Simplify Year-End Paperwork: Your Ultimate Organizing Guide

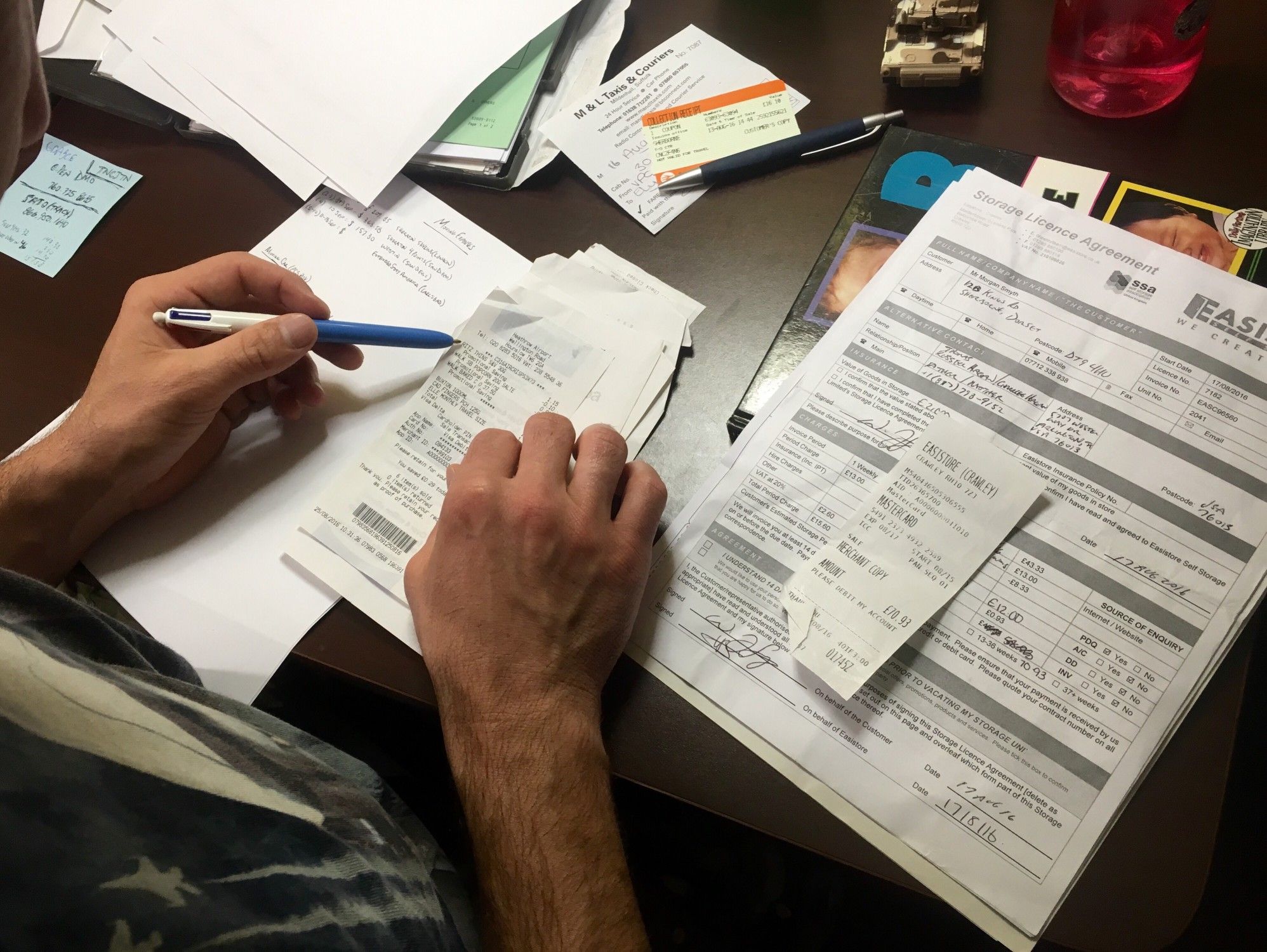

As the year draws to a close, many individuals and businesses find themselves inundated with paperwork that must be organized before the new year begins. From tax documents to financial statements, expense reports, and personal records, year-end paperwork can be overwhelming. However, with the right strategies and tools, you can simplify this process and ensure everything is in order. This guide will walk you through the steps to efficiently organize your year-end paperwork, reduce stress, and start the new year on a clean slate.

