6 Essential Documents for Your Mortgage Application

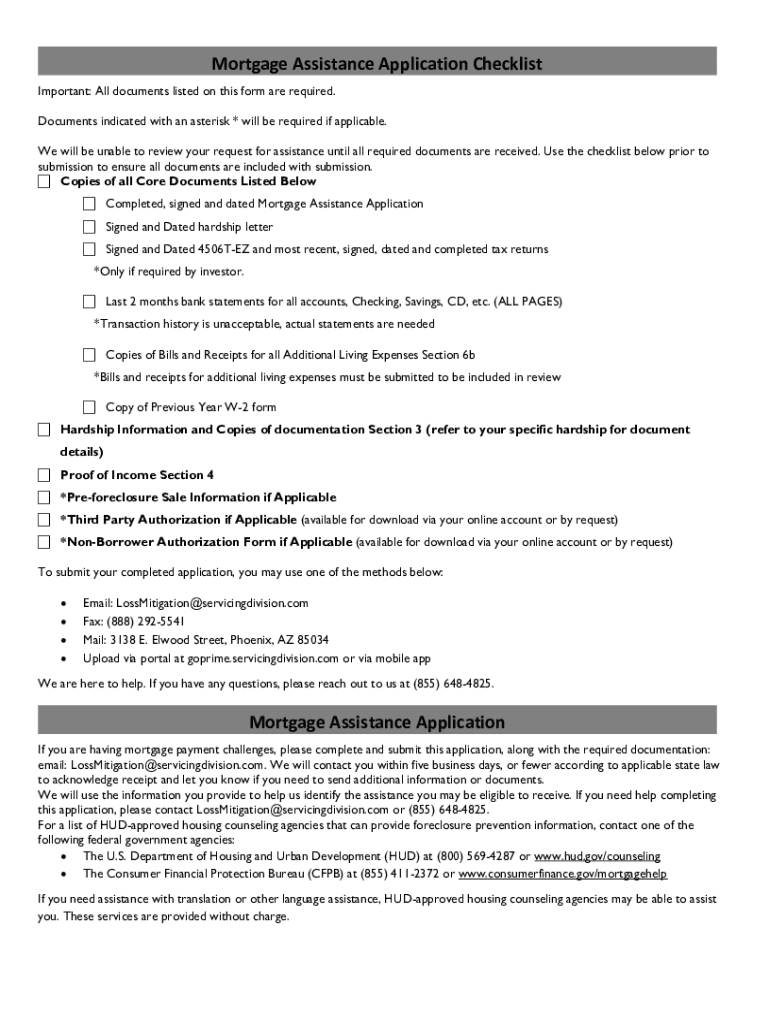

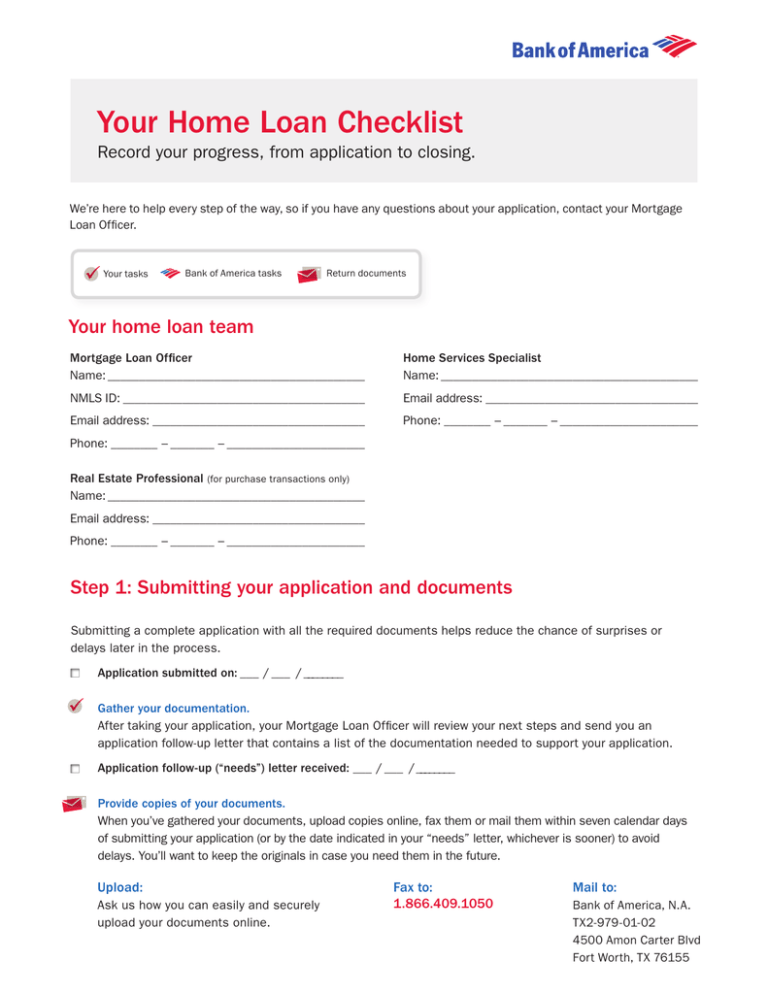

The journey to securing a mortgage and owning your dream home starts with gathering the necessary paperwork. While the specific documents required can vary based on your situation, location, and the mortgage lender, certain documents are universally essential. Here are the six key documents you need to prepare for your mortgage application:

Income Verification

Proving your income is critical in demonstrating your ability to repay the mortgage. Lenders will look for:

- Pay Stubs: Submit your recent pay stubs, ideally covering the last two months.

- W-2 Forms: Provide W-2 forms for the past two years to show your consistent income history.

- 1099 Forms: If you're self-employed or have multiple income streams, 1099 forms will serve the same purpose.

- Tax Returns: You'll need to provide federal tax returns for the last two years. This helps lenders verify your declared income matches with their records.

💼 Note: For self-employed individuals, lenders might require additional documentation, such as a profit and loss statement or schedule C of your tax return.

Credit Report

Your credit history plays a pivotal role in your mortgage application. Lenders will:

- Obtain your credit report from major credit bureaus to review your credit score, payment history, and debt-to-income ratio.

Asset Documentation

Lenders want to assess your financial stability beyond just your income. Common documents include:

- Bank Statements: You'll need to provide statements for all your accounts for the past two to three months.

- Investment Accounts: Statements for any investment accounts, like 401(k), IRAs, or stocks, showing both current balances and transaction history.

- Other Assets: Information about other assets like real estate, business interests, or valuable items might be needed if they're substantial.

| Document | Purpose |

|---|---|

| Bank Statements | Verify your liquidity and savings to cover down payment, closing costs, and reserves. |

| Investment Statements | Show the value of your assets, especially if using these as part of your down payment. |

| Other Assets | May bolster your financial stability, showing potential sources of repayment. |

