5 Essential Documents to Open a Bank Account

Opening a bank account is a crucial step towards financial empowerment and security. Whether you're a new resident, starting your first job, or simply looking to switch banks, knowing the essential documents required to open a bank account can streamline the process and prevent potential hurdles. Here are the five fundamental documents you need to bring to your bank:

1. Proof of Identity

Your identity is the first thing a bank will need to verify. This step is crucial for bank account verification to prevent fraud and comply with Know Your Customer (KYC) policies. Here’s what you might need:

- Passport: An international document widely recognized for proving identity.

- National ID Card or Driver’s License: These are usually accepted if issued by your country’s government.

- Resident Permit (if applicable): For non-residents or temporary residents.

Ensure your ID is current and not expired. If the original is in another language, consider bringing an official translation or an ID in English.

2. Proof of Address

Banks need to confirm where you live to send your account statements or correspondence. Here are documents that can serve as proof of address:

- Utility bills (electricity, water, gas) - not older than 3 months.

- Rental agreement or lease.

- Bank or credit card statement (make sure it shows your address).

- Government-issued letters like tax bills, social security letters, etc.

If you’re moving into a new residence, providing a proof of address might require some creativity if you haven’t received bills at your new address yet. In such cases:

🔍 Note: Contact the bank to see if a letter from your landlord or a utility bill in their name, accompanied by a statement indicating you are a tenant, would suffice.

3. Tax Identification Number

This document is vital for tax reporting purposes. Depending on your country, you’ll need:

- Social Security Number (SSN): In the USA.

- National Insurance Number: In the UK.

- Taxpayer Identification Number (TIN): For international applicants in many countries.

4. Proof of Income

Some banks might ask for this, especially if you’re applying for a particular type of account or services like loans or credit cards. Documents include:

- Recent pay stubs.

- Bank statements showing regular income deposits.

- Letter from your employer detailing your employment and salary.

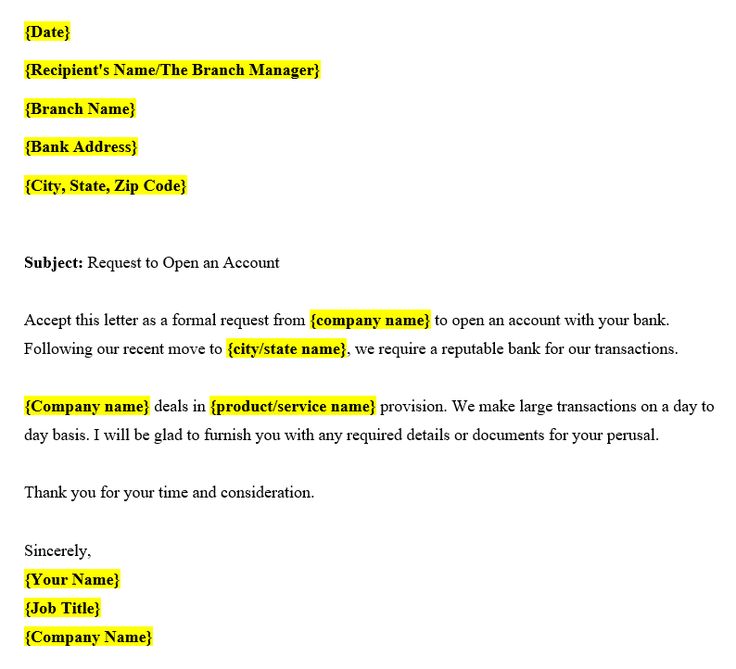

5. Business Documents (If Applicable)

If you’re opening a business or corporate account, additional documents are necessary:

| Document | Description |

|---|---|

| Business Registration | Proof that your business is legally registered with the relevant authority. |

| Articles of Incorporation or Partnership Agreement | Documents defining the company’s structure and governance. |

| Employer Identification Number (EIN) | A unique tax number for businesses in the USA or equivalent in other countries. |

| License or Permit | Industry-specific licenses or permits if required for your business operations. |

Please keep in mind that while these are the general bank account opening requirements, individual banks might have specific or additional requirements based on their policies, the type of account you're opening, or the laws of the country where the bank operates.

The process of opening a bank account can be straightforward if you come prepared with the essential documents. By having these documents ready, you'll find that your path to financial management is much smoother. Remember to check with the specific bank for any additional requirements, and enjoy the benefits that come with having a bank account, like easier bill payments, savings options, and investment opportunities.

To make your journey more seamless, here are some final steps you might consider:

- Make appointments with the bank to avoid waiting times.

- Review their online resources for any pre-account opening forms.

- Understand the fees associated with different account types.

Can I open a bank account without a physical address?

+

While it’s challenging, some banks might offer alternative solutions like using a mailing service address or a letter from a friend or family member stating you’re temporarily staying with them.

What if I don’t have a tax number?

+

Most banks will require a tax ID for tax reporting purposes. If you’re a non-resident or haven’t received one yet, speak with the bank’s representatives for alternative options or see if they accept an application without it initially.

Can I use a digital signature for the application process?

+

Some banks do accept digital signatures for convenience, especially for online applications. However, some might still require a physical signature.