Understanding Your Year-End Paperwork

Before diving into the organization, let’s clarify what counts as year-end paperwork. Here are some common documents:

- Tax Documents - W-2s, 1099s, receipts for deductions

- Financial Statements - Bank statements, credit card statements, investment statements

- Business Records - Sales reports, payroll, inventory records

- Personal Records - Medical records, bills, warranties, and insurance policies

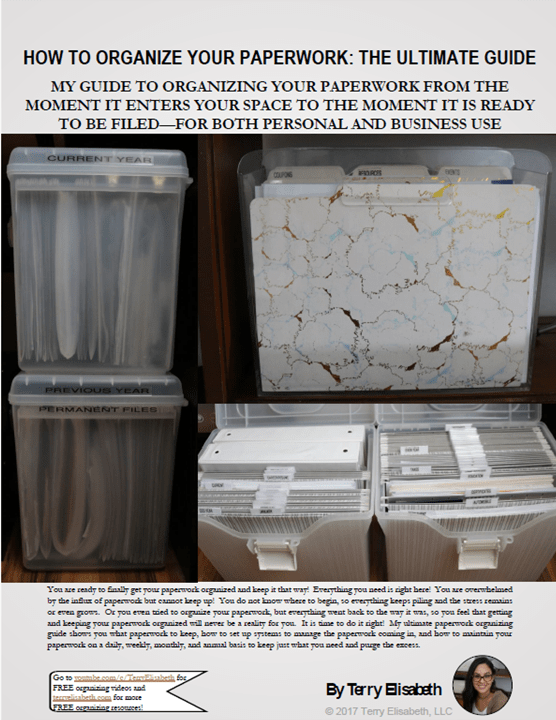

Categorizing Your Documents

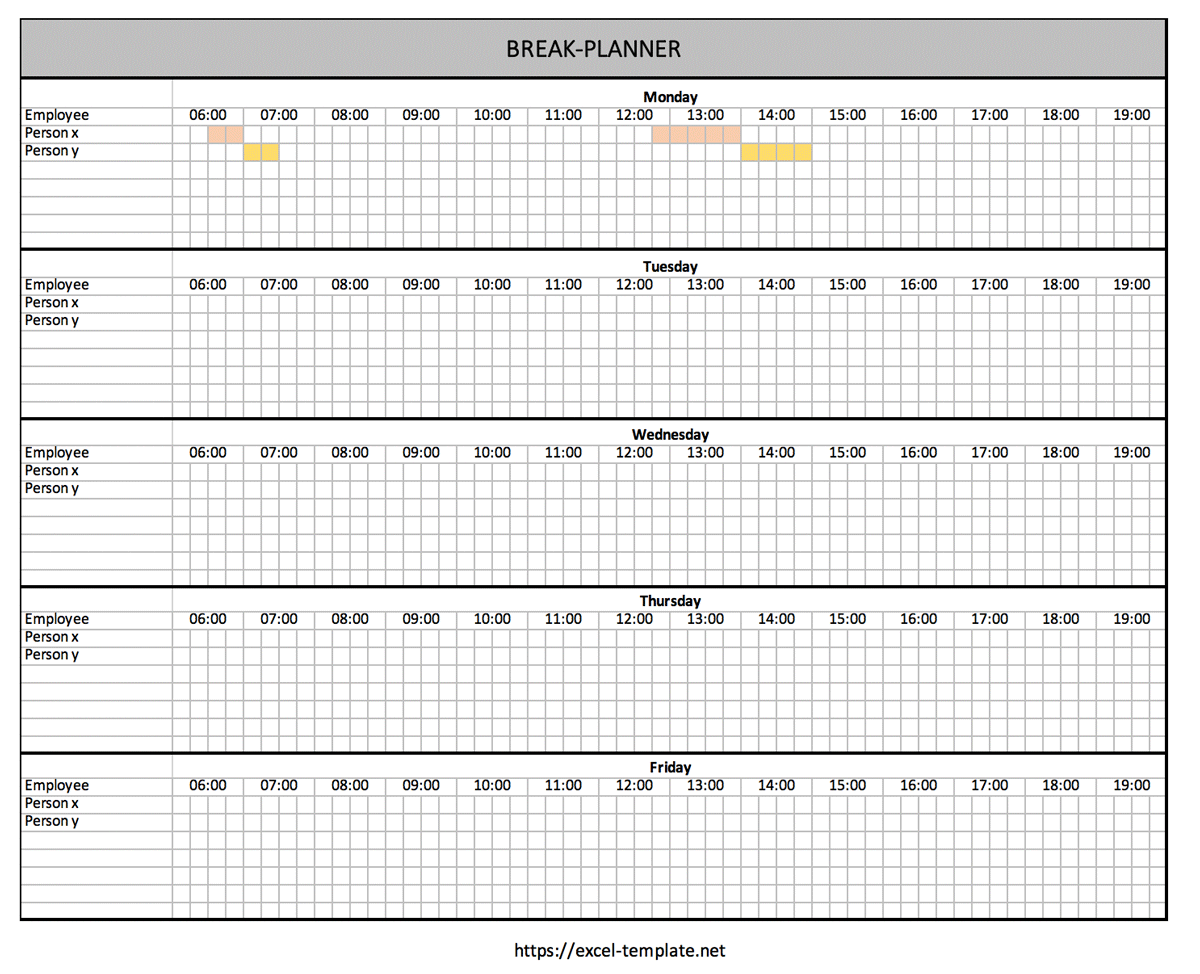

Start by grouping your documents into categories:

- Taxes: Include all tax forms, receipts, and relevant financial documents.

- Finance: Statements from banks, credit cards, and investment accounts.

- Business: Sales records, payroll, and other business-specific documents.

- Personal: This could be anything from utility bills to personal expenses.

📝 Note: Keeping documents in their respective categories will make it easier to locate and manage them throughout the year.

Digitalization and Storage Solutions

In our increasingly digital world, paperless solutions offer a way to manage and secure documents:

- Scanning: Use a scanner or a smartphone app to digitize physical documents.

- Cloud Storage: Services like Google Drive, Dropbox, or OneDrive provide secure storage with easy access.

- Password Protection: Protect your digital files with strong, unique passwords.

Adopting these technologies reduces clutter and the risk of physical document loss:

Best Practices for Digital Storage

| Practice | Description |

|---|---|

| File Naming | Use clear, descriptive names for files, including dates. |

| Folder Structure | Create folders for different categories or by year. |

| Regular Backups | Back up your digital records to prevent data loss. |

Handling Sensitive Information

Documents like tax forms or financial statements often contain sensitive information:

- Shredding: Physically shred documents that are no longer needed.

