5 Essential Tips for Keeping Tax Credit Records

Tax credit records are crucial when dealing with annual tax returns and financial documentation. Efficient organization and management of these records can prevent stress during tax season, expedite the filing process, and ensure you don't miss out on any benefits or deductions. Here are five essential tips to help you maintain your tax credit records effectively:

Tip #1: Keep Your Documents Organized

An organized record-keeping system can drastically reduce the time you spend hunting down documents when it’s time to file your taxes.

- Use Folders: Create physical or digital folders labeled by year, type of credit, or source of income. This helps in quickly locating documents when needed.

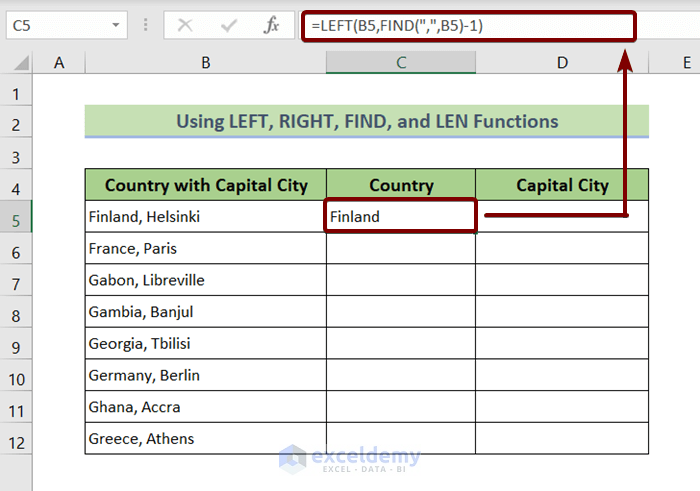

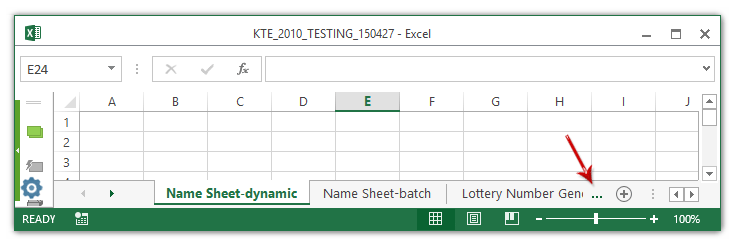

- Consistent File Naming: Adopt a standardized naming convention for your digital files. For example, “2023_TaxCredit_NameOfDocument”.

- Chronological Order: Sort documents either by the date they were received or created to track financial activities over time.

🔖 Note: Keeping documents in folders not only saves time but also prevents the accidental loss or misplacement of important records.

Tip #2: Retain Documents for the Right Amount of Time

Understanding how long you need to keep your tax documents is vital to comply with regulations and protect yourself in case of audits:

- General Tax Records: Retain these for at least three years from when you filed your tax return.

- Real Estate and Investments: Keep records for at least seven years for any asset or investment that could trigger a capital gains tax.

- Permanent Retention: Hold onto birth certificates, deeds, or documents related to property ownership indefinitely.

📆 Note: IRS guidelines recommend retaining tax returns and supporting documents for at least three years, but some situations might require longer retention periods.

Tip #3: Use Digital Storage

Digital storage provides numerous advantages over traditional paper-based records:

- Cloud Storage: Services like Dropbox, Google Drive, or iCloud allow you to store files securely in the cloud, accessible from any device.

- Regular Backups: Ensure your files are backed up regularly to prevent data loss in case of system failures.

- Easy Accessibility: Share files with your tax advisor or retrieve them quickly for reference or audit purposes.

💾 Note: Before fully transitioning to digital storage, consider the security of the cloud service and the privacy implications of storing sensitive financial data online.

Tip #4: Stay Updated with Tax Credit Changes

Tax laws are constantly evolving, and staying abreast of these changes can help you maximize your credits:

- Subscribe to Updates: Follow the IRS or local tax authority for updates on new or modified tax credits.

- Read Financial News: Stay informed by reading financial news outlets or industry publications.

- Attend Seminars: Participate in tax seminars or workshops, often offered by tax preparation companies or professional associations.

📰 Note: Being proactive about tax credit information can lead to strategic tax planning and better financial decisions.

Tip #5: Consult with a Professional

Professional advice can be invaluable, especially when you’re dealing with complex tax situations:

- Accountants: Certified Public Accountants (CPAs) or tax advisors can guide you through tax planning and ensure you’re taking advantage of all available credits.

- Financial Advisors: They can offer insights into long-term financial strategies that align with your tax goals.

- Legal Counsel: For complex business structures or high-stake transactions, consider consulting with a tax attorney.

👨💼 Note: Engaging with a professional can provide peace of mind and could even save you money by optimizing your tax strategy.

In summary, meticulous organization, understanding retention periods, embracing digital solutions, keeping abreast of tax law changes, and seeking expert guidance are fundamental steps in effectively managing your tax credit records. This approach not only helps during tax filing but also ensures your financial records are accurate and secure. It's worth noting that while these tips will streamline your tax documentation process, they are not a substitute for professional advice when it comes to complex tax scenarios or high-stake financial decisions.

How long should I keep my tax records?

+

The IRS suggests keeping your tax returns and related documents for at least three years. However, in cases involving real estate or investment property, you should retain records for at least seven years, and some documents like birth certificates or property deeds should be kept indefinitely.

What should I do if my documents are digital?

+

Ensure regular backups of your digital files using cloud services or external drives. Also, check the security of your cloud storage provider to safeguard your sensitive tax information.

Is it necessary to stay updated on tax credit changes?

+

Yes, as tax laws can change annually or even during the year, staying updated can help you maximize your tax credits and plan your financial strategy effectively.