Employment Verification

A stable employment history reassures lenders of your ability to make mortgage payments. They might:

- Contact your employer directly.

- Ask for a letter of employment confirming your position, length of employment, and income.

Proof of Homeownership Costs

When you're selling your current home to buy a new one, lenders need proof of:

- Property Taxes: Most recent year's property tax bills.

- Home Insurance: Current insurance policy information.

- Mortgage Statement: Recent mortgage statement if you have an existing mortgage.

Additional Supporting Documents

Beyond the core documents, here are some extras you might need:

- Down Payment Gift Letters: If part of your down payment is a gift, you'll need documentation from the donor.

- Divorce Decrees: If you've been divorced recently, this document can clarify financial obligations.

- Bankruptcy or Foreclosure Disclosures: Be transparent about any past financial distress, as you'll need to disclose these events.

The process of applying for a mortgage can be complex and detailed, but gathering these essential documents upfront will streamline your journey. By providing clear, accurate, and comprehensive documentation, you'll not only improve your chances of approval but also potentially secure a better mortgage rate. Remember, each lender might have slight variations in their requirements, so it's wise to check with them early in your home-buying process to ensure you have everything in order.

Can I apply for a mortgage with a part-time job?

+

Yes, but lenders will look for stability in your income, requiring documentation for both your part-time job and any other sources of income to ensure you meet their debt-to-income ratio requirements.

What if I’ve recently switched jobs?

+

Lenders prefer stable employment history, but if you’ve changed jobs, provide employment letters from both employers, along with your pay stubs and W-2 forms, to show continuity of income.

Do I need to provide documents if I’m a first-time homebuyer?

+

Yes, first-time homebuyers need to supply all the same documents as others. Some lenders offer special programs, but you’ll still need to verify your income, assets, and creditworthiness.