5 Documents Required for Michigan Inheritance Tax Claims

Handling an estate after someone's passing can be a complex and emotional process, particularly in states like Michigan, where specific inheritance tax considerations come into play. If you're managing an estate in Michigan, it's crucial to understand what documents are needed to process inheritance tax claims efficiently.

What is Michigan Inheritance Tax?

Michigan, like many states, does not have a separate inheritance tax; however, it does enforce certain inheritance practices related to estate taxes and probate laws. While there isn’t an inheritance tax per se, understanding the estate tax implications is vital since the estate must be settled properly.

Documents Required for Michigan Estate Settlement

- Death Certificate: This is the initial document needed to confirm the death of the decedent. You’ll need several original certified copies since various institutions require them.

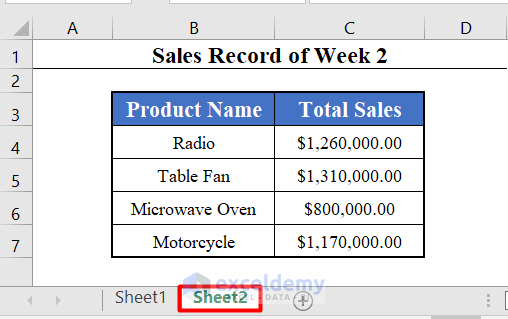

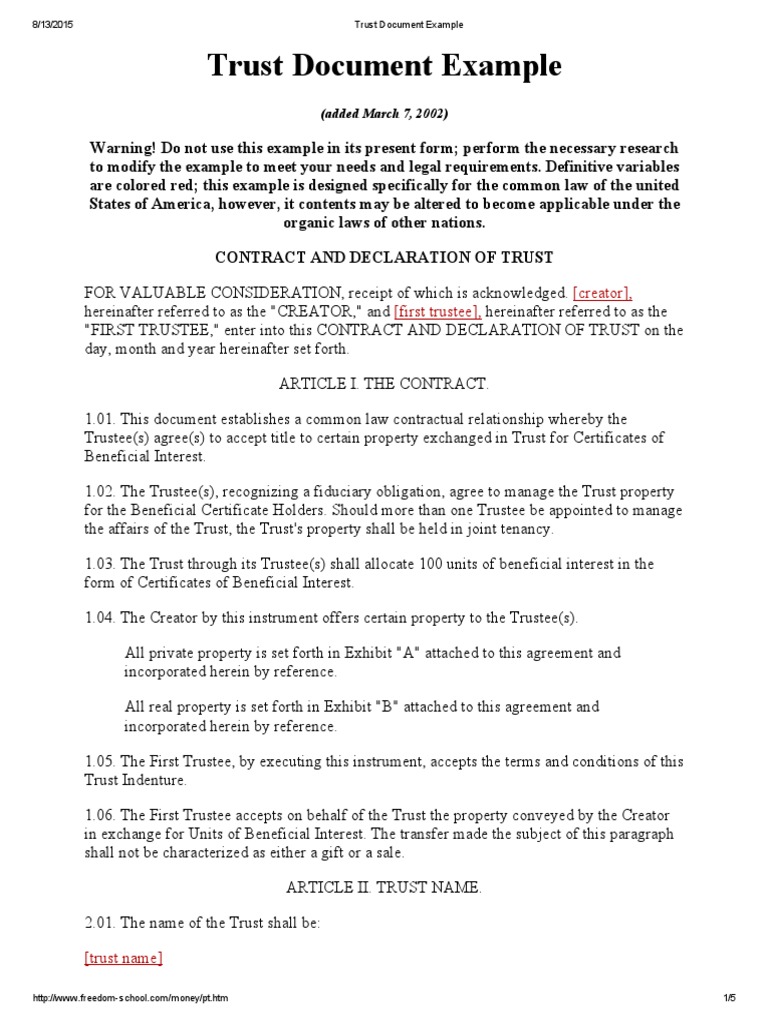

- Will or Trust Document: The will outlines the decedent’s wishes for asset distribution. If there’s a trust, trust documents will guide the trustee on how to manage the assets.

- Letter of Authority (LOA): This is issued by the probate court if there’s no will or the will is contested, granting authority to an executor or administrator to handle estate matters.

- Estate Tax Returns: While Michigan doesn’t impose its own estate tax, federal estate tax returns must be filed if the estate’s value exceeds the federal exemption amount. Forms like IRS Form 706 are necessary.

- Probate Court Documents:

- Petition for Probate: To open the estate in probate court.

- Inventory of Estate: A detailed list of all the decedent’s assets.

- Affidavit of Heirship: To establish legal heirs if there’s no will.

💡 Note: Michigan’s probate process can be daunting, especially when dealing with heirs, creditors, and tax issues. Engaging an estate attorney can be beneficial to navigate this complex process.

Probate Process in Michigan

The probate process in Michigan can vary significantly depending on whether the estate is testate (with a will) or intestate (without a will). Here’s how it typically works:

- Filing the Petition: Submit the Petition for Probate and any accompanying documents to open an estate.

- Appointment of Executor or Administrator: The court appoints an executor as named in the will or an administrator if intestate.

- Notification of Heirs and Creditors: These parties must be notified, giving creditors an opportunity to make claims against the estate.

- Estate Inventory: A comprehensive list of assets is compiled and possibly appraised.

- Payment of Debts and Taxes: Estate debts, including taxes, are paid.

- Distribution of Assets: Once debts are settled, remaining assets are distributed per the will or state intestacy laws.

- Closing the Estate: After distribution, an estate closure is filed to close the probate process.

🌟 Note: If disputes arise during the probate, a court hearing might be necessary, which can prolong the process and potentially lead to legal fees.

Understanding Estate and Inheritance Taxes

Michigan’s approach to estate and inheritance taxes includes:

- No Michigan Inheritance Tax: Michigan does not impose a state inheritance tax; however, be aware of potential federal estate taxes.

- Estate Tax: If the estate’s total value exceeds the federal estate tax exemption ($12.06 million in 2022), then estate tax could apply.

- Probate Tax: While not an inheritance tax, probate fees based on the value of the estate might apply.

Steps to File Michigan Inheritance Tax Claims

If you need to file Michigan inheritance tax claims or manage related estate taxes:

- Obtain death certificates.

- Gather the will or trust documents.

- File for probate, if necessary, to receive a Letter of Authority.

- Prepare and file an estate inventory.

- Calculate any due estate tax and file Form 706 if required.

- Pay debts and taxes before distributing the assets.

What happens if a will can’t be found?

+

If no will is found, the estate is considered intestate, and Michigan’s intestacy laws determine how assets are distributed. An administrator is appointed by the court to manage the estate.

Do I need a lawyer for Michigan probate?

+

While you can navigate probate without a lawyer for simple estates, the intricacies of tax laws, estate valuation, and potential disputes often make legal guidance beneficial.

How long does probate take in Michigan?

+

The duration of probate varies, typically lasting from six months to over a year, depending on factors like estate complexity, disputes, or creditor claims.