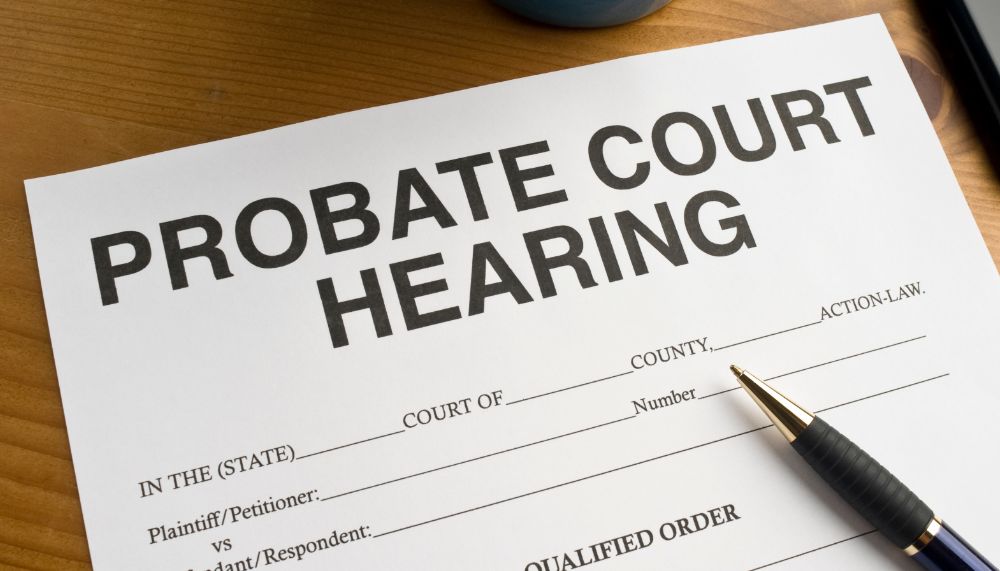

Probate Paperwork Timeline: What to Expect and How Long?

The probate process can be an overwhelming experience, especially during a time of grief. Understanding the timeline and steps involved in probate paperwork can help ease some of this burden. Here’s a detailed guide on what to expect and how long probate might take, offering clarity during a challenging period.

Understanding Probate

Probate is the legal process through which a deceased person’s estate is properly distributed to heirs and their outstanding debts are paid. Before diving into the timeline, it’s crucial to grasp the basics:

- Estate Settlement: This involves identifying all the property of the deceased, paying taxes and debts, and distributing remaining assets.

- Executor or Administrator: The person responsible for managing this process is appointed by the court if not named in the will.

Initial Steps

The probate process begins almost immediately after a person’s death. Here are the initial steps:

- Filing the Will: The original will must be filed with the probate court if one exists.

- Appointment of Executor or Administrator: A petition is filed to the court to either confirm the executor named in the will or appoint an administrator if there is no will.

- Notification: All potential heirs, beneficiaries, and creditors must be notified of the probate process.

⚠️ Note: Ensure you have multiple copies of the death certificate as they are often required during probate.

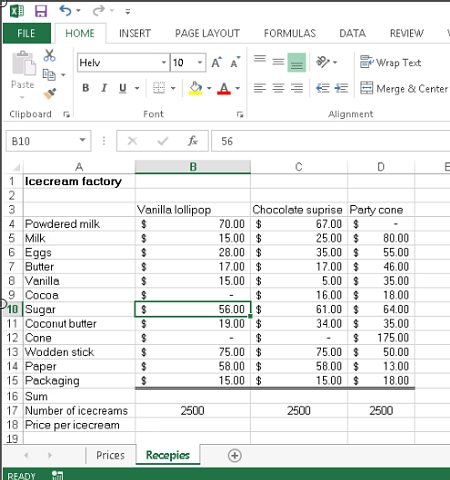

The Probate Timeline

The exact time probate takes can vary significantly based on several factors:

- Complexity of the Estate: Assets requiring professional appraisals or sales (e.g., real estate) extend timelines.

- Will or No Will: With a will, the process is typically faster. Without, intestacy laws govern, potentially complicating matters.

- Court Backlog: Depending on the jurisdiction, court delays can occur.

