Essential Paperwork for Refinancing Your Car Loan

Refinancing a car loan can be an incredibly savvy financial move. Not only can it potentially lower your monthly payments and reduce the total interest paid over the life of the loan, but it also offers the flexibility to change terms or lenders. However, the process isn't as simple as just applying for a new loan. There's essential paperwork that needs to be prepared and submitted to ensure a smooth refinancing experience. In this guide, we'll walk you through the essential documents you need to gather when looking to refinance your car loan.

Understanding Your Current Loan

Before you start gathering paperwork, it’s beneficial to have a clear understanding of your current car loan. This includes knowing:

- Your current interest rate and remaining balance

- The term left on the loan

- Your monthly payment amount

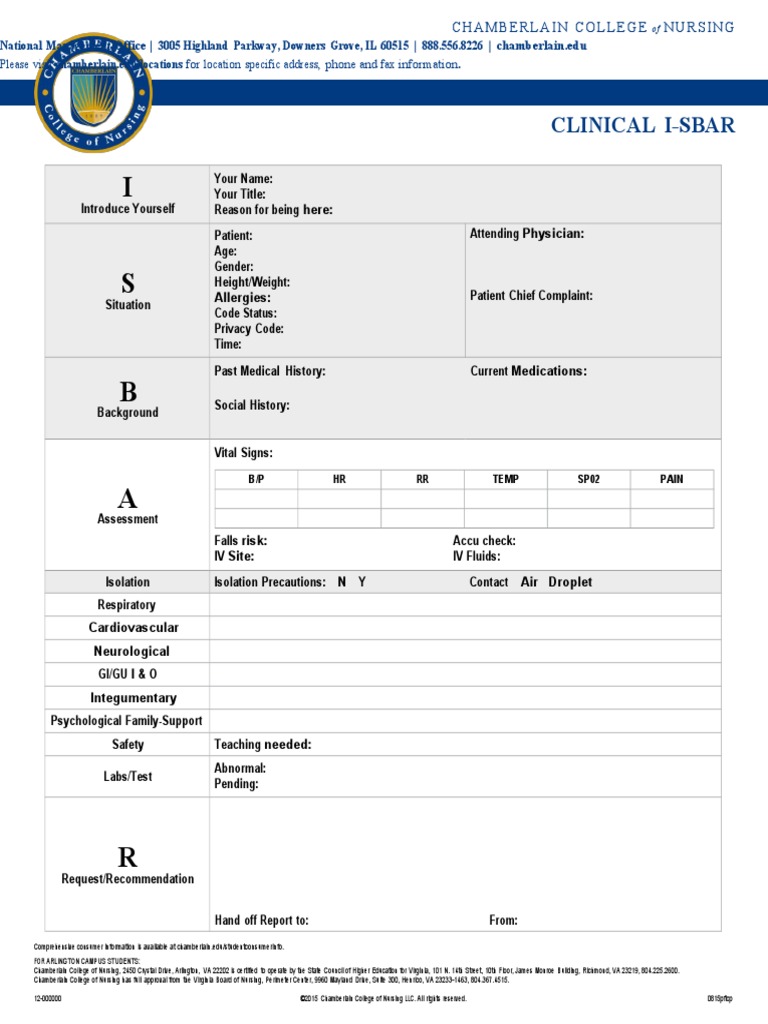

Essential Documents for Refinancing

Here’s a list of documents typically required for refinancing:

Proof of Identity

- A clear copy of your driver’s license or any government-issued ID.

- This confirms your identity and allows lenders to check your credit.

Proof of Income

- Recent pay stubs (usually the last two to three months)

- W-2 forms for the past two years

- If self-employed, you might need to provide tax returns for the past two years, bank statements, and profit and loss statements.

Proof of Residency

- Utility bills, lease agreements, or bank statements showing your address.

Vehicle Information

- Your car’s make, model, year, mileage, and Vehicle Identification Number (VIN).

- Copy of the title or registration

🔍 Note: Some lenders may require an odometer disclosure statement.

Current Loan Information

- Loan payoff statement (this might require contacting your current lender)

- Copies of all loan documents including the original loan agreement

Credit Information

- Authorization for lenders to pull your credit report, which they’ll use to assess your refinancing application.

Optional But Helpful Documents

While not always mandatory, these documents can make the process smoother:

Gap Insurance

- If you have gap insurance, providing this information can be beneficial, especially if your car’s value might not cover your loan in an accident or theft.

Employment Verification

- A letter from your employer verifying your position, salary, and length of employment.

Insurance Policy

- A copy of your current auto insurance policy to prove coverage.

| Document | Description | Purpose |

|---|---|---|

| Driver’s License | Clear copy of government-issued ID | To verify your identity and allow credit checks |

| Pay Stubs | Last 2-3 months | Proof of income |

| W-2 Forms | Past two years | Income verification |

| Utility Bill | Recent proof of residency | To establish residency |

| Car Title | Copy of the title or registration | To provide vehicle information |

The documents mentioned above are crucial for refinancing your car loan. Here are some important notes to keep in mind:

⚠️ Note: Having all these documents ready can expedite the refinancing process, reducing wait times for approval.

📅 Note: Ensure all documents are current. Lenders are particularly interested in your recent financial status to assess your ability to repay the new loan.

Once you have successfully navigated the paperwork, you're well on your way to refinancing your car loan. Whether your goal is to secure a lower interest rate, extend or shorten the loan term, or simply switch lenders, the journey begins with preparation. Remember, refinancing can significantly impact your monthly budget and total interest paid. Gathering all the necessary documents upfront ensures that you can take full advantage of potential savings and streamline the application process.

Can I refinance my car loan if I have bad credit?

+

Yes, it’s possible to refinance with bad credit, although you might not get the best interest rates. Some lenders specialize in refinancing for those with less-than-perfect credit.

What is the benefit of refinancing my car loan?

+

Refinancing can lower your monthly payments, reduce total interest paid, change the term of your loan, or allow you to switch to a better lender.

How long does the refinancing process take?

+

The refinancing process can take anywhere from a few days to a few weeks, depending on your lender and how quickly you can provide the necessary documents.

Can I refinance my car loan multiple times?

+

Technically, yes, but each refinancing comes with closing costs and potential fees, so it’s important to ensure that the savings from refinancing outweigh these costs.

Should I refinance if my car is underwater?

+

If your car is underwater (you owe more than it’s worth), refinancing could be challenging. Lenders might not want to finance a loan greater than the car’s value. However, some lenders do offer solutions for this scenario.