5 Financial Disclosure Tips for Initial Divorce Filing

The journey through divorce can be emotionally taxing, but ensuring your financial affairs are in order can significantly ease the legal and emotional strain. Financial disclosure during the initial stages of filing for divorce is a critical step. It involves providing a detailed and accurate account of all your assets, liabilities, income, and expenses to both your spouse and the court. Here are some key tips to guide you through this often-overlooked aspect of the divorce process:

1. Understand What Financial Disclosure Involves

Financial disclosure isn’t just about filling out forms; it’s about transparency. Here’s what you need to include:

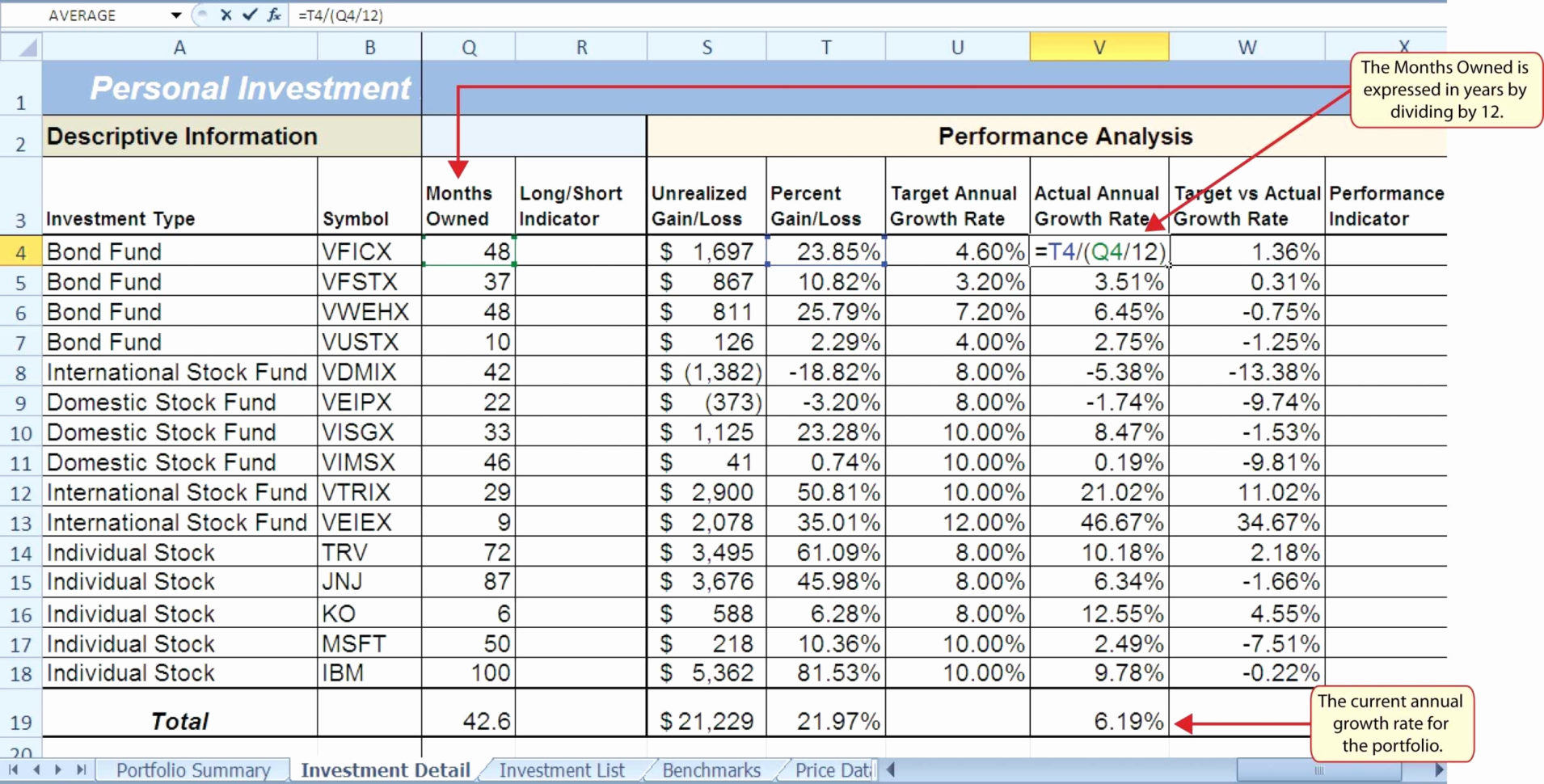

- Income: This includes all forms of income from employment, investments, self-employment, government benefits, or any other source.

