Essential Paperwork for New Hires: A Checklist

Welcome aboard to the latest team member! Hiring a new employee is a thrilling process but also one that involves diligent attention to legal formalities. Ensuring you have the correct paperwork in place is not just good practice; it's a legal requirement. Here is an exhaustive checklist to guide you through the essential paperwork for new hires.

The Core Documentation

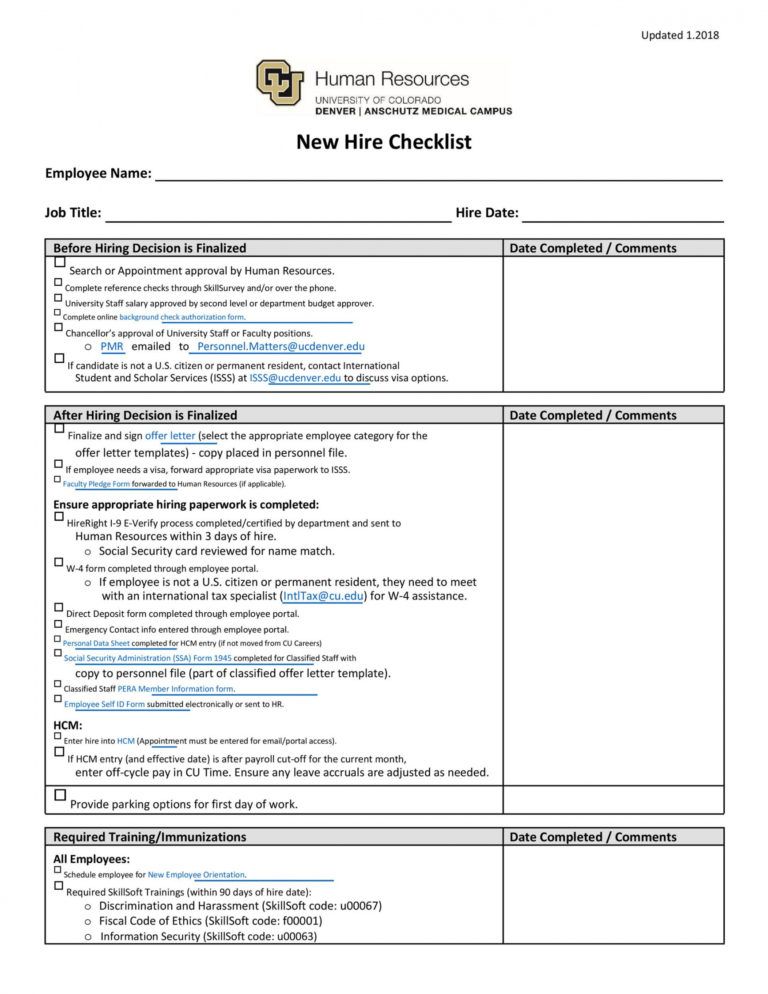

Below is a list of key documents that should be collected from every new employee:

- Employment Application - Even if you've conducted interviews, having a formal application on file is critical for record-keeping.

- Offer Letter - This outlines the job position, salary, start date, and other job specifics.

- W-4 Form - Necessary for U.S. employees for federal and state tax withholding.

