PPP Loan Application: Essential Paperwork Guide

The journey to securing a Paycheck Protection Program (PPP) loan can be both a lifeline for small businesses and a complex maze of paperwork. This guide is here to help demystify the process, ensuring you have the essential documents in hand to streamline your application.

Understanding the PPP Loan

The PPP loan, introduced as part of the CARES Act, was designed to provide a direct incentive for small businesses to keep their workers on the payroll during the economic downturn caused by the COVID-19 crisis.

Why PPP Loans Matter

- Employee Retention: Keeps staff employed, helping businesses maintain their workforce.

- Forgiveness Feature: Under specific conditions, the loan can be fully or partially forgiven.

- Financial Flexibility: Offers businesses relief to cover essential costs like payroll, rent, utilities, and mortgage interest.

💡 Note: Ensure your business qualifies for the PPP loan as per the latest SBA guidelines.

Eligibility Criteria

- The business must have fewer than 500 employees (or meet the employee size standard for its industry).

- Sole proprietors, independent contractors, and self-employed individuals are also eligible.

- The business must have been operational on February 15, 2020.

Preparing Your Documents

Here’s a checklist of documents you’ll need to gather before applying:

| Document | Purpose |

|---|---|

| Payroll Documentation | To calculate loan amount and forgiveness. |

| 2019 Tax Return | To verify the business's financial health and eligibility. |

| Profit & Loss Statement | Required if you are self-employed or operating as a sole proprietor. |