- Disputes: Any contesting of the will or disputes among heirs can significantly prolong the process.

Typical Timeline

- First 30-90 Days: Filing the will, appointing the executor, and giving notice to interested parties.

- 30-120 Days: Collecting and appraising assets, and paying all outstanding debts and taxes.

- 120-270 Days: Distribution of assets to heirs or selling off assets, if necessary.

- 270-360 Days: Final accounting and the executor’s report, with court approval to close the estate.

| Stage | Timeframe |

|---|---|

| Filing and Executor Appointment | 30-90 Days |

| Asset Collection and Debt Settlement | 30-120 Days |

| Asset Distribution | 120-270 Days |

| Final Accounting and Estate Closure | 270-360 Days |

📌 Note: These time frames are generalized; individual cases can and do vary.

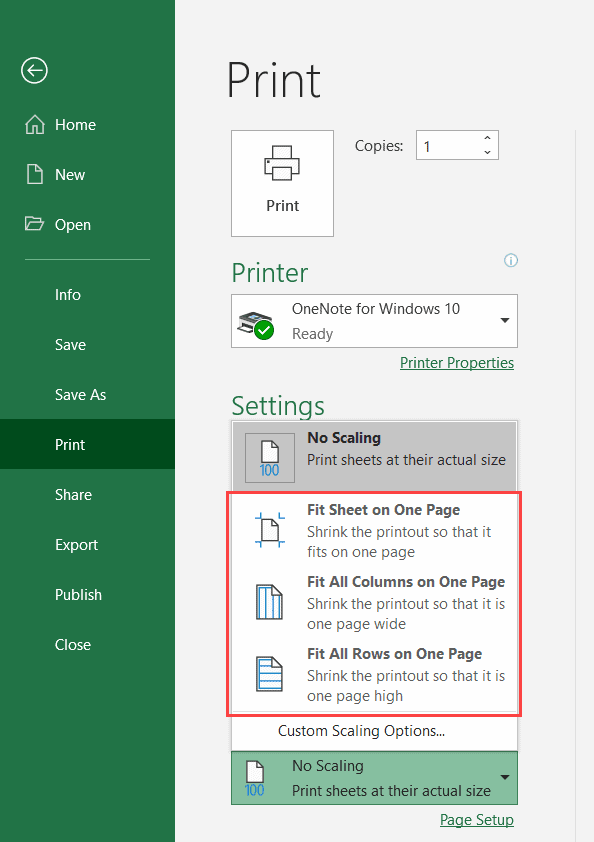

Navigating Probate with Efficiency

To expedite the probate process:

- Use Beneficiary Designations: Retirement accounts, life insurance policies, and sometimes bank accounts can bypass probate through beneficiary designations.

- Small Estate Affidavit: If the estate is below a certain value, many states allow for a simplified affidavit process to settle assets.

- Maintain Records: Keep all estate documents organized and accessible, reducing time spent locating them.

- Legal Assistance: A probate attorney can guide through legal nuances, potentially speeding up the process.

In the end, understanding the probate process timeline and the necessary paperwork is crucial for anyone who will or might be involved in probate. From the initial filing of the will to the final distribution of assets, each step has its duration influenced by the complexity of the estate, legal procedures, and personal disputes. By preparing in advance and seeking professional assistance when needed, executors and heirs can navigate this complex journey with greater confidence and efficiency.

What is the role of an executor in probate?

+

The executor is responsible for managing the deceased’s estate through probate. Their duties include locating the will, filing it with the court, notifying heirs, paying debts and taxes, selling property if needed, and distributing remaining assets.

Can probate be avoided entirely?

+

Probate can be minimized or avoided in several ways: using trusts, beneficiary designations, and joint tenancy with right of survivorship. However, in most cases, some form of probate may still be necessary.

What happens if a will is contested?

+

A contested will can significantly delay the probate process. If the will is challenged on grounds like lack of testamentary capacity, fraud, or improper execution, the court will hold hearings to resolve these disputes, which could take months or even years.

How can I ensure my estate goes through probate quickly?

+

Keeping your estate well-documented, using beneficiary designations, setting up trusts, and keeping a detailed list of assets and debts can help streamline the probate process. Engaging a knowledgeable estate planning attorney can also prevent common pitfalls.