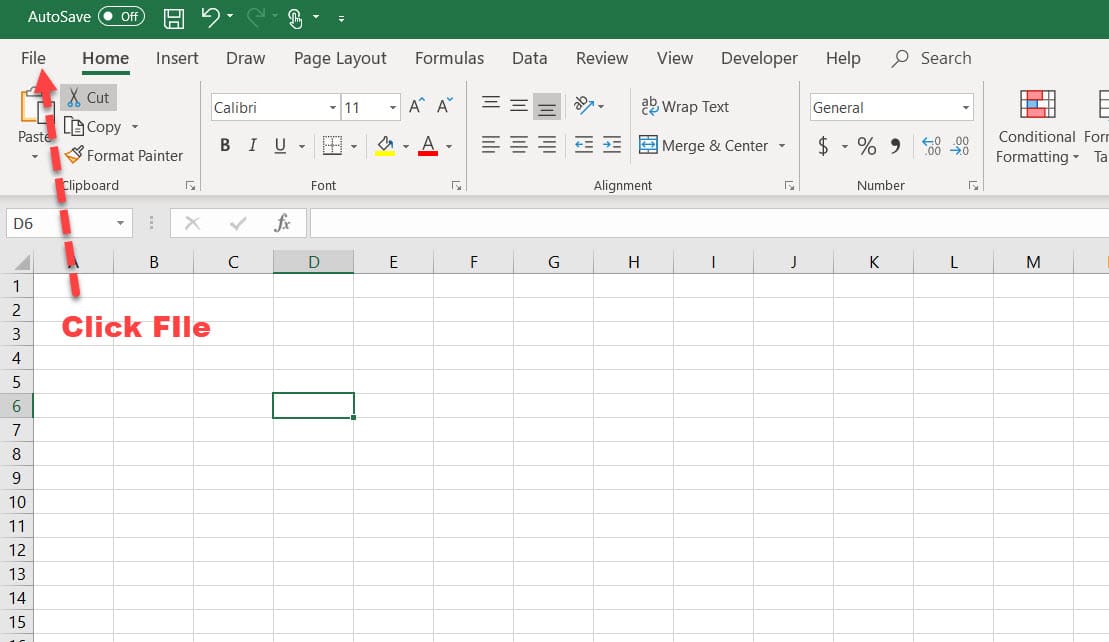

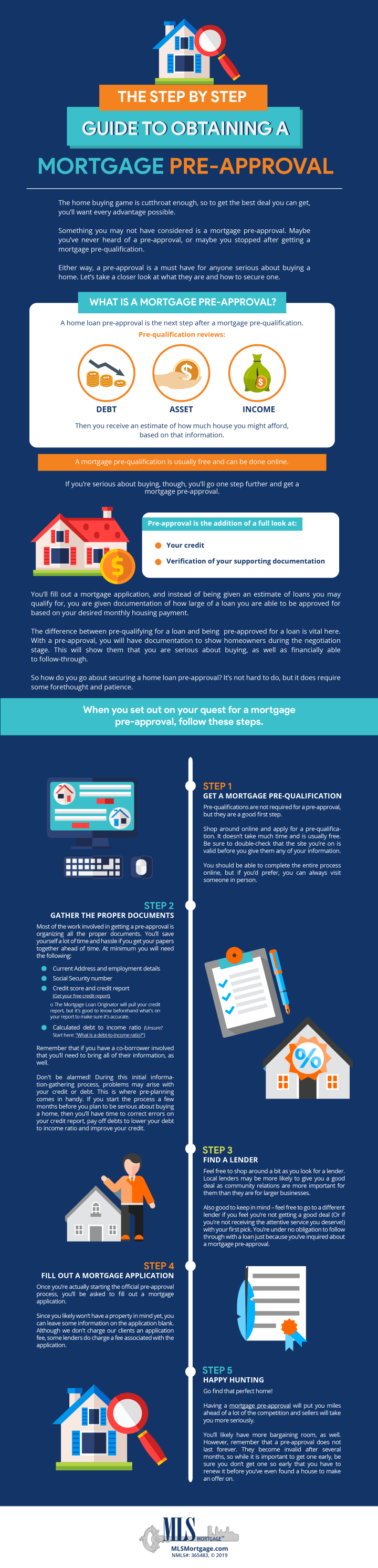

What is Mortgage Pre-Approval?

