Create Your Rent and Utilities Excel Sheet Easily

What is a Rent and Utilities Excel Sheet?

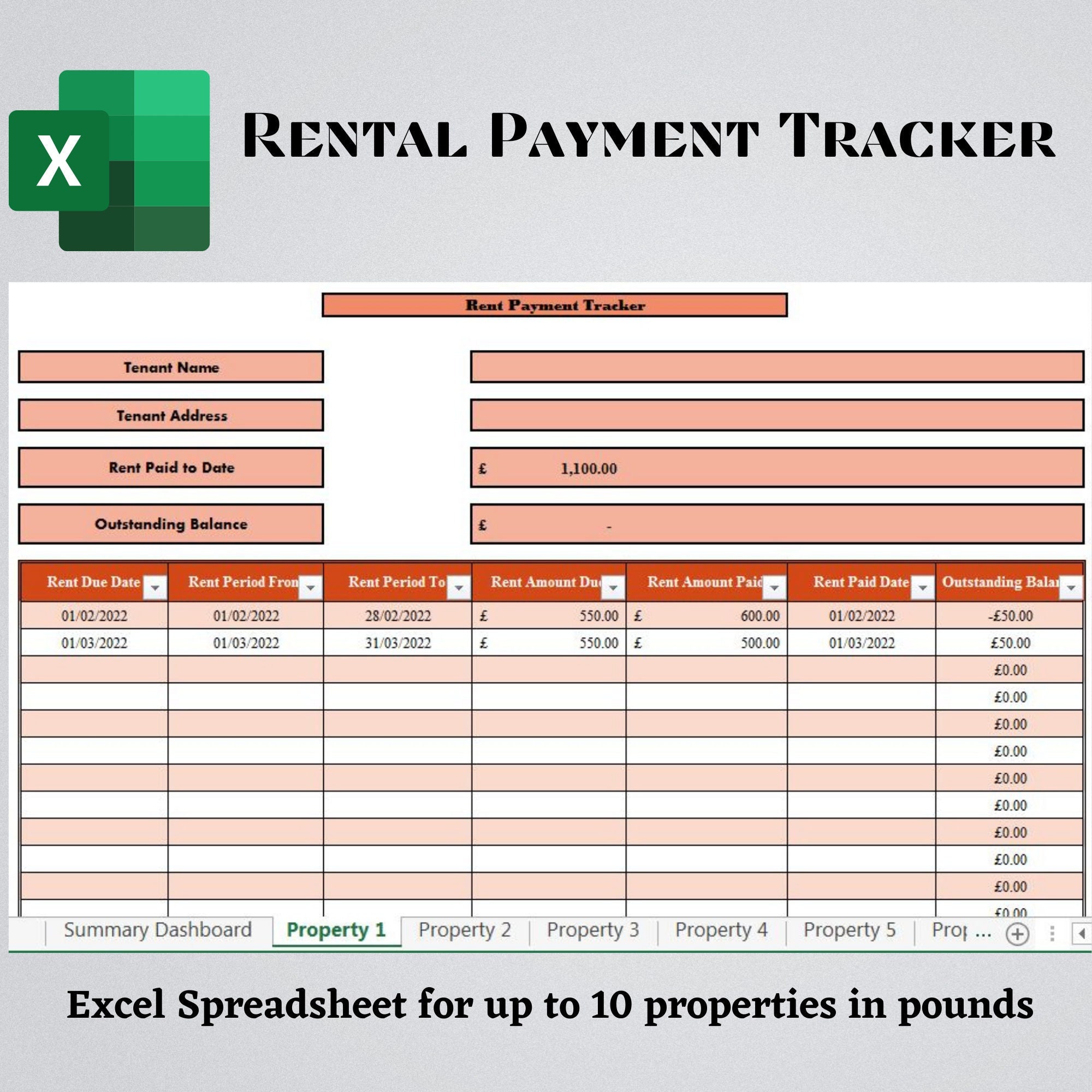

A Rent and Utilities Excel Sheet is a digital tool designed to help individuals or families manage their monthly rent and utility bills efficiently. It tracks expenses, helps in budgeting, and provides an organized record of all payments related to housing costs. Whether you’re renting an apartment or managing a household, this spreadsheet can be your financial ally, helping you keep your budget in check without the hassle of paper records.

Benefits of Using an Excel Sheet for Rent and Utilities

- Organisation: Categorize and track all your expenses in one place, making it easier to see where your money is going each month.

