Paperwork Process for Selling Your House Explained

Understanding the Paperwork Involved in Selling Your House

Selling a house involves a mountain of paperwork, something that can seem daunting if you’ve never navigated the process before. Whether you’re upgrading, downsizing, or simply moving to a new area, understanding the paperwork is key to a smooth transaction. This blog post will walk you through the essential documents, helping you ensure your sale goes as seamlessly as possible.

The Initial Paperwork

The selling process begins with some basic documents that you’ll need to prepare:

- Seller’s Disclosure Form: This form is mandatory in many states. It provides potential buyers with any known issues or defects with the property. Transparency is key here to avoid legal issues down the line.

- Preliminary Title Report: This document outlines any liens, easements, or encumbrances on the property that might affect the sale. It’s your first step in ensuring a clear title.

⚠️ Note: Ensure all information provided in the disclosure is accurate. False information can lead to legal consequences.

Listing Agreement

When you hire a real estate agent, you’ll sign a Listing Agreement:

- This contract outlines your agent’s responsibilities, the listing price, and the duration of the agreement.

- It also details the commission structure and any dual agency agreement if your agent is also representing the buyer.

Offer and Acceptance

Here’s where things get exciting:

- Purchase and Sale Agreement: Once an offer is made and accepted, this document details the sale conditions, including price, contingencies (like home inspections or financing), and the closing date.

👉 Note: Ensure you understand all terms and conditions in the purchase agreement before signing. It's the legal backbone of your sale.

The Escrow Process

After the agreement, the property enters escrow:

Escrow Instructions: This document details how escrow is to be handled, including deposit of funds, disbursement, and closing requirements.

Escrow Agreement: An agreement between all parties involved, defining the terms of the escrow arrangement.

| Document | Purpose |

|---|---|

| Escrow Instructions | Details how funds are to be held and disbursed |

| Escrow Agreement | Defines terms of escrow handling |

Home Inspection and Contingency Releases

A home inspection is often a contingency of the sale:

- Home Inspection Report: This isn’t something you provide but rather something the buyer will have done. If issues are found, you might need to:

- Negotiate Repairs: With the buyer, you’ll either fix the problems, offer a credit, or reduce the sale price.

- Sign a Release of Liability: If the buyer agrees to take on the repairs themselves, this form releases you from any future liability.

✅ Note: Address any home inspection issues promptly to keep the sale on track.

Title and Deed Transfer Documents

At the closing, you’ll encounter:

- Grant Deed or Warranty Deed: This document officially transfers the property from you to the buyer.

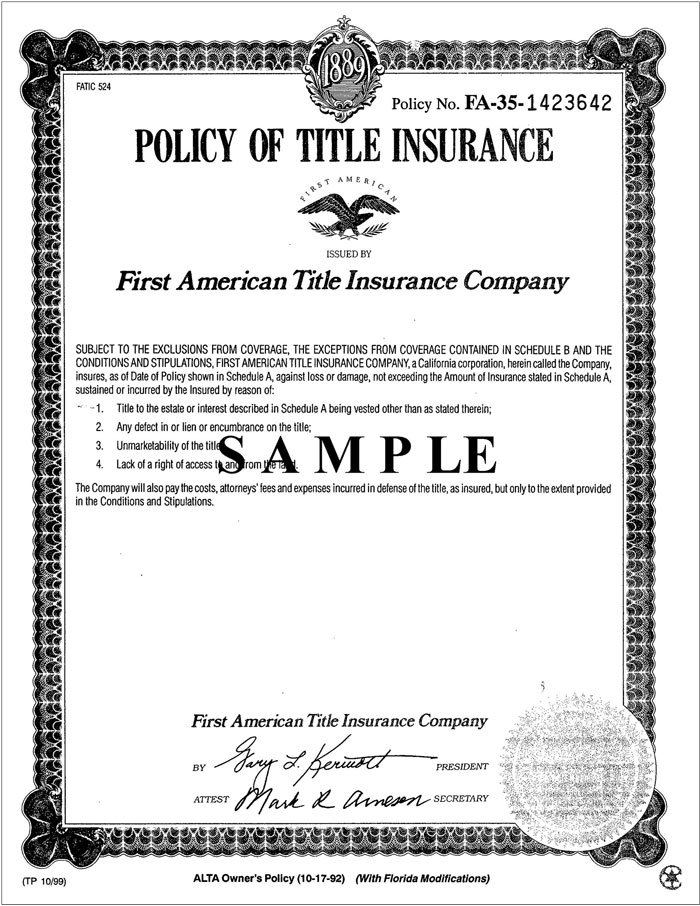

- Title Insurance: Ensures that the title is clear and protects both parties from potential future claims.

Closing Documents

As the closing date approaches:

- Settlement Statement: Details all costs, credits, and debits for both the buyer and the seller.

- Affidavit of Title: You’ll sign this document stating that no new liens have been placed on the property and that you’re the legal owner.

Final Thoughts

Going through the paperwork to sell your house can be an overwhelming experience, but breaking it down into manageable steps makes the process less intimidating. From the initial disclosure forms to the final deed transfer, each document plays a crucial role in ensuring that the sale of your home is both legal and equitable. Here are the key takeaways:

- Be Transparent: Always provide accurate and truthful information, especially in the Seller’s Disclosure Form.

- Understand Your Agreements: Listing agreements, escrow instructions, and purchase agreements have binding terms. Know them well before you sign.

- Handle Contingencies: Issues from home inspections should be addressed swiftly to keep the transaction moving forward.

- Stay Organized: Keep all your documents neatly organized to facilitate a smoother closing process.

By ensuring you have a clear understanding of each step, and with the guidance of a real estate professional, you can navigate through the paperwork with confidence.

What happens if I find a mistake in the Seller’s Disclosure Form after I’ve already given it to the buyer?

+

You should promptly notify the buyer and provide an updated disclosure. Failure to correct known issues can lead to legal action.

Can I handle the sale of my house without an agent?

+

Yes, it’s possible through For Sale By Owner (FSBO). However, an agent can navigate complex paperwork and negotiations, often leading to a smoother sale.

What if the buyer finds an issue during the home inspection?

+

You can negotiate repairs, offer a credit, reduce the sale price, or let the buyer take on the repair with a release of liability.

How important is title insurance, and who pays for it?

+

It’s crucial to protect against future title disputes. Generally, the seller pays for the owner’s title insurance, while the buyer pays for the lender’s policy.

What does the settlement statement tell me?

+

This document details the final financial breakdown of the transaction, including all charges, credits, and funds you need to bring to closing.