Tracking Gambling Losses Without Paperwork: Smart Tips

While the excitement of gambling can be intoxicating, it's essential to manage the financial aspects responsibly. Keeping track of your losses is not only a practical way to manage your finances but can also be useful for tax deductions, understanding your gambling habits, and maintaining control over your budget. Here are several smart strategies to track your gambling losses without drowning in paperwork:

Utilizing Online and Mobile Gambling Apps

In today’s digital era, many casinos have shifted to the online platform, providing players with sophisticated apps for both desktop and mobile devices. These apps come with built-in features that can track:

- Betting History: Records all bets placed, including wins and losses.

- Game Statistics: Provides detailed statistics on game performance, win rates, and loss ratios.

- Financial Transactions: Tracks deposits, withdrawals, and casino credits.

By regularly reviewing this information, you can effortlessly maintain a record of your losses.

⚠️ Note: While these apps offer convenience, they can also be a temptation for more gambling. Use them wisely.

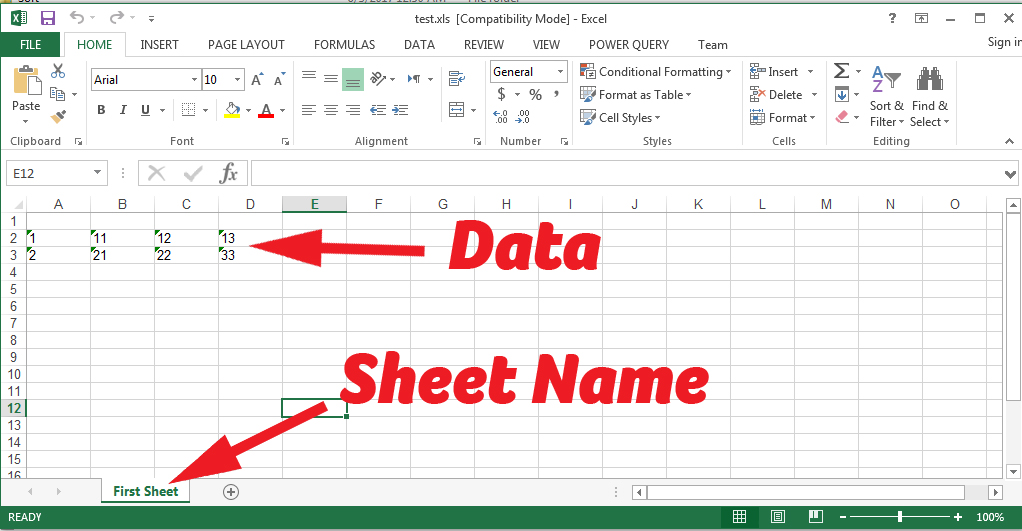

Digital Spreadsheets and Cloud Storage

For those preferring a DIY approach, creating a digital spreadsheet is a seamless way to track your gambling losses:

- Set up columns for date, casino, game type, bet amount, win/loss, and net result.

- Regularly update this spreadsheet with your gambling activities.

- Store your spreadsheet in the cloud for secure backup and accessibility.

This method not only helps you track losses but also provides a visual overview of your gambling habits.

Using Financial Apps and Bank Statements

Many financial management apps can categorize your expenses:

- Categorize gambling expenses under entertainment or hobby.

- Utilize the reporting features to analyze spending patterns.

- Regularly download and review bank statements to monitor ATM withdrawals and casino payments.

By integrating gambling into your financial tracking, you create a comprehensive record of your losses and expenditures.

Mobile Notes and Reminders

Mobile devices offer tools like note-taking apps:

- Create a dedicated note or list for gambling losses.

- Use reminders to log your losses after each gambling session.

- Set recurring reminders to review your gambling activities.

This method leverages technology you already use, ensuring you don’t forget to track your losses.

The IRS and Tax Deductions

Keeping track of your losses can be beneficial for tax purposes. Here’s how:

- Understand that gambling losses can be deducted if you itemize on your tax return.

- Ensure you have records that show losses, ideally matching your winnings.

- Be aware of the rules and forms associated with reporting gambling income and losses.

💡 Note: For detailed information on IRS guidelines for gambling losses, consult a tax advisor.

Combining Multiple Tracking Methods

Rather than relying on a single method, combining several can provide a robust tracking system:

- Integrate app data with your spreadsheets.

- Back up your financial tracking with screenshots from online gambling platforms.

- Regularly review your casino loyalty programs for performance reports.

This approach ensures a comprehensive and accurate record of your gambling activities.

In conclusion, effectively managing your gambling losses doesn't have to be a daunting task involving piles of paperwork. By embracing digital solutions like online gambling apps, spreadsheets, financial tracking tools, and mobile reminders, you can keep a clean and accurate record. This not only helps with financial management but can also assist with tax deductions, provide insights into your gambling habits, and foster responsible gambling. Remember, while these tools offer convenience, the key to using them successfully lies in discipline and regularity.

Can I track my gambling losses without a physical receipt?

+

Yes, with digital tools like gambling apps, financial management software, and even mobile notes, you can keep track of your gambling losses without paper receipts. Screenshots, transaction histories, and game statistics are all viable records for tracking losses.

Is it necessary to track gambling losses for taxes?

+

It is not mandatory, but if you itemize your deductions, you can deduct your gambling losses, provided they do not exceed your winnings. Keeping records ensures you can take advantage of these deductions.

How accurate do my gambling loss records need to be?

+

While exact figures are preferred, a reasonable estimate, especially when backed by bank statements or app data, can suffice. However, for tax purposes, more accurate records are advantageous.

What if I forget to log my losses?

+

Set up reminders or automate the process where possible. If you forget, review bank transactions, ATM withdrawals, or ask for any available casino records to approximate your losses.