5 Ways to Compute Compound Interest in Excel

Compound interest is a powerful financial concept where interest is added to the principal amount, which then earns interest on the new total. This can significantly accelerate the growth of your savings or investments over time. Excel, with its robust calculation capabilities, is an excellent tool for calculating and analyzing compound interest. Here are five effective methods to compute compound interest in Excel:

1. Using the Compound Interest Formula

The basic compound interest formula is:

[ A = P(1 + \frac{r}{n})^{nt} ]- A: Final amount after interest

- P: Principal investment

- r: Annual interest rate (as a decimal)

- n: Number of times that interest is compounded per year

- t: Number of years the money is invested or borrowed for

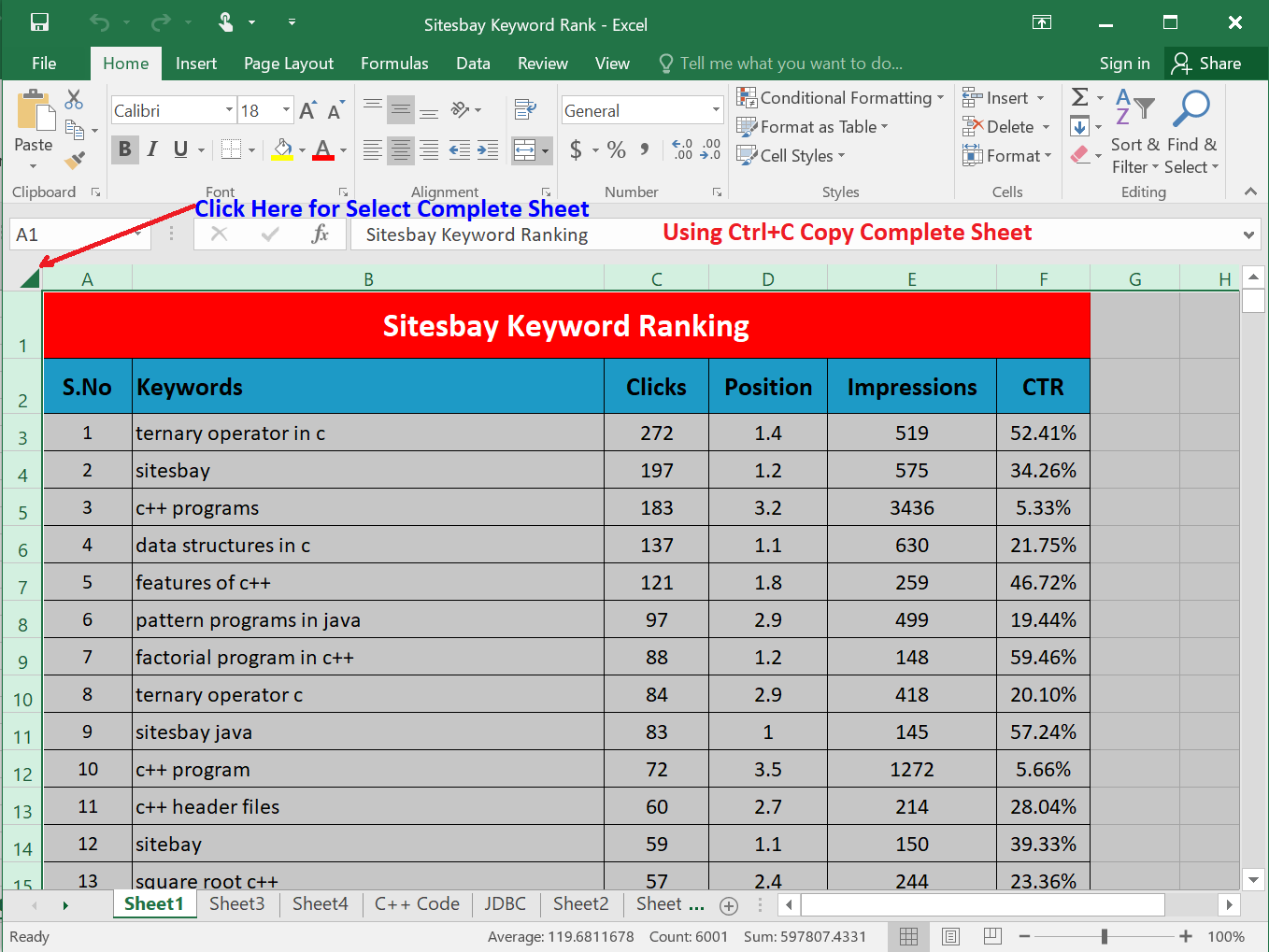

Here’s how you can apply this formula in Excel:

A2 = B2 * (1 + C2/D2)^(D2*E2)

- B2: Principal (P)

- C2: Interest Rate (r)

- D2: Number of times compounded (n)

- E2: Time period (t)

🧮 Note: If you're dealing with varying compounding frequencies or rates, adjust the formula accordingly.

