7 Steps to Create Provisional Balance Sheet in Excel

Creating a provisional balance sheet in Excel is a fundamental financial analysis task that helps businesses estimate their financial position without having final data or commitments. Here are seven steps to guide you through this process:

1. Understanding the Basics

Before delving into Excel, understand what a provisional balance sheet is:

- Definition: A provisional balance sheet is a financial statement that lists your assets, liabilities, and equity at a particular point in time, providing an estimate based on available or projected data.

- Purpose: It’s useful for internal planning, forecasting, or when you are seeking preliminary financial commitments from investors or lenders.

2. Gather Your Data

Compile all relevant data:

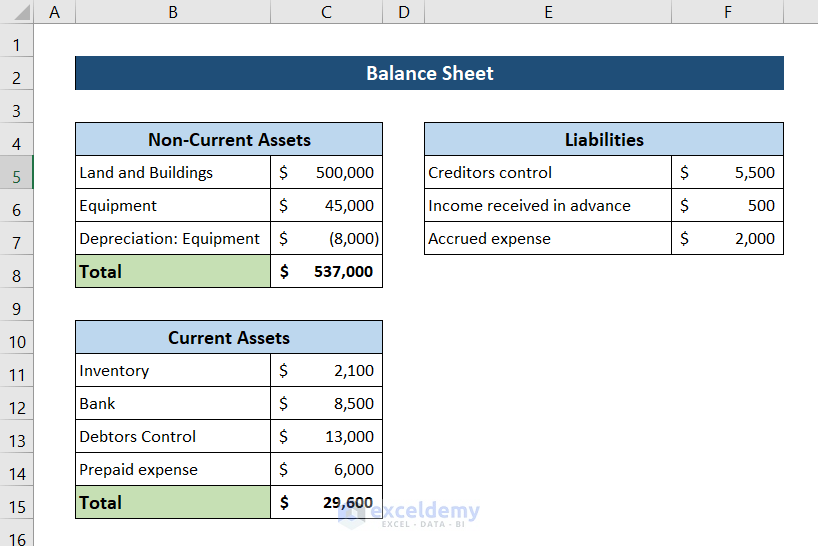

- Current Assets: Cash, inventory, accounts receivable, and short-term investments.

- Fixed Assets: Property, plant, equipment, and long-term investments.

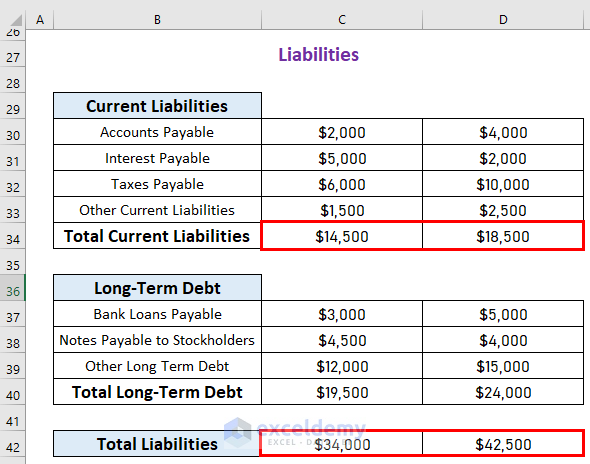

- Liabilities: Accounts payable, long-term debt, accrued expenses, and provisions.

- Equity: Share capital, retained earnings, and other equity items.

📝 Note: Ensure you have the most up-to-date data for accurate projections.

3. Set Up Your Excel Sheet

Open a new Excel workbook and organize it:

| Section | Cells | Description |

| Header | A1:D1 | Include your company name, date, and document title. |

| Assets | A2:B7 | List all assets with sub-categories. |

| Liabilities | A8:B13 | List all liabilities. |

| Equity | A14:B17 | List all equity items. |

| Total Row | B18 | Total Assets, Liabilities, and Equity. |

4. Inputting Data

Now, input your provisional figures:

- Enter the data for each category in the respective cells.

- Use the SUM function for totaling rows and columns.

- Ensure calculations reflect estimates based on current data or business forecasts.

5. Formatting for Clarity

Enhance readability with formatting:

- Use bold for headings, and apply different colors or font styles for different sections.

- Align numbers to the right and format them for better readability (e.g., with commas or decimal points).

- Conditional formatting can help highlight important figures or deviations from expectations.

6. Validation and Check

Perform data validation:

- Check that the sum of assets equals the sum of liabilities plus equity.

- Verify data accuracy by cross-referencing with available financial data.

- Use error checking tools in Excel to find calculation errors.

📝 Note: The balance sheet must balance! If it doesn’t, re-examine your figures.

7. Final Review

Review your provisional balance sheet:

- Ensure that all entries are logical and reflect the current or expected financial status of the company.

- Check for any formatting issues or errors that might mislead readers.

- Get a second pair of eyes to review your work for any missed errors or discrepancies.

By following these steps, you've successfully created a provisional balance sheet in Excel, providing a snapshot of your business's potential financial health. This tool can be used for internal management purposes, preparing for investor meetings, or securing loans. Remember, the value of a provisional balance sheet lies in its accuracy and its ability to be adjusted with new or more accurate data as it becomes available.

What is the difference between a provisional and an official balance sheet?

+

A provisional balance sheet uses estimated or projected data, making it less accurate than an official one which uses actual, audited financial data.

Can provisional balance sheets be used for official purposes?

+

While they can provide insights, they are not generally accepted for official financial reporting or legal requirements. They are more for internal or preliminary external discussions.

How often should a provisional balance sheet be updated?

+

It depends on the need for financial forecasting or discussions, but typically, updating on a monthly or quarterly basis can be useful.