How Long Should You Keep Your Unemployment Paperwork?

The duration you should keep your unemployment paperwork varies based on several factors, including potential future benefits, tax purposes, and possible audits. Understanding why and how long you need to retain these documents can save you from future headaches and potential legal troubles. In this post, we'll delve into the reasons for keeping these records and offer practical guidelines on how long to store different types of unemployment documents.

Why Keep Unemployment Paperwork?

Before diving into how long you should keep these documents, let's understand why retention is crucial:

- Audits: Both federal and state agencies have the right to audit your unemployment claims. Retaining documents helps in proving your eligibility and compliance.

- Tax Filings: Unemployment benefits are considered taxable income. Keeping records facilitates accurate tax reporting and ensures you have documentation if audited by the IRS.

- Future Claims: If you're reapplying for unemployment, previous paperwork can streamline the process by providing historical data on your work history and previous claims.

- Legal Proof: In case of disputes or identity theft, having your paperwork can serve as legal proof of your unemployment status and actions taken during the unemployment period.

How Long Should You Keep Each Document?

1. Unemployment Benefit Statements

Unemployment benefit statements, which include the amount you've received, should be kept for:

- At Least 3 Years: For federal tax purposes, the IRS recommends keeping records that substantiate income or deductions for at least three years.

- 7 Years: If your income is high or if there is a possibility of a significant tax error, you might opt to keep these records for 7 years due to IRS audit periods.

📌 Note: Retaining longer than necessary won't harm; it could be beneficial in unforeseen situations.

2. Employer Separation Notices

If your employer provided you with a notice explaining why your employment ended:

- Indefinitely: Keep these documents indefinitely as they can be crucial if there's a dispute about the termination or if you need to prove your unemployment reason in future claims.

3. Job Search Records

As part of many unemployment insurance requirements, you need to actively seek work:

- 1 Year After Benefits End: These records should be kept for at least a year after your benefits stop, to cover any possible state audits or inquiries regarding your job search activities.

4. Correspondence from Unemployment Office

All communications regarding your unemployment claim:

- At Least 3 Years: These should be retained for at least three years due to potential federal tax implications or audits.

- 7 Years: If the communications involve significant changes in your benefits or disputes, you might consider keeping them longer.

5. Wage and Tax Statements

Forms like W-2 or 1099-G that you receive when you're unemployed:

- 3-7 Years: For tax purposes, these should align with the tax record retention period, typically 3-7 years.

6. Payment History

Any record showing payments made to you by the unemployment agency:

- At Least 3 Years: Similar to benefit statements, keep them for at least three years for tax reasons.

- 7 Years: If there's significant monetary involvement or potential for a large tax liability, longer retention might be prudent.

The timeframe for keeping unemployment paperwork is not one-size-fits-all. Here are some general guidelines to consider:

Tips for Organizing and Storing Documents

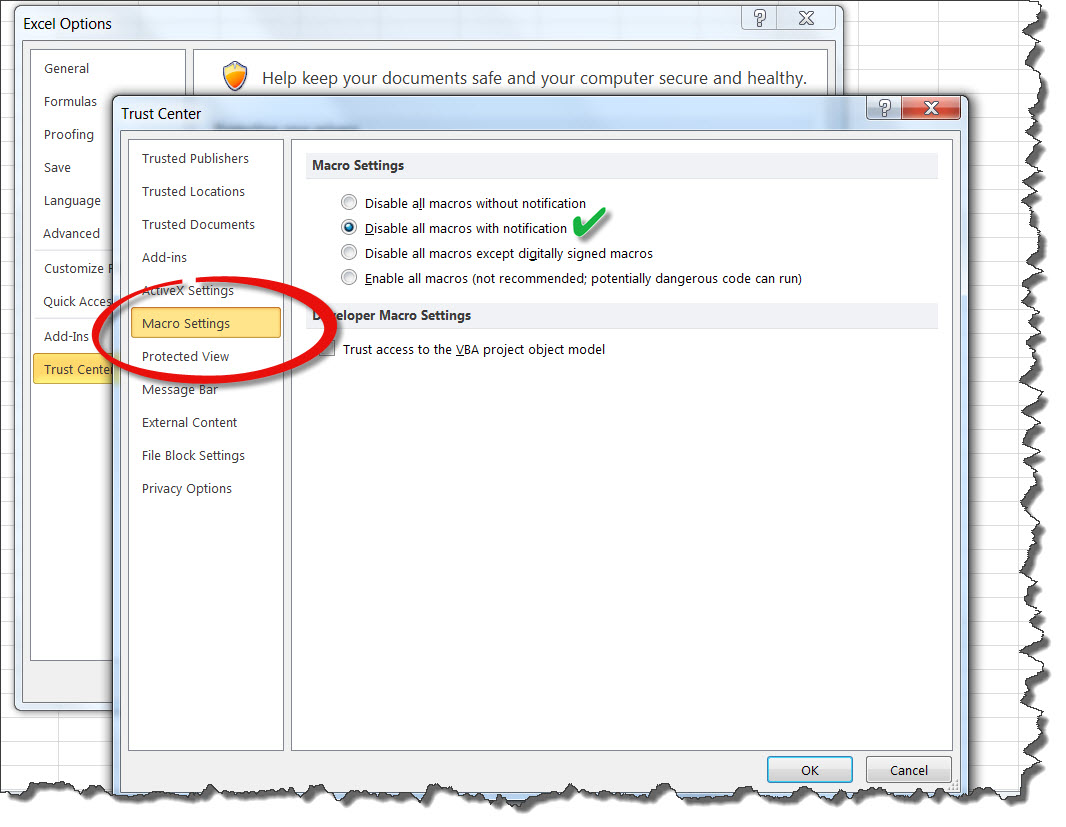

- Digital Archiving: Scan documents and save them in secure, encrypted folders or use a digital document management system.

- Physical Storage: Keep physical copies in a fireproof, waterproof safe, or file cabinet.

- Use Labels: Clearly label folders or files with content and year for easy retrieval.

- Annual Review: Each year, review your documents to decide what can be shredded or destroyed based on the guidelines provided.

Managing the Storage Process

Proper management of your unemployment paperwork will not only help in audits but also in personal financial planning:

- Regular Updates: Keep your records updated, especially if there are changes in your employment status or benefits.

- Password Protection: If storing documents digitally, ensure your computer or cloud storage has strong password protection.

- Backup Solutions: Regularly back up important documents to prevent data loss.

- Know Your State: State laws might dictate specific retention periods, so familiarize yourself with state-specific guidelines.

Your records should be stored with care for potential future needs, whether it's for another unemployment claim, a tax audit, or legal disputes. Keeping your paperwork in an organized manner will not only ease potential stress in such situations but also ensure you're always ready with the proof of your claims and financial history.

What if I lose my unemployment paperwork?

+

If you lose your unemployment paperwork, contact your state’s unemployment agency immediately. You can usually request replacement documents or get electronic access to your benefit details online. Maintain backups of important documents to prevent future losses.

Can I keep digital copies instead of physical ones?

+

Yes, digital copies are acceptable, provided they are stored securely. Use encryption and backup systems to ensure data safety. However, for certain legal disputes or situations, a physical copy might still be preferred or required.

What happens if I keep unemployment paperwork longer than necessary?

+

There’s no legal penalty for keeping paperwork longer than necessary. However, it’s prudent to shred or securely dispose of documents once they are no longer needed to protect against identity theft.