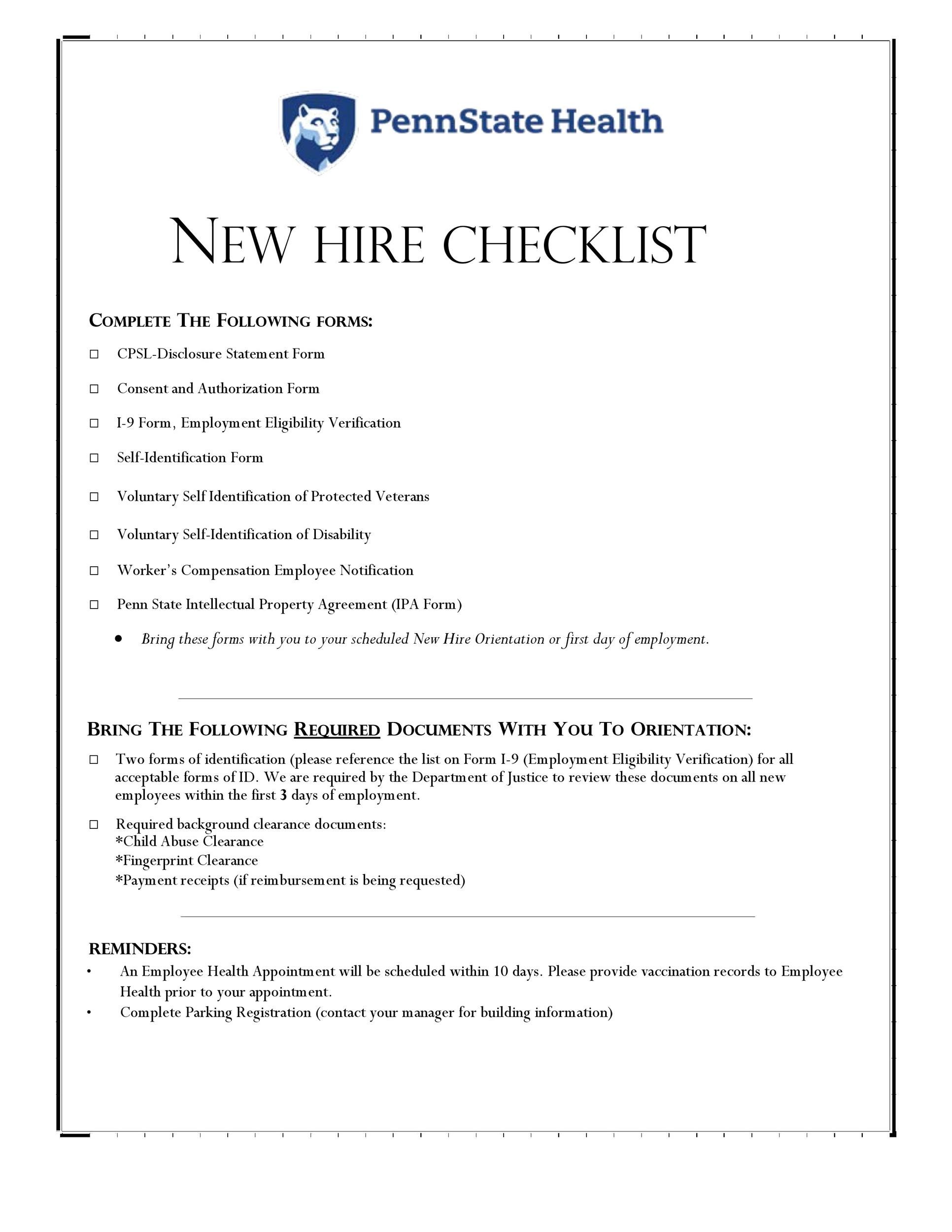

- I-9 Form - Confirms the identity and employment eligibility of individuals hired for employment in the United States.

- Background Check Authorization - If applicable, to perform criminal, credit, and employment background checks.

The Importance of the I-9 Form

The I-9 form is a pivotal document in the hiring process as it directly impacts compliance with federal immigration laws. Here's what you need to know:

- Ensure that the employee fills out and signs Section 1 on or before their first day of work.

- As an employer, you must examine the original documents presented by the employee to establish their identity and employment authorization.

- Record the documents examined in Section 2 of the I-9 within three business days of the employee's start date.

- Maintain the I-9 form for the entire duration of employment and for a specific period after the employment ends, as outlined by federal regulations.

