Excel Sheet for Daily Expenses: A Simple Guide

Managing daily expenses can often feel like a daunting task, especially when you're juggling various financial responsibilities. However, with the right tools and techniques, you can turn this potentially overwhelming endeavor into a manageable and even insightful process. In this guide, we'll walk through how to use Microsoft Excel to create and maintain a daily expense tracker, ensuring your financial health and peace of mind.

Why Use Excel for Tracking Expenses?

Excel isn't just for businesses; it's a versatile tool that can help individuals manage their personal finances too. Here's why Excel is an excellent choice:

- Accessibility: Most computers come with Excel pre-installed or it's easily accessible through Microsoft Office.

- Customization: Tailor your expense sheet to fit your specific needs with custom formulas, charts, and data validation.

- Analytical Power: Excel offers powerful data analysis tools, allowing you to track, analyze, and forecast your financial health.

- Data Entry and Visualization: Its grid layout is intuitive for data entry, and it provides features like graphs and pivot tables for visualizing spending patterns.

Setting Up Your Expense Tracking Sheet

Here are the steps to set up your daily expense tracker:

- Create a New Workbook: Open Excel and start with a blank workbook.

- Label Your Columns:

Column A Column B Column C Column D Column E Date Category Description Amount Balance

- Format for Data Entry:

- Use

=TODAY()in the Date column to auto-fill the current date. - Set up a dropdown list in the Category column using Data Validation for easy categorization.

- Ensure Description allows for notes or additional details about the expense.

- Format the Amount and Balance columns to display currency, and set up the Balance to auto-calculate using formulas like

=SUM(D2:D[row_number]) - SUM(D2).

