Streamline Petty Cash Tracking with Excel: Expert Tips

Managing petty cash can seem like a straightforward task, but without the right tools and methods, it can quickly become cumbersome. Excel, with its versatility and computational power, offers a robust solution for tracking petty cash. Here are some expert tips to streamline your petty cash tracking using Excel, ensuring accuracy, efficiency, and compliance.

Understanding Petty Cash

Petty cash refers to small amounts of cash kept on hand for minor expenses that do not warrant writing a check or using electronic payment methods. Here's how Excel can help:

- Ease of Use: Familiar interface for most business users.

- Data Organization: Organize transactions into categories, dates, and amounts.

- Real-Time Updates: Quickly update and share petty cash details.

- Error Reduction: Formulas ensure calculations are accurate.

Setting Up Your Petty Cash Spreadsheet

Begin by setting up your Excel spreadsheet to capture the following:

- Date: When the transaction occurred.

- Description: A brief description of the expense.

- Category: To which account the expense should be allocated.

- Vendor/Employee: Who received the cash.

- Amount: How much was spent or received.

- Balance: The current balance after each transaction.

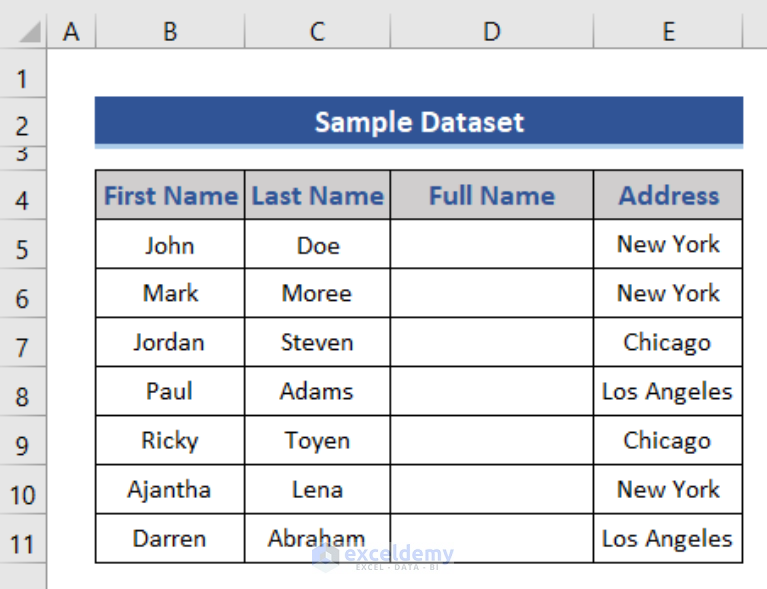

Step 1: Create Headers

On the first row, label each column appropriately. Use the first column for row numbers, if you wish, or merge cells for a title:

| Row Number | Date | Description | Category | Vendor/Employee | Amount | Balance |

|---|

Step 2: Input Data

Enter your transactions in the rows below the headers. Ensure each transaction is date-stamped for accurate tracking:

Step 3: Formulas for Calculations

Set up formulas to automatically update the balance:

- For the first transaction, enter the initial petty cash amount directly in the balance column.

- For subsequent rows, use a formula like `=B2-C2` where B2 is the balance from the previous transaction and C2 is the current transaction amount.

Step 4: Customize Your Spreadsheet

Use conditional formatting to highlight transactions, such as:

- Red for withdrawals exceeding a certain threshold.

- Green for deposits or cash returns.

✅ Note: Ensure your spreadsheet uses consistent data formatting to avoid formula errors.

Advanced Features for Better Tracking

Data Validation

Prevent errors by setting up data validation rules for:

- Date: Ensure dates are entered correctly.

- Category: Use a dropdown list to maintain consistency.

- Amount: Check if amounts are within reasonable limits.

Pivot Tables

Create a pivot table to analyze:

- Total expenses by category

- Expenses per employee

- Monthly cash flow

Data Protection

Protect your spreadsheet to prevent accidental changes or unauthorized access:

- Sheet Protection: Lock cells or entire sheets with a password.

- Backup: Regularly save copies of your spreadsheet to avoid data loss.

✅ Note: Keep the password secure and share it with authorized personnel only.

Maintaining Your Petty Cash Tracking System

Regular Reconciliation

Perform periodic reconciliation to ensure your cash balance in Excel matches the actual cash on hand. Here’s how:

- Count the physical petty cash.

- Compare it with the balance in your spreadsheet.

- Investigate and resolve any discrepancies.

Handling Discrepancies

When you find inconsistencies:

- Record the discrepancy in your spreadsheet.

- Investigate the source of the discrepancy.

- Adjust or add entries to correct the records.

Regular Reporting

Generate reports for:

- Monthly expenses

- Yearly totals

- Trend analysis to identify spending patterns

Summing up, Excel provides an excellent platform for tracking petty cash transactions with features that streamline the process. By setting up a well-organized spreadsheet, utilizing advanced Excel functions, and maintaining regular reconciliation, you can significantly reduce errors and improve financial oversight. The key is to ensure all entries are accurate, categorized correctly, and reviewed periodically. This approach not only simplifies petty cash management but also allows for insightful financial analysis, promoting transparency and accountability within your organization.

What are the benefits of using Excel for petty cash management?

+Excel offers ease of use, error reduction through formulas, data organization, and the ability to share updates in real-time, making petty cash management more efficient and accurate.

How do I handle discrepancies in my petty cash tracking?

+Record the discrepancy in your spreadsheet, investigate the cause, and correct the records either by adjusting existing entries or adding new ones to account for the difference.

Can I automate my petty cash reports using Excel?

+Yes, you can automate reports by setting up pivot tables, using macros, or integrating Excel with reporting tools to automatically generate periodic financial reports.