New Hire Paperwork Essentials: 8 Must-Include Documents

Embarking on a new job is an exciting journey for employees, but the process involves navigating through a significant amount of administrative paperwork. Ensuring that all new hires complete their paperwork correctly is crucial for both legal compliance and smooth integration into the company culture. Here, we'll explore the 8 essential documents every new hire should have in their onboarding packet.

1. Job Offer Letter

A Job Offer Letter is the first formal document a new employee receives. This document outlines:

- The position offered

- Start date

- Compensation details

- Benefits package

- Key employment terms

It acts as a formal acceptance of employment, setting clear expectations between the employer and employee.

2. Employment Contract or Agreement

The Employment Contract or Agreement provides legal protection for both the employer and employee. This document covers:

- Job responsibilities

- Duration of employment

- Termination clauses

- Confidentiality agreements

- Non-compete clauses

While not all employees will have a detailed contract, agreements like confidentiality agreements are often necessary even for at-will employment situations.

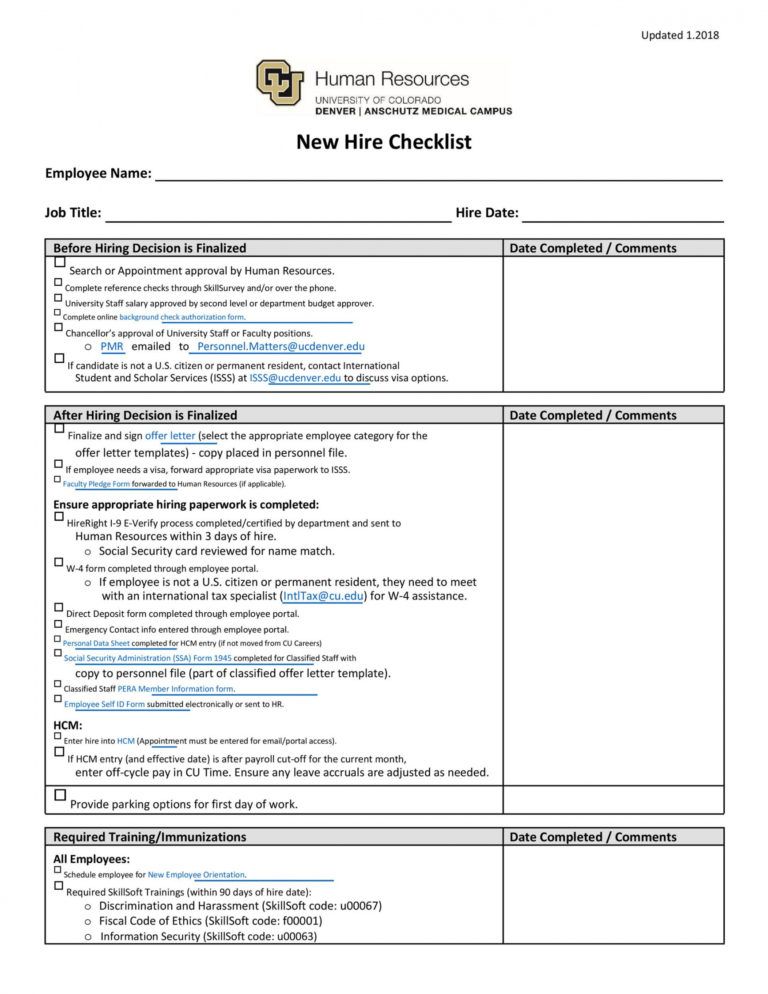

3. W-4 and State Tax Withholding Forms

Proper tax documentation is vital for payroll processes:

- The W-4 form determines federal income tax withholding from the employee’s salary.

- State-specific tax withholding forms must also be completed to comply with local tax laws.

Ensuring employees fill out these forms accurately helps prevent any issues with payroll processing.

4. I-9 Form

The I-9 Form is a legal requirement in the United States for verifying the identity and employment authorization of new hires. This form requires:

- Section 1 to be completed by the employee on or before the first day of work.

- Section 2 to be completed by the employer within three business days of the start date, with proper documentation review.

5. Employee Handbook Acknowledgment Form

The Employee Handbook Acknowledgment Form confirms that the employee has:

- Received the company handbook

- Understood the policies and procedures outlined within

- Agreed to abide by these rules

This form can also serve as evidence that employees were made aware of key company policies such as safety, anti-harassment, or code of conduct.

📝 Note: Updating the employee handbook regularly ensures all employees have access to current policies.

6. Direct Deposit Authorization

To streamline payroll, many companies require a Direct Deposit Authorization form. This document asks for:

- Bank account details

- Authorization to deposit salary directly into the account

7. Emergency Contact Information

Safety and concern for employees prompt the need for Emergency Contact Information. This form should include:

- Name, relationship, and contact number of emergency contacts

- Any known health issues or allergies

This information can be vital in unforeseen circumstances.

8. Benefits Enrollment Forms

Completing Benefits Enrollment Forms is an important step for:

- Health insurance

- Retirement plans

- Optional benefits like vision or dental insurance

These forms ensure employees are properly enrolled in any benefits the company offers.

In the hiring process, ensuring all required paperwork is completed accurately and on time is a shared responsibility. By having these 8 essential documents, both the company and the new employee can start their relationship on the right foot, ensuring legal compliance and a clear understanding of rights, obligations, and benefits. The goal is to make the transition as smooth as possible, setting the stage for a productive and harmonious employment relationship.

What happens if an employee doesn’t complete the I-9 form on time?

+

Employers must complete Section 1 of the I-9 form by the employee’s first day of work and Section 2 within three business days. Failure to do so can result in fines, legal action by the Department of Homeland Security, or issues with payroll and tax processing.

Are all benefits mandatory for employers to offer?

+

No, while certain benefits like health insurance can be mandatory for large employers, most benefits are optional. Employers can choose what benefits to offer based on their size, industry standards, and business model.

Can an employee start work before signing the employment contract?

+

Technically, yes, but it’s not advisable. Without a signed contract, terms of employment might be unclear, potentially leading to misunderstandings or legal disputes. It’s always best to have a contract in place before work begins.