- Assets: All tangible and intangible assets, from real estate and vehicles to bank accounts, investments, and personal property.

- Liabilities: All debts, mortgages, loans, credit card balances, and any other financial obligations.

- Expenses: Detailed monthly and annual expenses to give a clear picture of your financial status.

2. Gather All Necessary Documents

To avoid last-minute stress, start collecting documents early. Here’s a list to consider:

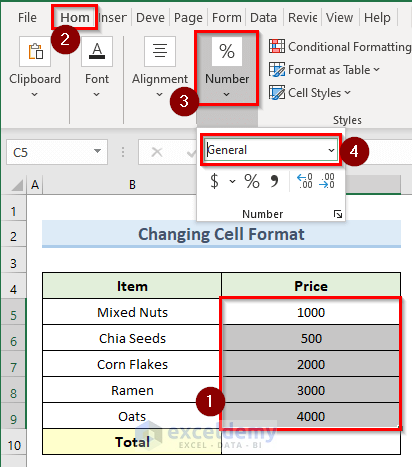

| Category | Documents |

|---|---|

| Income | Recent pay stubs, tax returns, business income statements |

| Assets | Bank statements, property deeds, titles to vehicles, investment account statements |

| Liabilities | Loan statements, credit card statements, mortgage documents |

| Expenses | Utility bills, insurance policies, monthly subscriptions, school fees, etc. |

Keep these documents organized in a secure file for easy access during the legal process.

📝 Note: While gathering documents, ensure to redact sensitive information like social security numbers or account numbers if they are to be shared with your spouse or their legal representative.

3. Be Thorough and Accurate

One of the most critical aspects of financial disclosure is the accuracy:

- Be honest and thorough. Attempting to hide assets or under-report income can lead to legal consequences, including unfavorable divorce terms or even criminal charges.

- Update your disclosure if your financial situation changes significantly before the finalization of the divorce. This might include job loss, receiving an inheritance, or acquiring new debts.

4. Seek Professional Help

Divorce can be complex, and financial intricacies can be daunting:

- Consider hiring a forensic accountant if there’s suspicion of hidden assets. They can help trace and value hidden income or assets.

- Financial planners can also assist in understanding how the division of assets and liabilities will impact your financial future.

⚖️ Note: Engaging professionals like accountants or financial advisors can provide clarity and might be tax-deductible if related to legal proceedings.

5. Prepare for Negotiations

Understanding your financial position is just the beginning. Prepare for negotiations:

- Know what assets are marital or separate to help with negotiations. Marital property is subject to division, while separate property usually remains with the owner.

- Have a clear understanding of your financial needs post-divorce. This includes your budget for housing, child support, alimony, and future financial planning.

- Be ready for compromise. It’s rare for one party to get everything they want in a divorce. Knowing your non-negotiables can streamline the process.

In the labyrinthine path of divorce proceedings, financial disclosure serves as the foundation for fair asset distribution, child support, and alimony arrangements. The process, although tedious, ensures that both parties have an equitable chance to review, understand, and plan their financial futures post-divorce. While challenging, the key takeaways from this preparation are straightforward: be meticulous, seek help where needed, and approach the negotiations with a mindset geared towards finding a fair resolution.

What happens if I don’t disclose all my assets?

+

Failing to disclose all assets can lead to legal consequences, such as contempt of court, and can severely impact the final settlement. The court might order a new division of assets, making the process longer and more expensive, or penalize you financially.

Can I change my financial disclosure after it’s submitted?

+

If there are significant changes in your financial situation, you should update your disclosure. However, deliberate changes made to skew the outcome can lead to distrust or legal repercussions.

Should I disclose inherited assets or gifts?

+

Assets received as gifts or through inheritance during marriage might be considered marital property in some jurisdictions, but this depends on local laws. Consult with your lawyer to understand the specifics relevant to your case.