5 Steps to Buy at Richmond Homes: Paperwork Guide

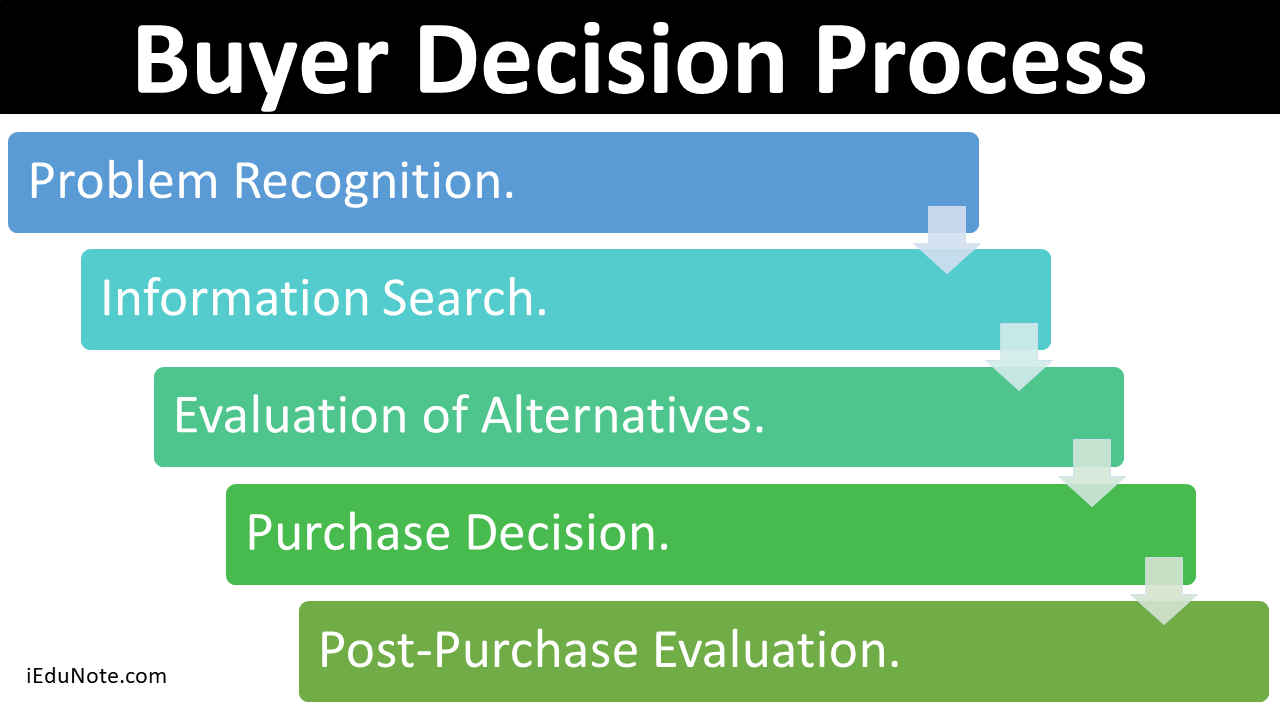

In today's housing market, buying a home at a RBI Developments community such as Richmond Homes can be a thrilling yet intimidating journey. From selection to settlement, the home-buying process involves numerous steps and substantial paperwork. This guide outlines the 5 essential steps to secure your dream home at Richmond Homes, detailing the necessary documents and processes at each stage.

