Refinance Your Car: Essential Paperwork Guide

Refinancing your car can be a smart financial move, especially if you can secure a lower interest rate or change the terms of your loan to better suit your current financial situation. However, the process involves several steps and requires you to gather and prepare essential paperwork to ensure a smooth and efficient refinancing experience. This guide will walk you through what documents you need and how to organize them effectively.

Understanding Car Refinancing

Before diving into the documentation, it’s crucial to understand what refinancing means for your car loan:

- Lowering Interest Rates: If interest rates have dropped since you took out your loan, or if your credit score has improved, refinancing might secure you a lower rate.

- Changing Loan Terms: You might want to adjust the duration of your loan to either reduce monthly payments or pay off the car faster.

- Removing Co-Signer: Refinancing can help remove a co-signer from the loan if their guarantee is no longer needed.

Essential Documents for Refinancing

To refinance your car, you’ll need to provide specific documents. Here’s a detailed list:

| Document | Purpose |

|---|---|

| Current Car Loan Statement | Shows payoff amount, lender details, and current balance |

| Proof of Income | Demonstrates your ability to repay the new loan |

| Vehicle Title or Proof of Ownership | Verifies ownership of the vehicle |

| Personal Identification | Driver’s license or another government-issued ID |

| Insurance Information | Confirms that your car is insured |

| Pay Stubs | Recent pay stubs as part of income verification |

| Personal and Employment History | Stability and creditworthiness |

| Registration Documents | Proves the vehicle is registered and legal to drive |

Gathering and Organizing Your Documents

- Current Car Loan Statement: Obtain a copy from your current lender, which should include your remaining balance, monthly payment, and loan term.

- Proof of Income: Collect recent pay stubs, bank statements, or tax returns. If self-employed, provide business financial statements.

- Vehicle Title or Proof of Ownership: This document proves you legally own the vehicle. If you’ve lost the title, you can usually get a duplicate from your state’s DMV.

- Personal Identification: A valid ID is necessary for identity verification.

- Insurance Information: Lenders want to see that your car is adequately insured, which protects their investment.

- Personal and Employment History: Details of your work history and residence can help lenders assess your creditworthiness.

- Registration Documents: Ensure your car’s registration is current.

💡 Note: Keep all documents in an organized folder or digital file for easy access during the refinancing application process.

Steps to Refinance Your Car

- Shop for Rates: Compare offers from various lenders to find the best rate and terms.

- Pre-Qualify: Many lenders offer pre-qualification without impacting your credit score.

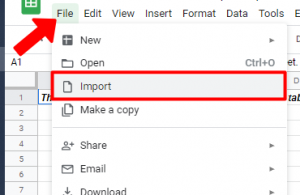

- Submit Application: Once you choose a lender, submit your documents.

- Wait for Approval: Lenders will review your application and documents.

- Payoff Process: After approval, they’ll pay off your existing loan and set up your new loan.

⚠️ Note: Be proactive about providing all required documents promptly to avoid delays in the refinancing process.

In closing, refinancing your car can be a financially rewarding decision, but it requires careful preparation. By understanding the paperwork involved and ensuring you have all documents ready, you can streamline the refinancing process. This guide provides you with the essentials, helping you to organize and present your financial health in a manner that lenders appreciate.

Can I Refinance My Car if I Have Bad Credit?

+

Refinancing with bad credit is possible, but you might face higher interest rates or stricter terms. Lenders consider multiple factors beyond just your credit score, so improvements in your financial situation or having a co-signer can help.

What If I’ve Lost My Car Title?

+

If you’ve lost your car title, you can apply for a duplicate title through your state’s DMV. The process usually involves a fee and some form of verification of ownership, but the replacement title can be used for refinancing.

How Long Does Car Refinancing Take?

+

The timeline for refinancing can vary, but generally, it can take from a few days to a couple of weeks. This depends on how quickly you can provide the necessary documents, how fast the lender processes your application, and any potential delays from your current lender in providing a payoff amount.