| Bank Statements | To prove payroll and expenses. |

| Owner Compensation Records | Important for self-employed individuals. |

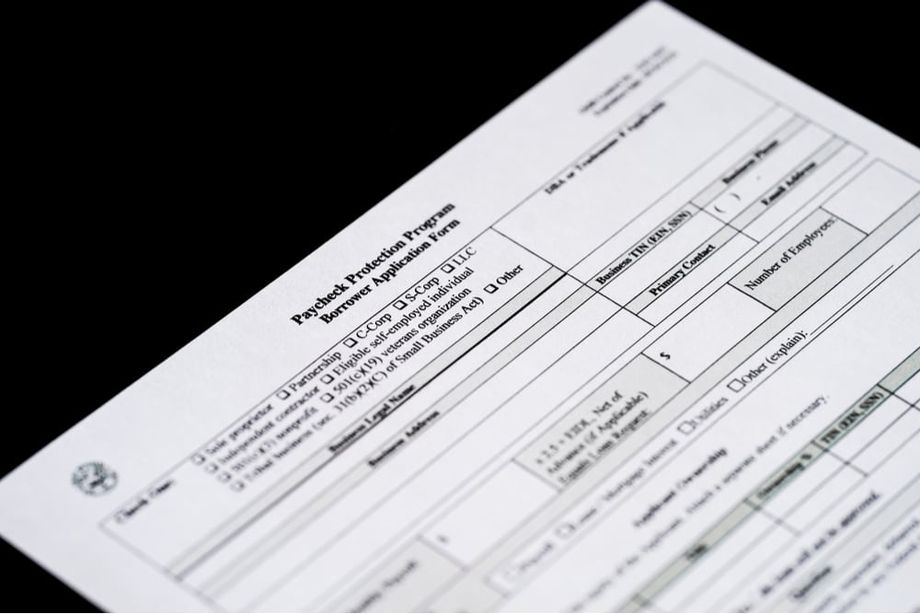

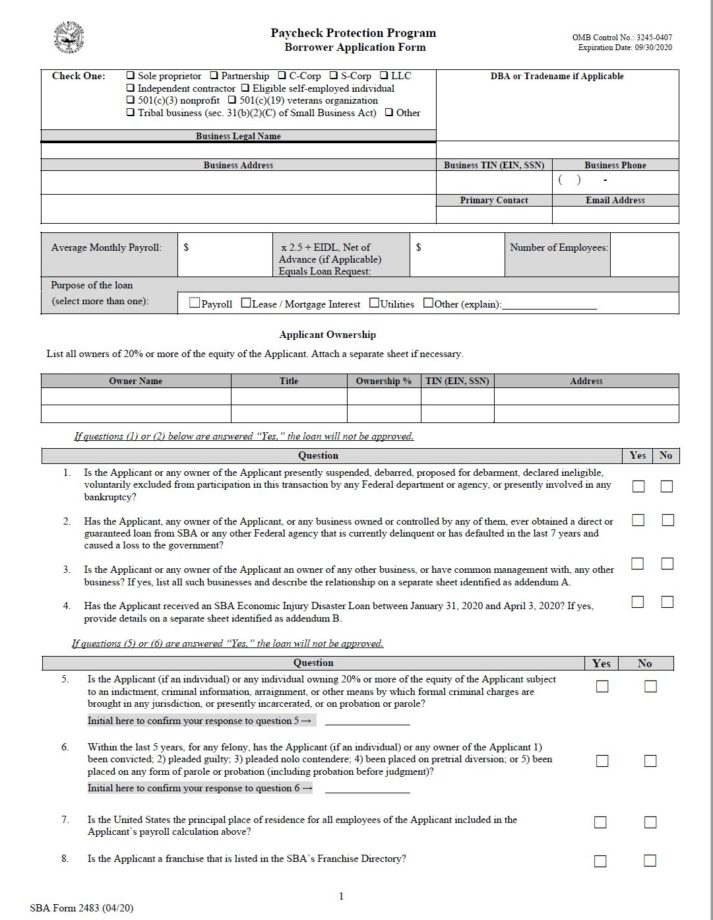

Filling Out the Application

While the specifics can vary by lender, here are the common elements:

- Loan Application Form: Often the SBA Form 2483 or similar from your chosen lender.

- Business Legal Structure Documentation: Articles of Incorporation, Partnership Agreements, or other relevant documents.

- Payroll Records: Past payroll records, tax forms like 941 or state quarterly wage reporting, and proof of health insurance costs for employees.

- Ownership Structure: Ownership structure and beneficial ownership information.