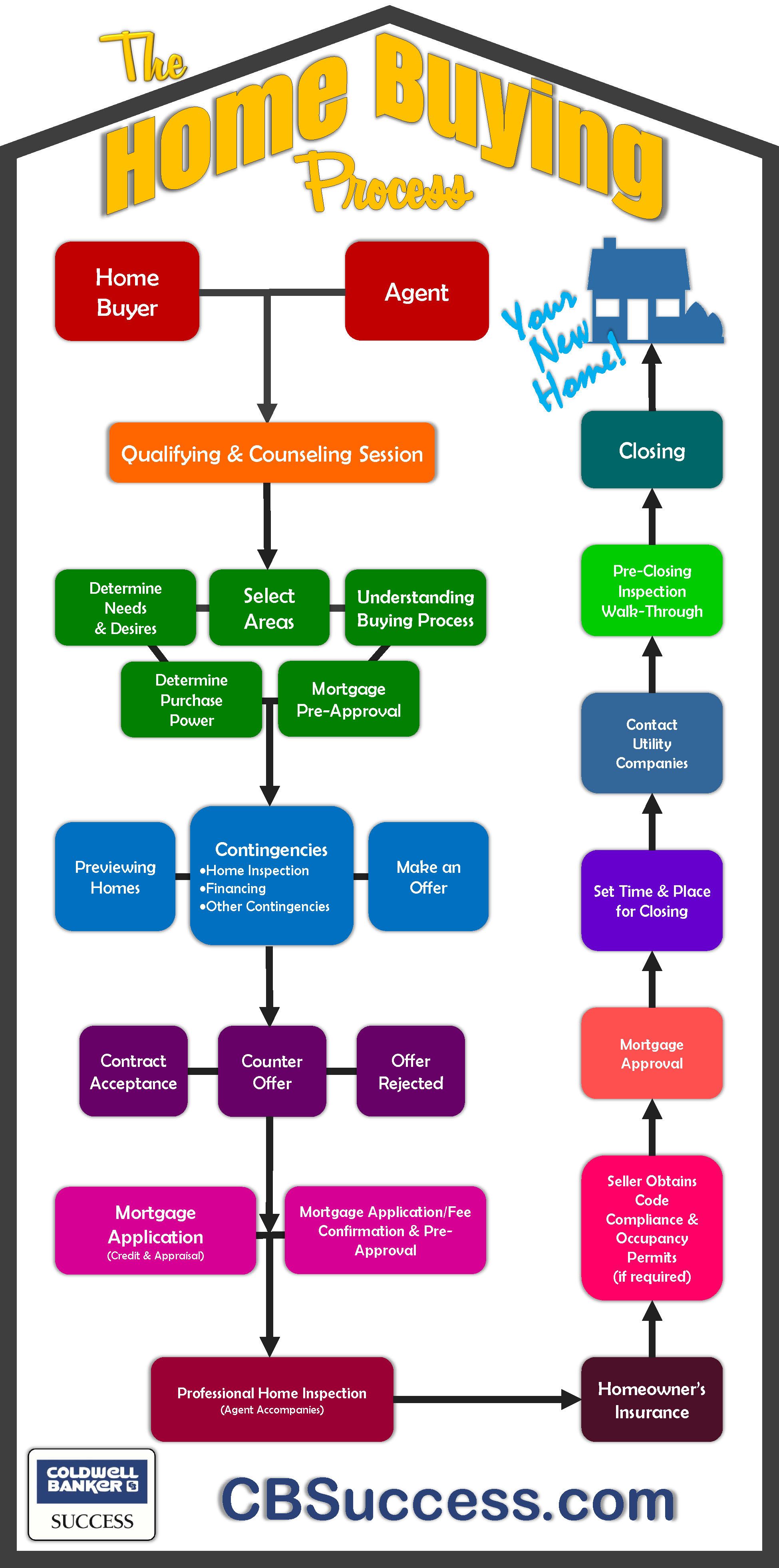

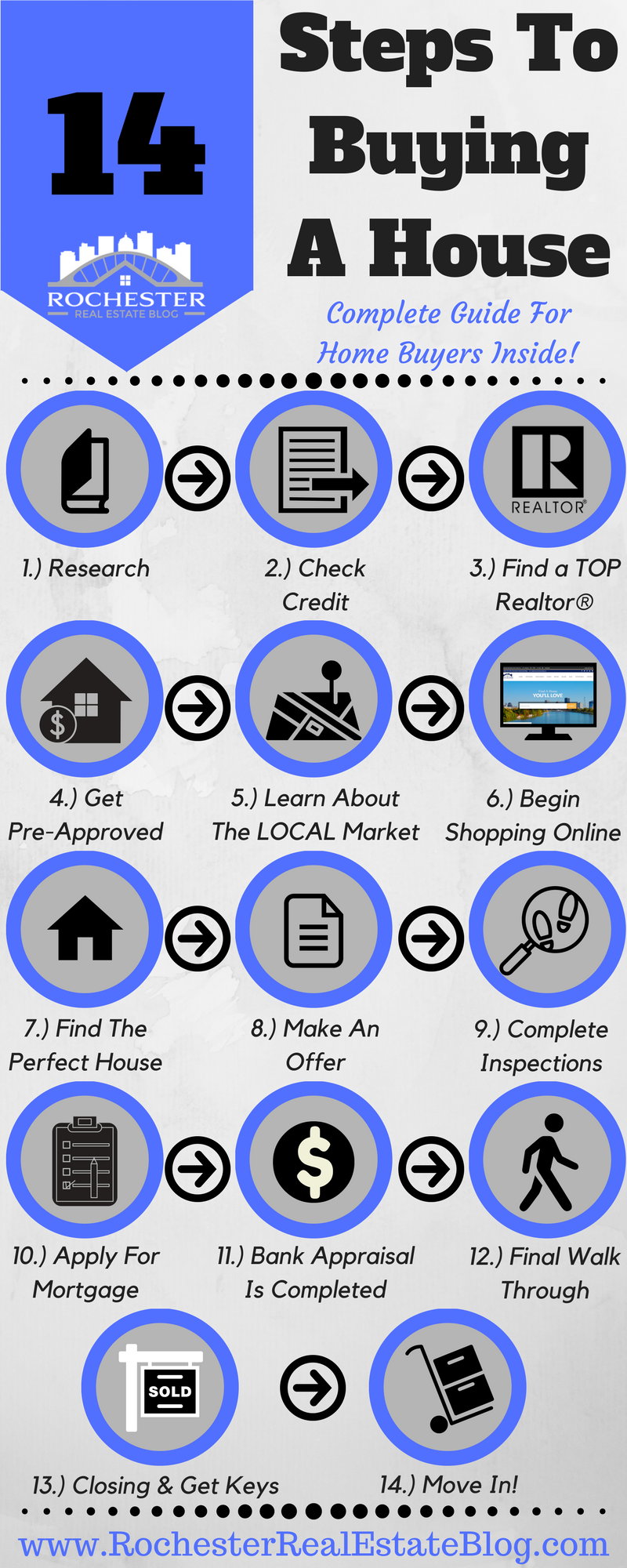

Step 1: Home Selection and Offer

Your journey begins with selecting a home that meets your lifestyle, budget, and aesthetic preferences. Here are the key activities for this step:

- Explore Available Homes: Visit Richmond Homes’ showcase homes or check their website for virtual tours and floor plans.

- Meet with a Sales Representative: Discuss customization options, upgrade packages, and financing.

- Make an Offer: Submit a purchase agreement or an offer document that includes your price, terms, and conditions.

