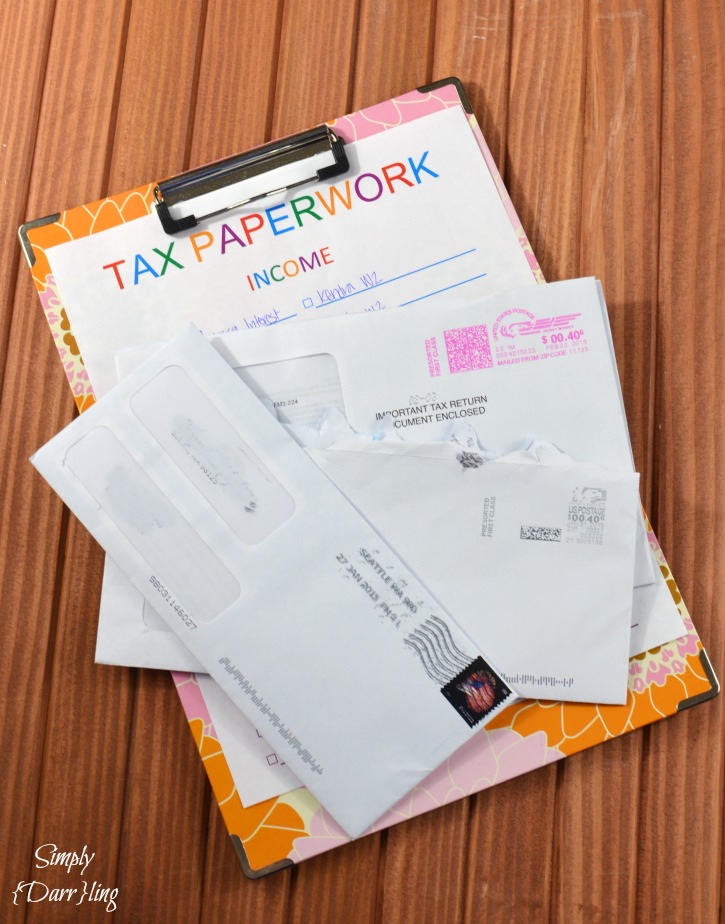

How to Easily Get Your Tax ID Paperwork

Obtaining your Tax Identification Number (TIN) or related documents can seem daunting, but with the right information, it's a straightforward process. Whether you're an individual setting up your tax affairs for the first time, a business owner seeking to register for taxes, or someone in need of an Employer Identification Number (EIN) for their company, understanding the steps involved can save you from unnecessary stress and delays.

Understanding Your Need for a Tax ID

A Tax ID number is essential for several reasons:

- Tax Filing: It’s necessary for filing your federal and state tax returns.

- Business Transactions: It’s required for opening a business bank account, hiring employees, or when filing for permits and licenses.

- Contract Work: Freelancers and independent contractors need a TIN to report income and for clients to provide on their 1099-MISC forms.

Types of Tax ID Numbers

Here are the primary types of Tax ID numbers:

| Type | Who Can Apply | Purpose |

|---|---|---|

| Social Security Number (SSN) | Individuals | Personal tax filing and identification |

| Employer Identification Number (EIN) | Businesses and certain estates and trusts | Business tax filing, hiring employees, opening a business account |

| Individual Taxpayer Identification Number (ITIN) | Non-resident and resident aliens who are not eligible for an SSN | Filing federal tax returns without an SSN |