- Budget Control: By having all your data entered into an Excel sheet, you can easily calculate your monthly expenditure and compare it against your income to ensure you stay within budget.

- Financial Transparency: Visualise your spending patterns, which can be crucial for identifying areas where you might be overspending.

- Accountability: Keeping records in an Excel sheet provides a clear, historical record of payments, which can be useful during tenant disputes or when preparing taxes.

- Time-Saving: Automating repetitive tasks like monthly payment entries through Excel's formula functions can save you time.

Creating Your Rent and Utilities Excel Sheet

Here’s a step-by-step guide on how to create your Rent and Utilities Excel Sheet:

1. Setup the Spreadsheet

Begin by opening Microsoft Excel or Google Sheets. Here’s what you need to do:

- Create a new workbook.

- Name the first worksheet "Overview" for a summary of all your expenses.

🌟 Note: Ensure your Excel version supports all the functions and tools mentioned here for the best experience.

2. Define Your Columns

Your Excel sheet should have columns for:

| Column A | Column B | Column C | Column D | Column E |

|---|---|---|---|---|

| Date | Expense Type | Description | Amount | Status |

Here’s what goes in each column:

- Date: The date of the payment or due date.

- Expense Type: This could be 'Rent', 'Electricity', 'Water', etc.

- Description: Any additional notes (like the account number or bill number).

- Amount: The amount of money spent on that particular expense.

- Status: Whether it has been paid, pending, or late.

✍️ Note: You can format the 'Date' column to automatically calculate the day of the week if needed.

3. Enter Your Data

Start entering data into your Excel sheet:

- Input the date of each expense.

- Categorize the expense type.

- Add a description for clarity.

- Enter the expense amount.

- Update the status as necessary.

Use formulas to automate calculations:

- =SUM(Cell1:CellX) for calculating totals.

- =IF(Condition, Value if true, Value if false) for status updates (e.g., if today's date is past the due date, mark it as late).

4. Conditional Formatting

To make your data more user-friendly:

- Set up conditional formatting to highlight due dates, paid bills, or overdue payments in different colors.

- Use different cell colors or font styles to differentiate between various expense types.

5. Tracking Overdue Bills

To track overdue bills:

- Use a formula like this to check if a bill is overdue:

=IF(TODAY()>Date, "Overdue", "Not Overdue")

- Automate an email reminder or pop-up message through VBA scripting if an expense becomes overdue.

🕒 Note: You might need basic knowledge of VBA scripting to set up reminders automatically.

6. Advanced Features

Enhance your sheet with these advanced features:

- Pivot Tables: Create a pivot table to analyze your expenses by category or month.

- Charts: Use charts to visualize trends in your expenditure.

- Macros: Set up macros to automate repetitive tasks like copying data from one sheet to another.

Additional Tips for Excel Efficiency

- Save your Excel file in a format that preserves your formulas (e.g., .xlsx).

- Back up your data regularly to prevent loss.

- Use password protection for sensitive data.

- Keep your Excel skills updated by exploring new features or functions regularly.

Summing up, creating a Rent and Utilities Excel Sheet is an invaluable way to take control of your financial life. By organizing your expenses in one place, you gain a clearer picture of your financial health, make budgeting easier, and prepare for unforeseen expenses. This tool not only tracks your spending but also gives you the insights needed to make better financial decisions, ultimately leading to a more stress-free and financially secure life.

Can I share my Excel sheet with roommates or family members?

+

Yes, you can share your Excel sheet. Use features like ‘Share Workbook’ in Microsoft Excel or share permissions in Google Sheets to collaborate with others. Ensure you set up proper permissions to edit or view to maintain the integrity of your data.

How often should I update my rent and utilities sheet?

+

It’s best to update your Excel sheet as soon as you make a payment or receive a bill. Regular updates help you keep track of due dates and avoid late payments. Setting a monthly review can also be helpful to spot trends or budget adjustments.

What if I lose my data or forget to back up my Excel file?

+

If you’re using cloud-based options like Google Sheets or OneDrive, your data is backed up automatically. However, for local files, consider setting up regular backups to external drives or cloud storage to prevent data loss.

Is there an app or alternative tool I can use instead of Excel?

+

Yes, there are several apps and tools designed for budgeting and expense tracking like Mint, YNAB, or Personal Capital, which might offer a more user-friendly interface and additional features for financial planning.