Understanding SOT Paperwork: A Guide for Gun Shops

In the firearms industry, the administration of paperwork is as crucial as the sales and service of the products themselves. For gun shops, understanding and managing the Special Occupational Taxpayer (SOT) paperwork is imperative for legal compliance and smooth business operations. This comprehensive guide will navigate through the intricacies of SOT, from application to ongoing responsibilities.

What is SOT?

SOT stands for Special Occupational Taxpayer, a designation required for certain businesses involved with the manufacturing, importing, or dealing in National Firearms Act (NFA) items. NFA items include silencers, short-barreled rifles or shotguns, machine guns, and destructive devices. An SOT status permits a Federal Firearms Licensee (FFL) to engage in activities related to these items that would otherwise be restricted.

Who Needs an SOT?

If your gun shop deals with:

- Manufacturing or importing NFA items.

- Dealing in NFA firearms at a wholesale level.

- Transferring NFA items to other FFL holders.

Then, you need to apply for and maintain an SOT status. Here’s a detailed look at how to manage this:

The Application Process

To apply for an SOT, follow these steps:

- Prepare Documentation: Ensure your FFL is current and up to date.

- ATF Form 5630.5: Fill out this form, which is an application for tax registration.

- Tax Payment: The tax amount varies based on your class of SOT:

- Class 1: 500/year</li> <li>Class 2: 500/year

- Class 3: $200/year

- Submit Application: Send your application and payment to the ATF.

📝 Note: Ensure all documents are signed and dated correctly. Any errors can result in delays or rejections.

Managing SOT Responsibilities

Once your SOT is approved, here are key responsibilities to manage:

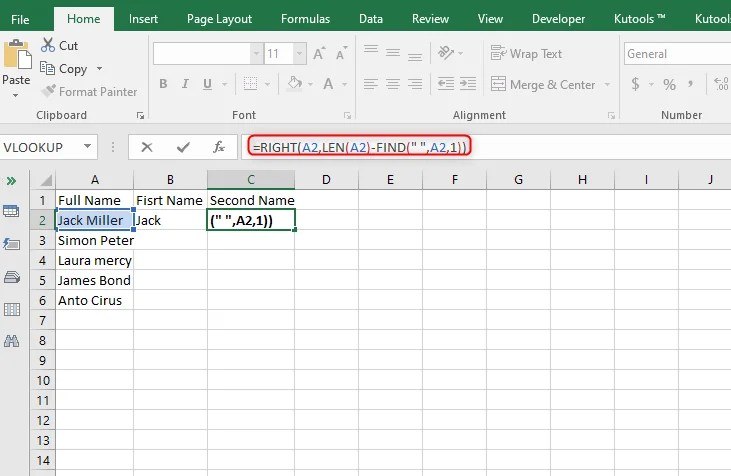

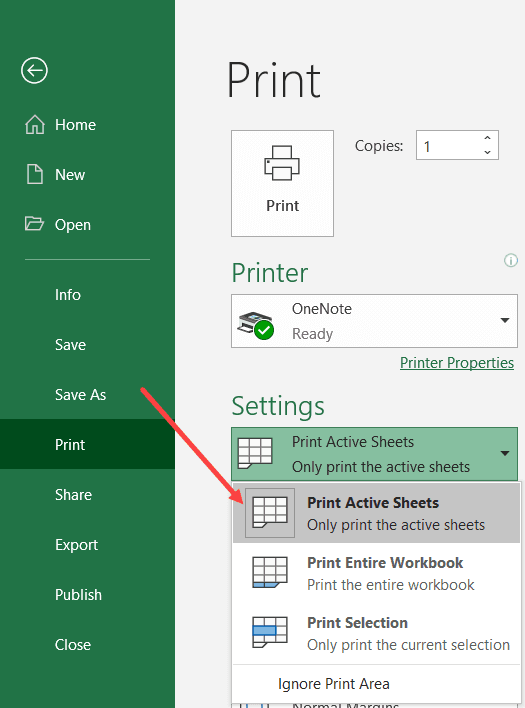

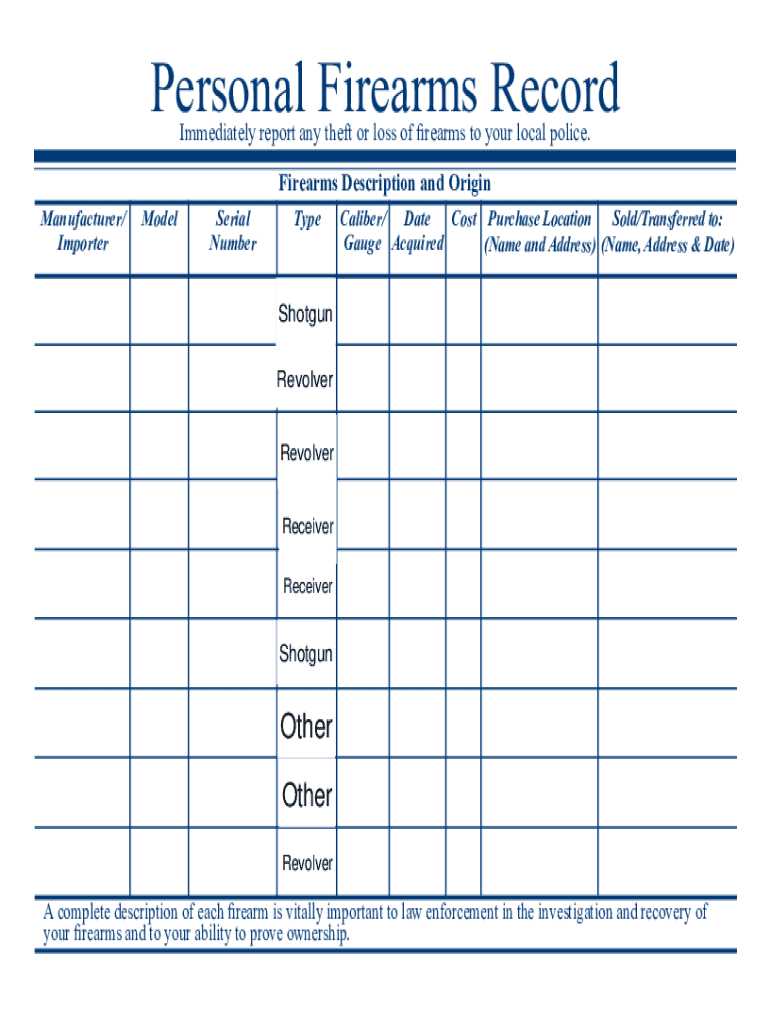

- Record Keeping: Maintain meticulous records of all NFA transactions including ATF Form 4473 for every firearm sold, and ATF Form 4 or 5 for NFA items.

- Annual Renewal: SOTs must be renewed yearly, with payments made before July 1st for the upcoming tax year.

- Storage and Security: Ensure NFA items are stored in compliance with ATF regulations.

- Tax Payments: Keep track of and fulfill tax obligations on time.

Common Challenges and Solutions

Here are some common issues SOT holders face:

- Late Filing:

- Set up calendar reminders or use software to alert you of renewal dates.

- Complex Forms:

- Consider engaging a professional to assist with ATF paperwork to avoid common mistakes.

- Record Keeping Errors:

- Use specialized software designed for firearms dealers to streamline record keeping.

⚠️ Note: Non-compliance with SOT regulations can lead to severe penalties, including fines, revocation of license, or imprisonment. Always stay informed about current regulations.

In managing SOT paperwork, gun shops not only fulfill legal obligations but also build a reputation for professionalism and reliability in the firearms industry. This guide should serve as a starting point for understanding the process, but remember, ATF regulations can change. Staying proactive with your paperwork ensures your business remains compliant, thereby securing your operational continuity and customer trust.

What happens if I miss the SOT renewal deadline?

+

If you miss the SOT renewal deadline, your SOT status will lapse, and you could face penalties from the ATF. It’s crucial to renew your SOT before the deadline to avoid any legal complications.

Can a non-FFL apply for an SOT?

+

No, only Federal Firearms Licensees (FFLs) can apply for an SOT. Non-FFLs do not have the legal authority to deal in NFA items.

How often does the SOT tax amount change?

+

The SOT tax amount has remained relatively stable, but changes can occur. Always refer to the latest ATF regulations for the current tax rates.

Is there an audit for SOT?

+

Yes, ATF conducts audits to ensure compliance with NFA regulations. Keeping meticulous records will make these audits less daunting.