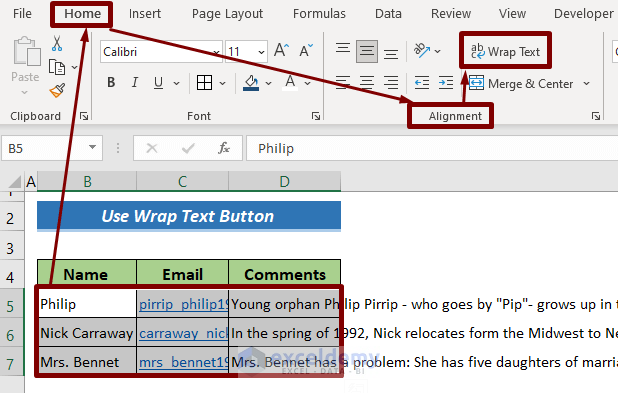

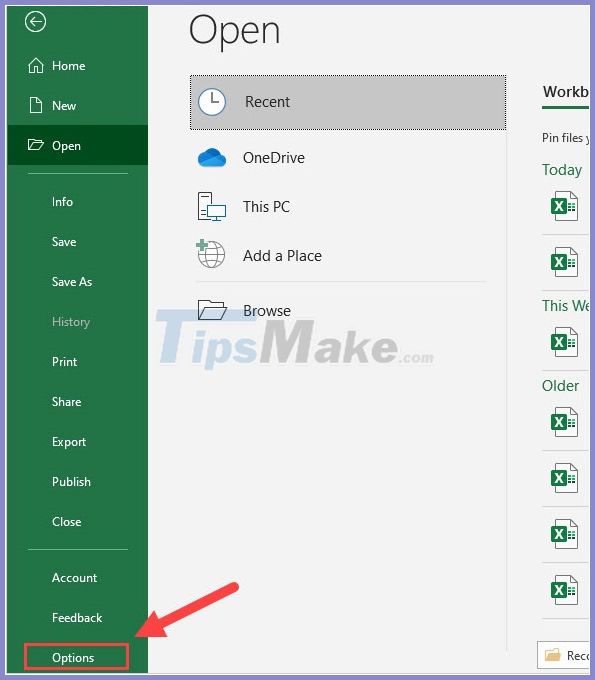

Steps to Get Your Tax ID

Applying for your Tax ID, especially an EIN or ITIN, can be done in several ways:

Applying for an EIN

- Online Application: Visit the IRS website. You can apply online, and the EIN will be issued immediately upon approval.

- Fax or Mail: Complete Form SS-4 and fax or mail it to the IRS.

- By Phone: Available only for international applicants.

Applying for an ITIN

- Complete Form W-7: This form is available on the IRS website.

- Submit with Tax Return: Include your tax return with Form W-7. You must file a return to be eligible for an ITIN.

- Visit an Acceptance Agent: If you cannot file a tax return, you can apply through an IRS-authorized Acceptance Agent.

- Send by Mail: Mail the completed Form W-7, your tax return, and proof of identity and foreign status to the IRS.

💡 Note: If you’re applying for an ITIN because you do not have an SSN, make sure to provide all necessary documentation to avoid delays in processing.

Common Challenges and Solutions

- Information Submission: Be meticulous with the information you provide to avoid processing delays or rejections.

- Time-Sensitivity: Apply early if your business needs immediate operation or if you’re facing a tax deadline.

- Lost or Forgotten Numbers: If you’ve lost your TIN, contact the IRS for assistance. They won’t give you a new TIN, but they can help you retrieve it.

Obtaining your Tax ID is not just about complying with legal requirements; it's also a crucial step in securing your financial future. Whether you're an individual taxpayer or running a business, having your tax paperwork in order simplifies interactions with financial institutions and government entities. This guide should have provided you with a clear pathway to obtaining your tax identification paperwork efficiently and effectively.

Can I apply for an EIN online?

+

Yes, the IRS provides an online application service where you can apply for an EIN immediately upon approval.

How long does it take to get an ITIN?

+

The processing time for an ITIN can vary, typically taking 6 to 11 weeks. Applying early and ensuring all documents are correctly submitted can expedite this process.

What if I lost my EIN?

+

If you’ve lost your EIN, you can contact the IRS. They won’t issue a new number, but they can help you retrieve the one you have.

Can a non-resident alien apply for an EIN?

+

Yes, non-resident aliens can apply for an EIN for their U.S.-based business or trust by using Form SS-4.