- Encryption: Use encryption for digital files with sensitive data.

- Secure Disposal: Properly dispose of old hard drives or USB drives.

🔒 Note: Always use secure disposal methods for any physical or electronic media containing personal or financial information.

Compliance with Tax and Legal Requirements

Make sure your paperwork adheres to current tax laws and legal standards:

- Tax Deadline: Know when tax returns are due and prepare documents accordingly.

- Record Retention: Keep records for the required period to avoid penalties.

- Legal Notices: Be aware of any legal notices or changes in tax law.

Final Check and Year-End Wrap-Up

As you near the end of the year, do a final review:

- Reconcile: Check all financial transactions and ensure accuracy.

- Create Summaries: Generate reports or summaries of your financials for easy reference.

- File Paperwork: Place important documents in easily accessible locations.

In wrapping up this guide on simplifying year-end paperwork, we’ve explored various strategies to streamline this often daunting task. From understanding your documents to leveraging digital solutions, securing sensitive information, and ensuring compliance, each step builds towards a more organized approach to your paperwork. As you close out this year, take a moment to appreciate the clarity and control these methods bring, setting you up for a smoother transition into the next year.

How long should I keep financial documents?

+

Generally, financial documents should be kept for at least seven years due to tax regulations. However, keep tax returns and related documents permanently.

What is the best way to shred sensitive documents?

+

Use a crosscut shredder or take documents to a professional shredding service to ensure information cannot be reconstructed.

Can I claim home office expenses for tax purposes?

+

Yes, but ensure you meet the criteria set by the IRS for a home office deduction, which includes exclusive and regular use for business.