Applying for Dissolved Company Papers: A Simple Guide

When a business decides to dissolve, there are numerous legalities and formalities to consider to ensure the process is handled correctly. One such formality is the application for the dissolution papers, a process which, while daunting at first glance, can be navigated smoothly with the right guidance. This article will guide you through the steps involved in applying for dissolution papers for your company, addressing why and how this process should be approached, the documentation required, and essential tips for a hassle-free experience.

The Decision to Dissolve

Before diving into the specifics of dissolution paperwork, it’s crucial to understand the reasons behind choosing to dissolve a company:

- Financial Insolvency: If the company can’t meet its financial obligations.

- Business Goals Achieved: When the purpose or goals set by the founders have been met or are no longer viable.

- Change in Ownership: If there’s a significant change in ownership or management leading to restructuring or dissolution.

- Legal Reasons: Compliance with legal mandates or to avoid litigation risks.

- Voluntary Liquidation: Choosing to liquidate assets to satisfy debts or distribute them among shareholders.

Steps to Dissolve a Company

Let’s break down the steps you need to follow when dissolving your company:

1. Board Resolution and Shareholder Approval

The first step is to get a resolution passed by the board of directors to dissolve the company. Here’s what you’ll need:

- A formal meeting with the board of directors where a motion to dissolve is proposed.

- If applicable, get approval from shareholders, which might require a special resolution or a general meeting.

📝 Note: The specific requirements for passing resolutions can vary by jurisdiction, so it’s beneficial to review local laws or consult with a legal advisor.

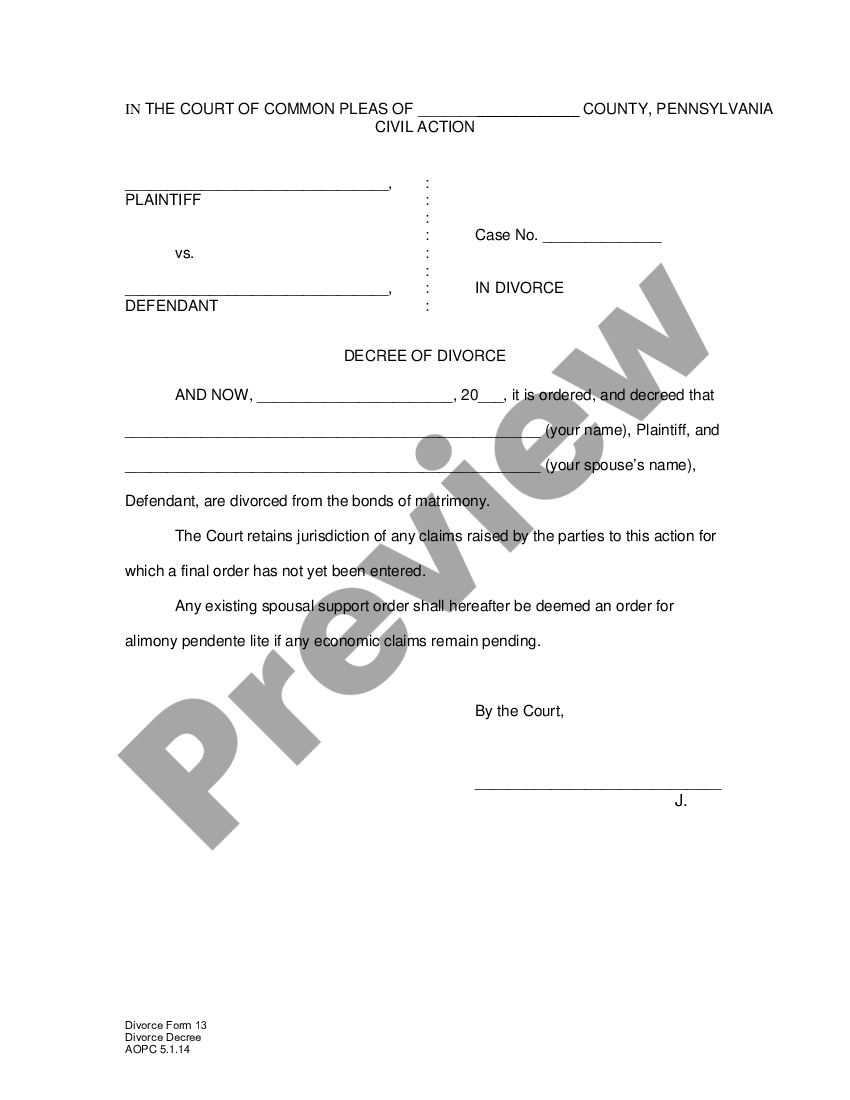

2. Preparing and Filing Articles of Dissolution

Once your internal approvals are in place, you’ll need to prepare the articles of dissolution:

- Complete the necessary forms, which often include your company name, date of dissolution, and reasons for dissolution.

- File these documents with the appropriate state agency, typically the Secretary of State’s office.

3. Settling Debts and Obligations

Before any dissolution can be finalized, you must:

- Settle all known debts and obligations of the company.

- Issue notices to creditors, giving them a chance to claim any outstanding debts.

4. Cancel Licenses and Permits

Cancel all business licenses, permits, and registrations held by the company, including:

- Business licenses

- Tax registrations

- Employer identification number

5. Liquidation of Assets

If there are remaining assets after paying off liabilities:

- Distribute them to shareholders according to their ownership stake or as agreed upon in the company’s bylaws.

6. Final Tax Returns and Close Accounts

Don’t forget to:

- File final tax returns for both federal and state levels.

- Close all company bank accounts and clear any outstanding balances.

Important Considerations

When dissolving a company, consider the following:

- Timely Filing: Delays can lead to legal repercussions or complications.

- Notification: Notify all stakeholders like employees, creditors, and relevant government agencies.

- Liability Protection: Ensure all personal liability protection is maintained during the process.

Documentation Required

To streamline the dissolution process, here are the documents you might need:

| Document Type | Description |

|---|---|

| Articles of Dissolution | The official document to initiate dissolution. |

| Board Resolution | Approval from the board to dissolve the company. |

| Shareholders’ Meeting Minutes | Record of the meeting where dissolution was approved. |

| Final Tax Returns | Federal and state, indicating the end of the business. |

| Debt Settlement Agreements | Proof of settlement with creditors. |

📍 Note: Always keep accurate records for future reference or potential disputes.

Navigating the Process

Understanding and preparing for the dissolution process can be the difference between a smooth transition and a legal nightmare. Here are some tips:

- Start Early: Initiate the process months in advance if possible.

- Hire Professionals: Engaging an attorney or accountant can provide legal and financial guidance.

- Stay Informed: Laws and requirements change, so keep updated or consult professionals.

- Maintain Communication: Keep lines of communication open with all parties involved.

The Wrap-Up

Dissolving a company requires careful handling of multiple formalities. The process, though intricate, can be handled with a focus on legal compliance, clear communication, and proper documentation. By following these steps, you ensure that your company’s dissolution is executed as smoothly as possible, allowing all stakeholders to move forward with clarity and peace of mind.

What happens if I fail to notify my creditors of the dissolution?

+

Failing to notify creditors can lead to legal claims against the company or its directors even after dissolution, as creditors might still seek payment for outstanding debts.

Can a dissolved company be reinstated?

+

In some jurisdictions, yes, under specific conditions like administrative oversight or if there was an error in the dissolution process. The process typically involves filing to reinstate with the state agency.

How do I handle employee notification and final payouts?

+

You must notify employees in advance, provide them with their final paychecks, any owed benefits, and comply with employment laws regarding layoffs or terminations.