- Use

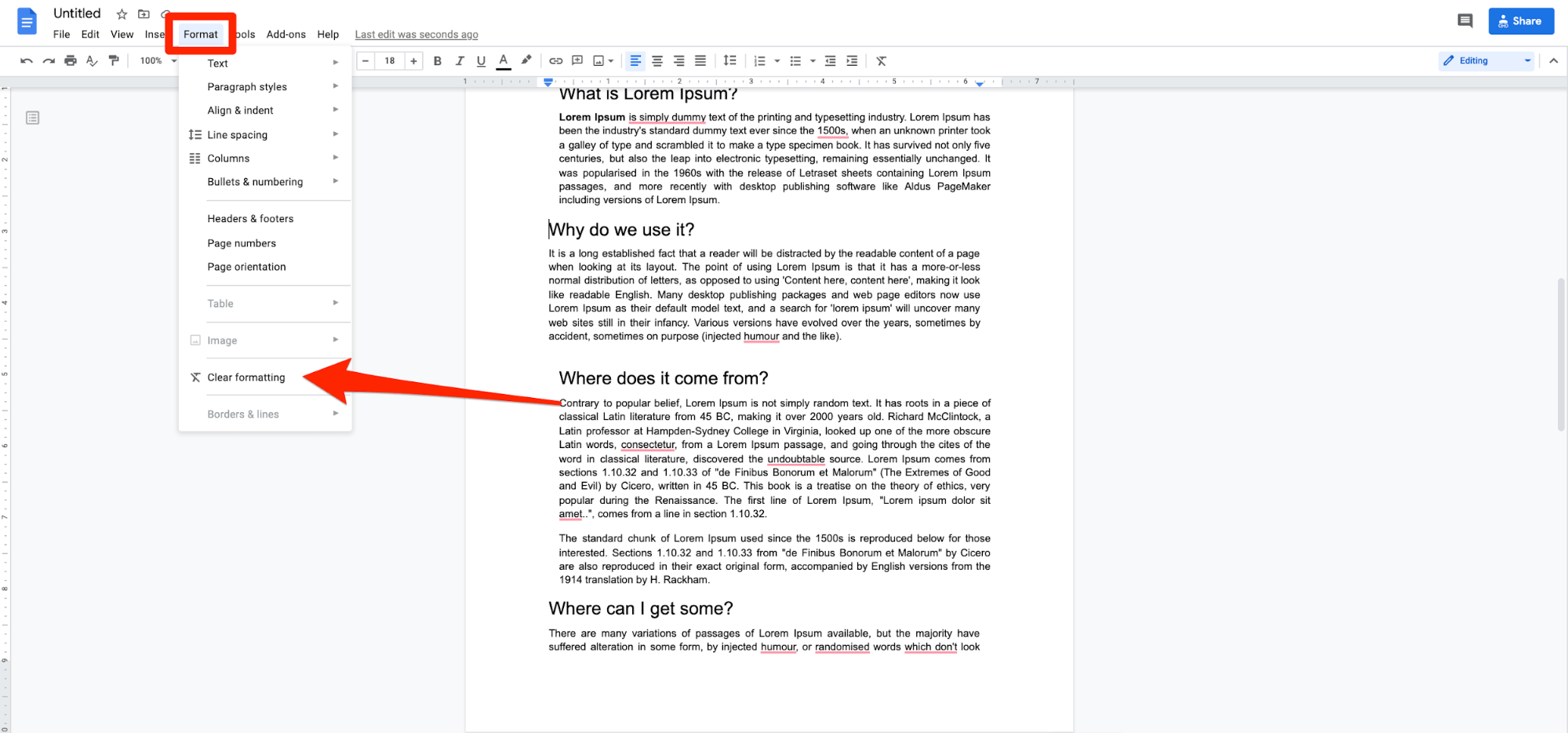

- Create Summary Sheets: Add separate tabs or sheets for monthly summaries, yearly summaries, or categorized spending charts.

- Apply Formulas:

- For daily expenses, you might use

=SUMIF(B:B,"category name",D:D)to total expenses in a specific category. - Use conditional formatting to highlight expenses above a certain threshold.

- For daily expenses, you might use

- Backup Regularly: Ensure you have backups of your workbook to prevent data loss.

🔹 Note: Regularly reviewing and updating your sheet is crucial for maintaining its accuracy and usefulness.

Best Practices for Maintaining Your Expense Sheet

To get the most out of your expense tracking sheet, follow these best practices:

- Consistency: Record expenses daily to keep the data up-to-date.

- Categorization: Be meticulous with categories to understand spending patterns better.

- Use of Automation: Leverage Excel's features like AutoFill and conditional formatting to automate data entry and analysis.

- Data Validation: Set up validation rules to ensure correct entries, reducing errors.

- Visualize Data: Use charts and graphs to make sense of your spending visually, making it easier to spot trends or areas for improvement.

Tips for Analyzing Your Data

Here are some ways to analyze your expense data effectively:

- Monthly Expense Breakdown: Use pivot tables to summarize expenses by category each month.

- Yearly Spending Review: Create annual charts to see how your expenses have trended over time.

- Budget Analysis: Compare actual expenses against a budget to see where adjustments are needed.

- Expense Forecasting: Utilize trendlines in charts or statistical functions like

FORECAST.LINEARto predict future expenses.

📌 Note: Remember that while Excel provides great tools, your interpretation of the data is what truly drives financial understanding and decision-making.

As we've explored, using Excel for tracking daily expenses not only helps you keep your finances in order but also empowers you with the knowledge to make informed financial decisions. Whether you're saving for a large purchase, managing debt, or simply trying to live within your means, Excel provides a platform that can grow with your financial needs. Remember, the key to effective expense tracking is consistency and regular review. With your Excel sheet as your financial dashboard, you'll have the insights needed to navigate your financial journey confidently.

How often should I update my expense sheet?

+

It’s best to update your expense sheet daily to keep your data current and accurate. However, if daily updates are too demanding, weekly updates can also be effective, as long as you batch your entries accurately.

Can I use Excel on my mobile device?

+

Yes, Microsoft provides Excel for mobile devices. You can download the app on your smartphone or tablet, allowing you to update your expense sheet on the go.

What are some common expense categories?

+

Common categories include:

- Rent/Mortgage

- Utilities (electricity, water, internet, etc.)

- Groceries

- Transportation (gas, public transit, car maintenance)

- Entertainment

- Dining Out

- Health/Insurance

- Savings/Investments