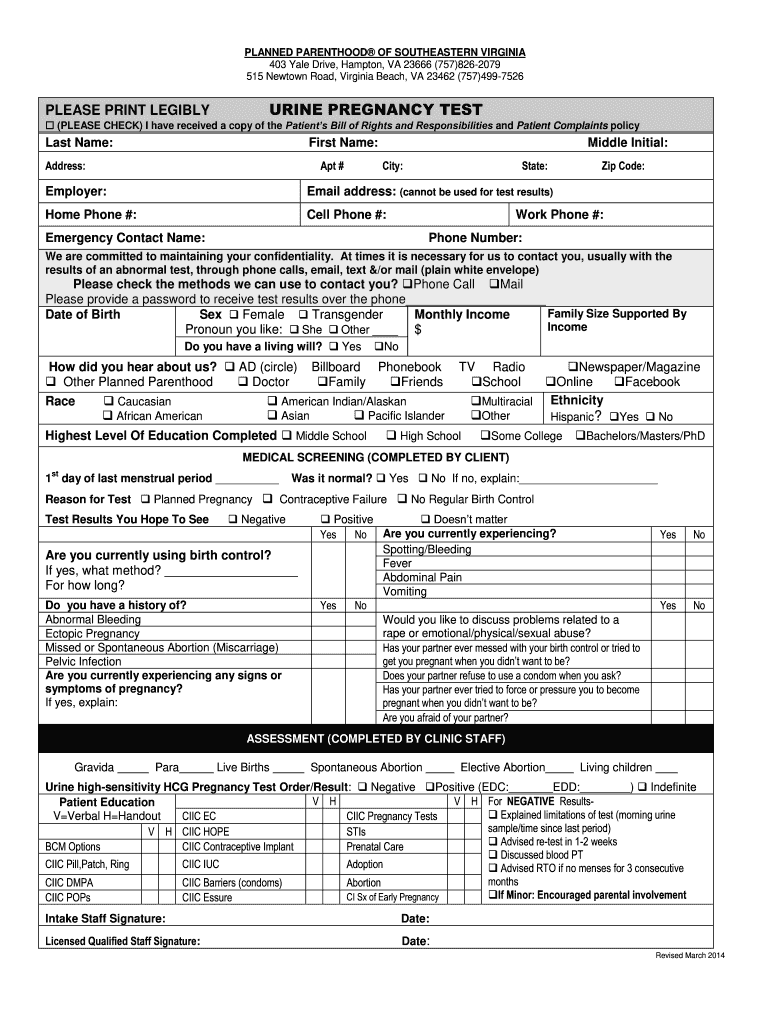

Mortgage pre-approval is an evaluation process where a lender checks your financial background to determine how much they would lend you to purchase a home. This involves:

- An assessment of your credit score and history

- Reviewing your income and employment stability

- Evaluating your existing debts and financial obligations

- An overview of your assets and down payment capacity

This pre-approval gives you a loan amount for which you're tentatively approved. It's not a guarantee but a strong indication of what you might be able to borrow, helping you set a realistic home purchase budget.

Why Get Pre-Approved?

Here are some compelling reasons to get pre-approved:

- Understand Your Budget: Pre-approval helps define how much house you can afford, which is crucial for setting realistic expectations.

- Gain a Competitive Edge: Sellers often view buyers with a pre-approval more favorably, as it shows that you are serious and capable of financing the purchase.

- Streamlined Home Buying: With pre-approval, the mortgage application process becomes more straightforward when you find a home.

- Interest Rate Lock: If you're pre-approved, you might be able to lock in current interest rates, which can be beneficial if rates are expected to rise.

- Identify Issues Early: Any credit or financial issues that might affect your loan approval can be addressed in advance.