2. Future Value (FV) Function

Excel offers the FV function to calculate compound interest directly:

= FV(rate, nper, pmt, [pv], [type])

- rate: Interest rate per period

- nper: Total number of payment periods

- pmt: Payment made each period; often 0 in savings scenarios

- pv: Present value, or initial investment

- type: When payments are due (1 if at the beginning, 0 if at the end)

Example:

= FV(B2/D2, D2*E2, 0, -B2, 0)

📚 Note: Here, we're considering compounding at the end of each period, which is why 'type' is set to 0.

3. Growth Over Time Table

A dynamic table can help visualize how compound interest grows your investment:

| Year | Amount |

|---|---|

| 0 | = B2 |

| 1 | = B2 * (1 + C2/D2) |

| ... | ... |

| 10 | = B2 * (1 + C2/D2)^10 |

📊 Note: This table shows how the balance grows each year with compound interest applied.

4. Impact of Changing Interest Rates

Understand how different interest rates affect your investment:

= P (1 + (rate/100))^t

- Create a range of interest rates from 2% to 10%.

- Use Excel's Data Table feature to fill the table with results.

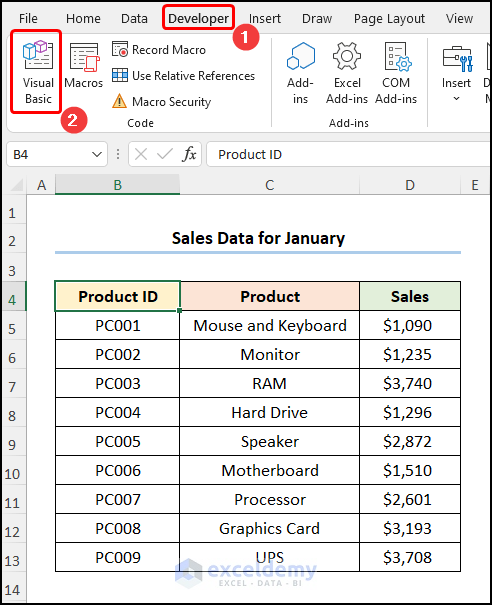

5. Using Goal Seek for Target Amounts

If you aim to reach a certain amount, Excel’s Goal Seek can help you find the necessary variables:

- Set up the compound interest calculation in a cell.

- Use Goal Seek to find the required time, interest rate, or compounding frequency.

To use Goal Seek:

- Go to ‘Data’ > ‘What-If Analysis’ > ‘Goal Seek’.

- Set the ‘Set cell’ to your interest calculation cell.

- Change ‘To value’ to your target amount.

- Specify the cell with the variable you want to change.

- Excel will calculate the required value.

🎯 Note: Goal Seek is particularly useful for reverse engineering financial goals.

Understanding and calculating compound interest is vital for anyone looking to make informed financial decisions. By using Excel, you can not only calculate compound interest but also model different scenarios, compare investment options, and project future values with different compounding frequencies. This can be a game-changer in your financial planning, allowing you to visualize potential growth over time and adjust your investment strategy accordingly.

What is the difference between simple and compound interest?

+

Simple interest is calculated only on the initial principal amount, whereas compound interest is calculated on the principal plus accumulated interest. Over time, compound interest leads to exponential growth.

Can Excel handle continuous compounding?

+

Yes, for continuous compounding, you can use the formula ( P \times e^{r \times t} ) in Excel, where ( e ) is approximately 2.71828.

How often should I reinvest dividends to maximize compound interest?

+

The more frequently you reinvest, the closer you come to the benefits of continuous compounding. Quarterly or monthly reinvestment is often advisable to maximize the compounding effect.

Is there a cap on how much compound interest can grow an investment?

+

Not inherently, but external factors like taxes, inflation, and market conditions can impact the actual growth of your investment.

Why is compounding considered the eighth wonder of the world?

+

Attributed to Albert Einstein, this phrase underscores the power of compounding to grow wealth exponentially over time, making it seem almost magical in its effect.