Additional Forms and Agreements

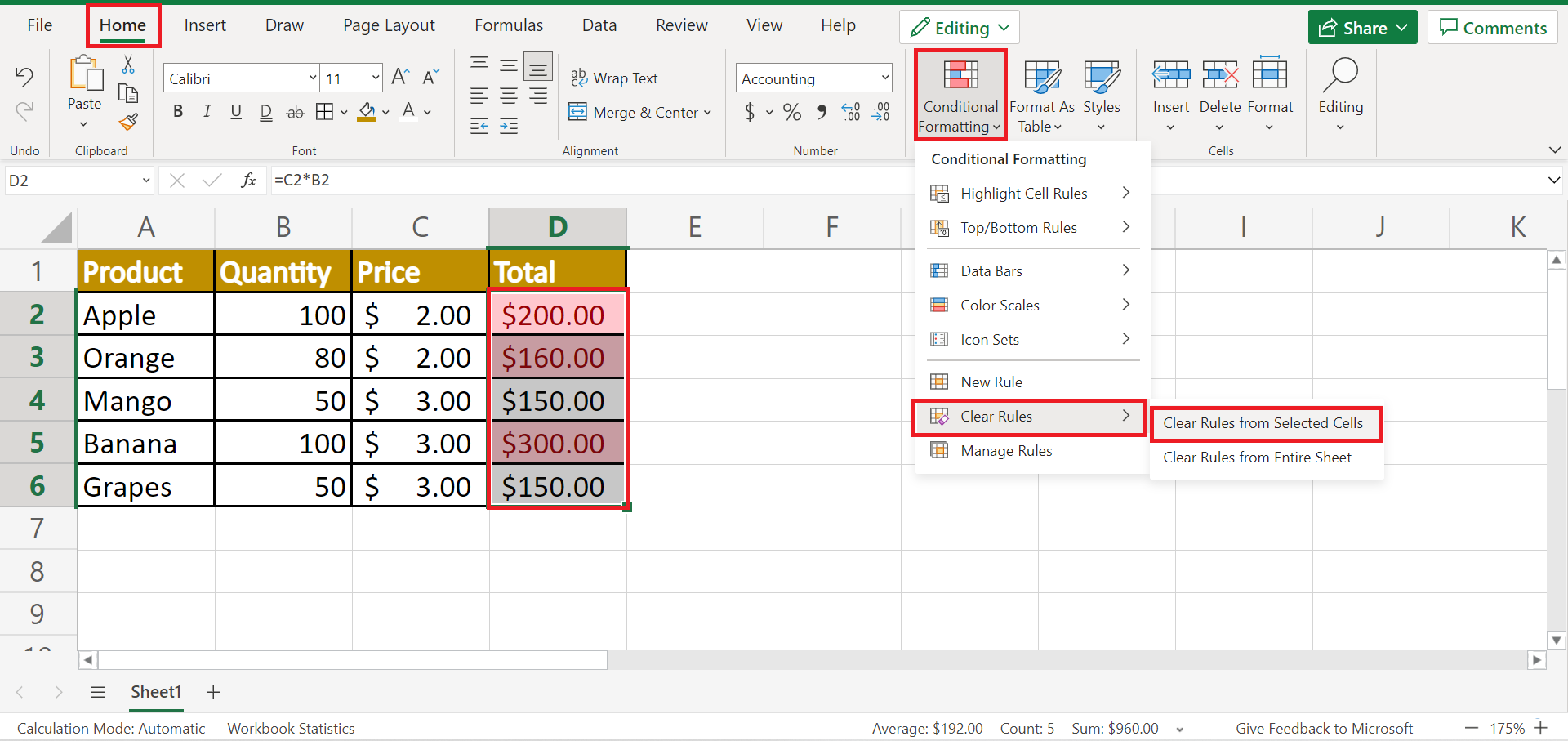

In addition to the core documentation, several other forms may be needed:

- Confidentiality and Non-Compete Agreements - Protects company information and can restrict competition from leaving employees.

- Employee Handbook Acknowledgment Form - Demonstrates that the employee has received and reviewed the company's policies.

- Direct Deposit Authorization - Allows for the electronic transfer of wages.

- Emergency Contact Form - Vital for critical situations.

- Employee Benefits Election Form - To select medical, dental, vision, life insurance, or other company-offered benefits.

- Acknowledgment of Company Policies - Agreement to adhere to company rules, including internet usage, conduct codes, etc.

- Safety and Equipment Agreement - If the job requires handling specific machinery or equipment, ensuring the employee understands safety procedures.

📝 Note: The specific requirements can vary based on company size, location, and industry. Always ensure you are up-to-date with local, state, and federal regulations.

State-Specific Requirements

Some states have additional requirements for new hires:

| State | Additional Requirement |

|---|---|

| California | Form DE 34 |

| New York | IT-2104 Form |

| Florida | Notice of Commencement of Employment |

| Texas | New Hire Reporting Form |

| Illinois | IL-W-4 Form |

📝 Note: Always check state-specific requirements as they can change, and additional forms or processes might be introduced.

The Onboarding Process

Once you have the necessary paperwork in hand, effective onboarding is key to:

- Culture Integration - Introduce the new hire to the company's culture, values, and team dynamics.

- Training - Provide job-specific and company-wide training.

- Setting Expectations - Clearly define roles, responsibilities, and performance metrics.

- Benefits and Compensation Overview - Explain pay structure, raises, bonuses, and any benefits programs.

- Documentation of the Process - Keep a record of each step in the onboarding to ensure compliance and track the employee's progress.

Best Practices in Onboarding

Successful onboarding goes beyond paperwork:

- Assign a mentor or buddy to assist the new hire in navigating the company.

- Schedule regular check-ins to address any initial issues or concerns.

- Facilitate introductions to key team members and departments.

- Use digital tools to streamline onboarding processes and improve efficiency.

To sum up, preparing for a new hire involves collecting a variety of paperwork, setting up an effective onboarding process, and keeping abreast of changes in employment law. A well-structured checklist ensures you are compliant and creates a positive experience for new team members, laying the groundwork for a successful long-term relationship with your company.

What happens if an employee doesn’t complete an I-9 Form?

+

If an employee does not complete the I-9 Form or provide the necessary documentation, employers risk fines, penalties, and potential legal action for non-compliance with immigration laws. The employee cannot work until the form is correctly filled out.

Can an employee start work before completing the W-4 Form?

+

Technically, an employee can start working before submitting a W-4, but this would result in default tax withholding (single with zero exemptions). To prevent this, it is advisable to have the form completed as soon as possible.

Are there exceptions for certain types of employees (e.g., contractors)?

+

Yes, independent contractors and self-employed individuals do not need to complete the I-9 Form. However, businesses should ensure contractors have all necessary licenses and meet all relevant hiring criteria.