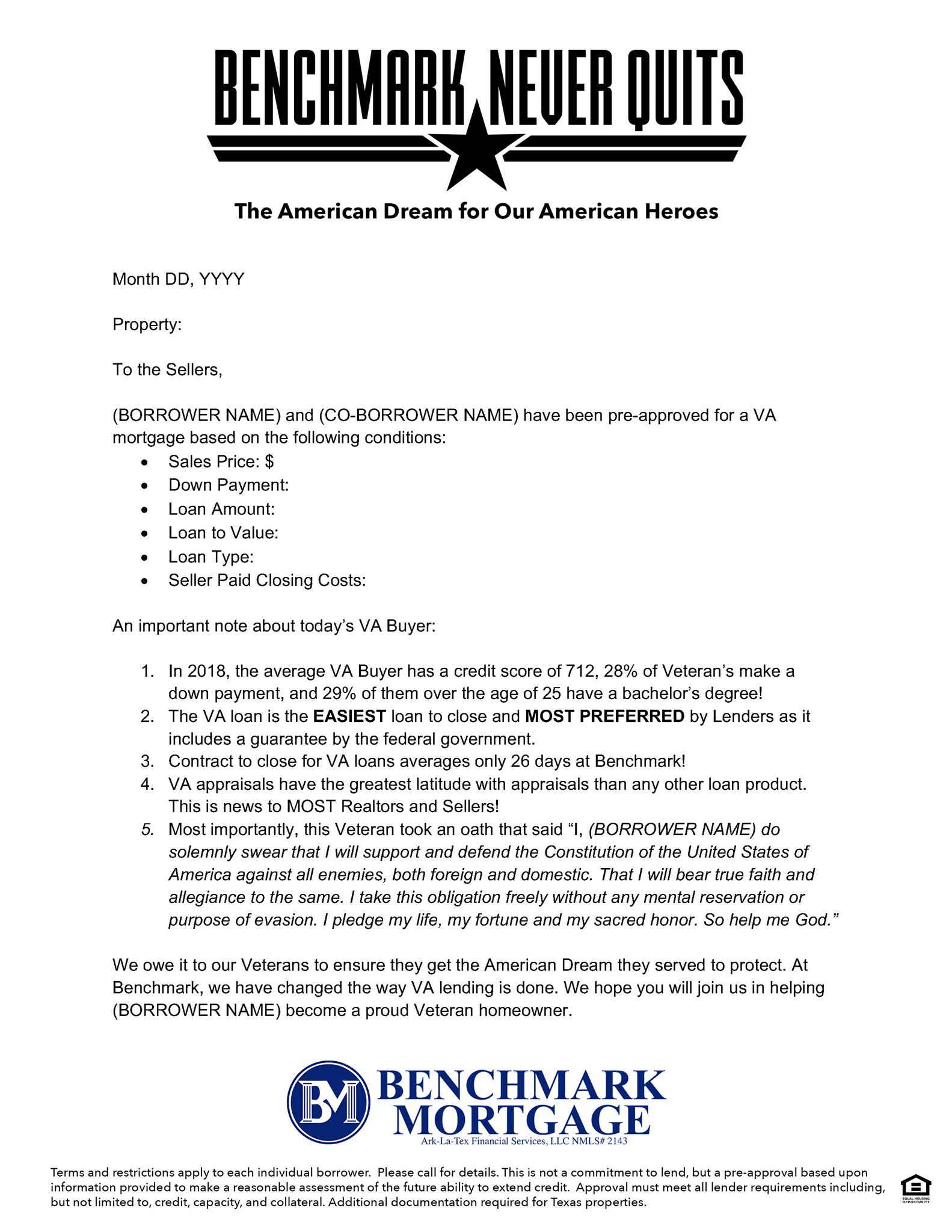

💡 Note: A pre-approval is not a commitment to lend. Lenders can still change their terms or decline your application based on various factors.

Documents Needed for Pre-Approval

To get pre-approved, lenders will typically require:

- Proof of income (pay stubs, W-2s, tax returns)

- Recent bank statements

- List of assets (stocks, bonds, retirement accounts)

- Details on current debts (car loans, credit cards, student loans)

- Employment verification

- Identification (driver's license, passport)

📝 Note: Have all documents organized and ready, as this can expedite the pre-approval process.