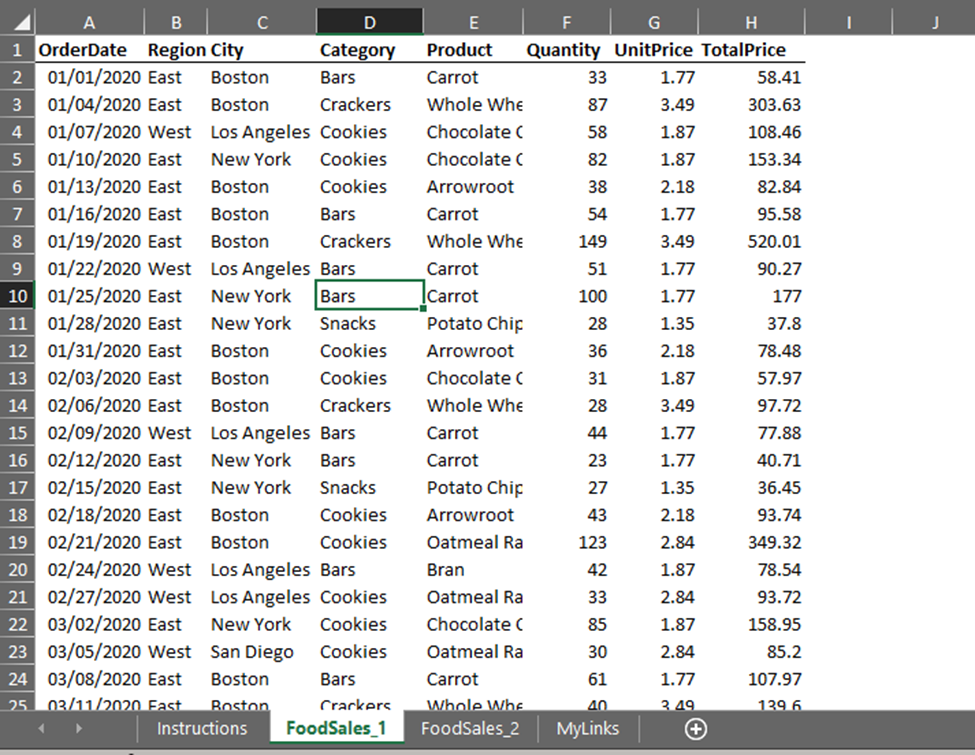

| Document | Description |

|---|---|

| Purchase Agreement | Outlines terms, price, and conditions of sale. |

| Offer to Purchase | Non-binding document specifying your intent to buy the home. |

Step 2: Financing and Pre-Approval

Getting pre-approved for a mortgage loan is crucial before you proceed further. Here’s what you need to do:

- Select a Lender: Choose a mortgage lender and discuss your loan options.

- Gather Necessary Documents: Including tax returns, pay stubs, bank statements, and W-2s.

- Apply for Pre-Approval: Submit your financial information to get a pre-approval letter.

🔍 Note: Remember, pre-approval is not a commitment to lend; final approval depends on your continued financial stability and the appraisal of the home.

Step 3: Contract and Closing Details

Once your offer is accepted, you will enter into a formal contract. This step involves:

- Contract Review: Hire an attorney to review the contract for clarity, especially regarding the closing date, deposits, and contingencies.

- Make Deposits: Submit an earnest money deposit to show commitment.

- Home Inspection: Schedule a home inspection to ensure the home is in good condition.

- Appraisal: The lender will order an appraisal to confirm the home’s value.

Step 4: Loan Application and Approval

With a signed contract, you’ll move to securing final loan approval:

- Submit Loan Application: Fill out the Uniform Residential Loan Application (URLA).

- Provide Additional Documents: Your lender might request further documentation such as investment account statements, etc.

- Underwriting Process: Await the underwriting decision, where your financials and the home’s appraisal are scrutinized.

Step 5: Settlement and Closing

The final step before you get the keys to your new home:

- Title Search and Insurance: Conduct a title search to ensure no liens or issues affect the property.

- Homeowners Insurance: Obtain a policy to protect your investment.

- Final Walk-Through: Inspect the home one last time to verify conditions met as per the contract.

- Sign Documents: At the closing meeting, you’ll sign numerous documents including the HUD-1 Settlement Statement, Note, and Deed of Trust.

- Transfer Funds: Wire or bring certified funds for the down payment and closing costs.

Embarking on the journey to buy a home at Richmond Homes involves a thorough understanding of the process, from selecting your dream home to the final settlement. This guide has walked you through the 5 essential steps, ensuring you are equipped with the necessary paperwork and knowledge at each stage. Remember, every step is designed to protect both you, the buyer, and the builder, providing peace of mind as you move into your new Richmond home.

What documents do I need to get pre-approved for a mortgage?

+

Typically, you’ll need to provide tax returns, pay stubs, bank statements, and W-2s to show your income and savings. Depending on your lender, additional documents like investment account statements might also be required.

How long does it take to close on a home at Richmond Homes?

+

The timeline can vary, but generally, from the time you submit your loan application, it might take about 30 to 45 days to close. Delays can occur due to lender issues, title problems, or unforeseen complications.

Can I customize my Richmond home?

+

Yes, during the initial meeting with a Richmond Homes sales representative, you can discuss customization options and upgrade packages to personalize your new home according to your preferences.