5 Ways to Find AGI on Your 2017 Tax Paperwork

Discovering your Adjusted Gross Income (AGI) on your 2017 tax paperwork can initially seem like a daunting task. However, with a few steps, you can locate this crucial number effortlessly. Understanding your AGI is key to ensuring accuracy when filing subsequent tax returns, applying for loans, or seeking government assistance. Here are five ways to find your AGI from your 2017 tax documents:

1. Look at the Summary of Your Tax Return

Your AGI is usually reported on the summary or overview section of your tax return. Here’s how you can find it:

- Form 1040: For the tax year 2017, your AGI is reported on line 38 of Form 1040.

- Form 1040A: If you filed Form 1040A, check line 22 for your AGI.

- Form 1040EZ: For the simplest filers, line 4 is where you’ll find your AGI on Form 1040EZ.

2. Review Any Amendments

If you’ve amended your 2017 return, make sure you’re looking at the final version:

- Review Form 1040X, which is used to amend returns. Your AGI might have changed if you claimed additional deductions or made other adjustments.

🔍 Note: If you made significant changes, the AGI on your amended return might differ from the original.

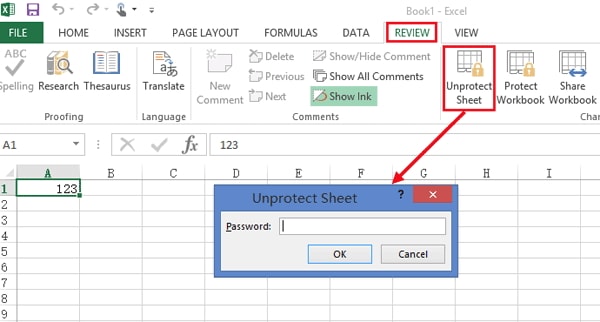

3. Check Your IRS Transcript

An IRS transcript is an official record of your past tax filings. Here’s how to get it:

- Request Online: Visit irs.gov and use the “Get Transcript Online” tool.

- By Mail: Complete Form 4506-T and mail it to the IRS.

| Document | AGI Location |

|---|---|

| Account Transcript | Line 38 of the “Adjusted Gross Income” section |

| Return Transcript | Line 38 of Form 1040, or equivalent line for other forms |

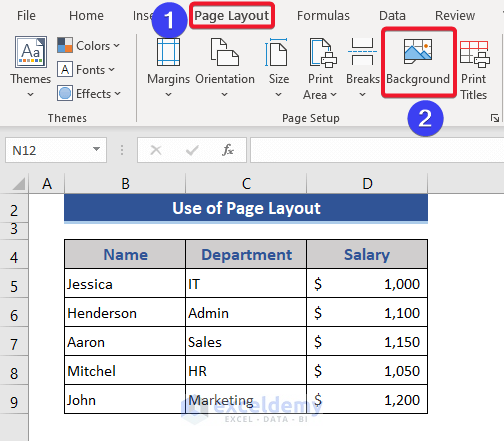

4. Review Your Tax Preparation Software

If you used tax software to file your 2017 return, look for these options:

- Check the final summary of your tax return stored within the software.

- Some software keeps a running total of AGI as you input your income and deductions.

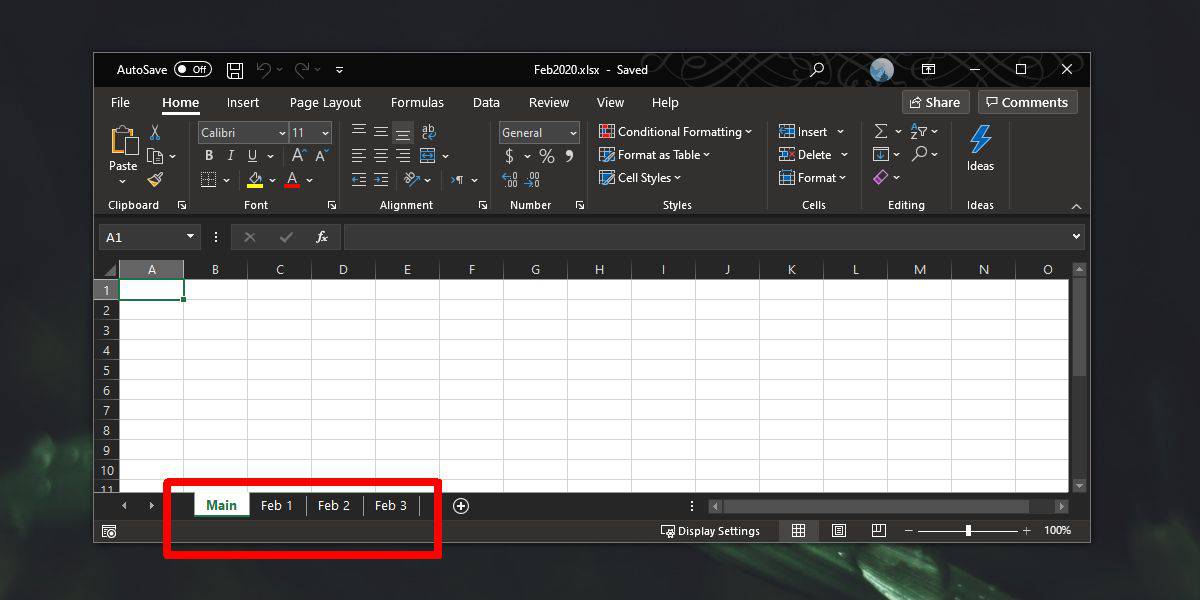

5. Consult Previous Tax Return Copies or Summary Pages

If you have access to your complete 2017 tax documents:

- Retrieve your previous return’s summary page, which often contains AGI.

- Look for any worksheets or schedules that might recap your AGI calculation.

In summary, finding your AGI from your 2017 tax paperwork can be straightforward with the right approach. Whether you're using tax forms, IRS transcripts, software, or previous records, there are multiple paths to find this essential number. Remember to check for any amended returns and utilize tools provided by the IRS or your tax software to simplify the process.

What if I can’t find my AGI from my 2017 tax return?

+

If you’ve misplaced your tax records, you can request a tax transcript from the IRS, which will include your AGI.

Do I need last year’s AGI to file my taxes for the current year?

+

For electronic filing, you typically need last year’s AGI to verify your identity. This requirement ensures that the person filing the return has access to previous tax information.

Can my AGI change after I file my tax return?

+

Yes, if you file an amended return or if the IRS makes adjustments to your return, your AGI might change from the original filed return.