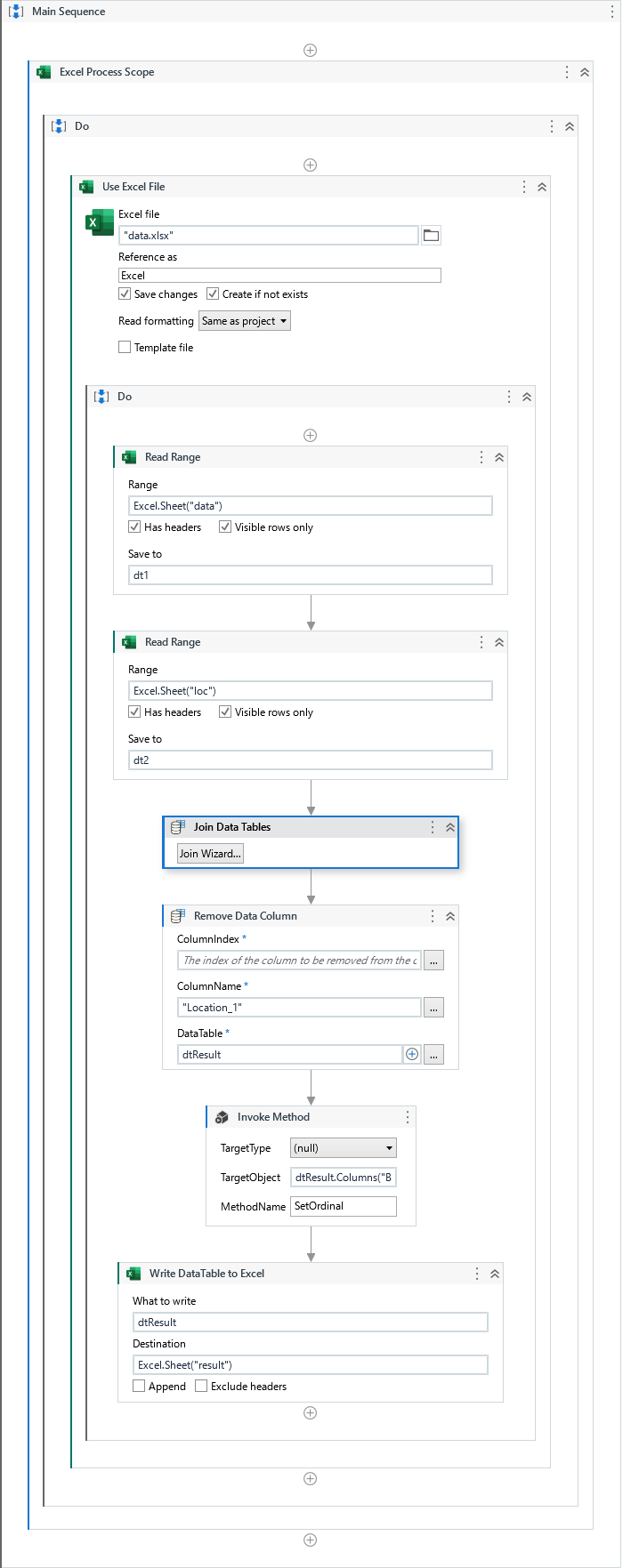

The Impact of Credit Score and Debt

Your credit score is a pivotal factor in the pre-approval process:

- A higher credit score can secure you better interest rates and loan terms.

- Lenders look at your debt-to-income (DTI) ratio to gauge your ability to manage payments.

Debt: A high level of existing debt can limit the loan amount for which you'll qualify. Here's how:

- Lenders prefer a DTI ratio below 43%, though some can go up to 50%.

- Types of debt, such as revolving credit vs. installment loans, are considered differently.

Improving your credit score and reducing your debt before applying can significantly improve your pre-approval outcome.

Down Payment and Private Mortgage Insurance (PMI)

A down payment affects not only the loan amount but also the insurance requirements:

- Less Than 20% Down: If you're putting down less than 20% of the home's purchase price, you'll likely need to pay for Private Mortgage Insurance (PMI) until your equity reaches 20%.

- PMI Costs: PMI can add a significant amount to your monthly payments, ranging from 0.3% to 1.5% of the original loan amount annually.

- Lower Down Payment Loans: Some loan programs allow for much lower down payments, but these might require alternative insurance or guarantees.

🚫 Note: PMI is not permanent. Once your loan balance drops to 80% or less of the home's original value, you can request its removal.

Understanding these key aspects of mortgage pre-approval will prepare you for the home-buying process, ensuring you approach it with confidence and a clear strategy. By knowing what lenders look for, preparing the necessary documentation, and working on your financial profile, you position yourself to get the best possible terms when it comes to financing your new home.

Remember, pre-approval is a starting point. It sets the stage for a more informed and strategic approach to home buying, helping you navigate this exciting journey with your eyes wide open to the possibilities and challenges ahead.

How long is a mortgage pre-approval valid?

+

Mortgage pre-approvals are generally valid for 60 to 90 days, though this can vary by lender. It’s advisable to act on your pre-approval within this timeframe as the market conditions, your financial situation, or lender policies might change.

Can I get pre-approved for a mortgage with bad credit?

+

Yes, but you might face higher interest rates and possibly less favorable loan terms. Improving your credit score before applying can lead to better mortgage offers.

What’s the difference between pre-qualification and pre-approval?

+

Pre-qualification is an informal estimate based on self-reported financial information. Pre-approval involves a more detailed review of your finances, including a credit check, and provides a more accurate loan amount you’re likely to get approved for.

Can shopping for multiple mortgage pre-approvals hurt my credit score?

+

When done within a short time frame (usually 14-45 days), multiple credit inquiries for mortgage purposes are typically treated as one inquiry, minimizing the impact on your credit score. However, excessively shopping around might still show as multiple inquiries, potentially affecting your score.

What happens if I exceed my pre-approved mortgage amount?

+

If you find a home that exceeds your pre-approved mortgage amount, you might need to reapply for a higher loan amount. However, this can involve another round of financial scrutiny, and your lender might reassess your financial stability, leading to different terms or even a denial of the loan application.