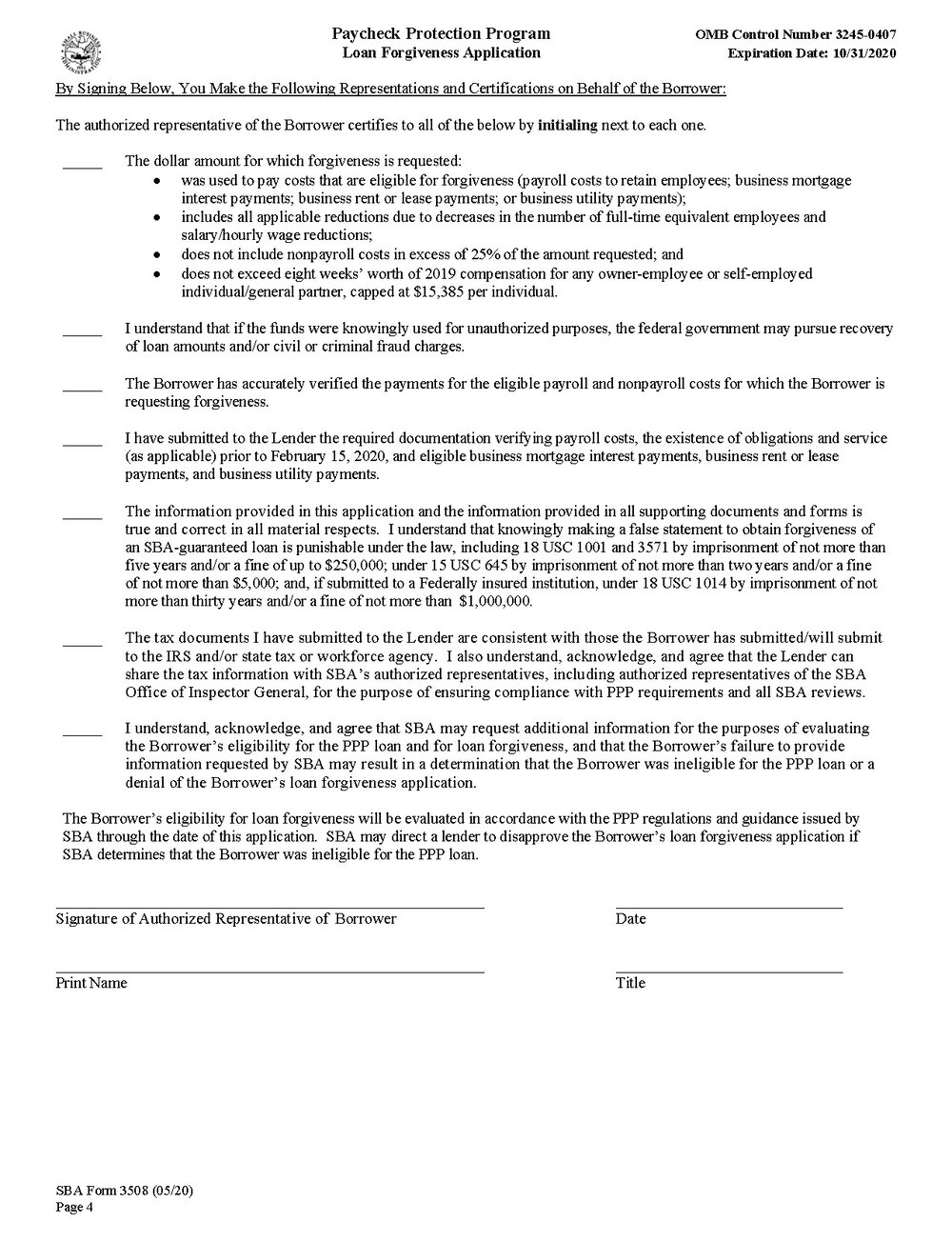

- Certifications: Affirmations regarding the use of the loan proceeds and plans for payroll maintenance.

Tips for Smooth Submission

- Have documents organized in digital format for easier submission.

- Double-check eligibility criteria as regulations can change.

- Communicate with your lender for any additional or missing documents.

🚨 Note: Misrepresenting information can result in severe penalties, including being ineligible for loan forgiveness.

What to Expect After Submission

After submitting your application:

- Your lender will review the documents for completeness and accuracy.

- The SBA will approve or deny the loan based on the lender’s recommendation.

- Funds can take up to 10 days to be disbursed after approval.

- Tracking your loan amount and forgiveness criteria begins.

Summing Up

Navigating the PPP loan application process requires meticulous preparation, from understanding the intricacies of eligibility to having your documents in order. By following this guide, you can streamline the application process, reduce the chances of errors, and position yourself for financial support in these challenging times. Remember, thoroughness and accuracy in your documentation are key to securing your PPP loan, and potentially, to ensuring its forgiveness.

Can I still apply for a PPP loan?

+

As of the latest guidelines, applications for the Paycheck Protection Program have concluded unless Congress authorizes further funding or extensions. However, businesses that qualified for the first round can apply for forgiveness if conditions are met.

What if I don’t have all the documents?

+

Contact your chosen lender immediately. They can often guide you on which documents are absolutely necessary, and you might be able to use alternative documentation if some are missing.

Is the loan forgiveness process automated?

+

No, forgiveness isn’t automatic. You’ll need to apply for loan forgiveness by documenting your use of the funds for qualifying expenses like payroll, rent, utilities, and mortgage interest.

Can I be denied forgiveness if I meet all the criteria?

+

While rare, it can happen if documentation is insufficient, errors are present, or if there are changes in regulations. Ensure all documents are accurate and up-to-date.