Chapter 7 Bankruptcy Discharge: Essential Paperwork Guide

What is Chapter 7 Bankruptcy Discharge?

Chapter 7 Bankruptcy, also known as "straight bankruptcy," allows individuals or businesses to eliminate or discharge most of their debts. The discharge means that the filer is no longer legally responsible for repaying the debts listed in the bankruptcy. Here's what you need to know: - Types of Dischargeable Debts: Credit card debt, medical bills, personal loans, and more. - Non-Dischargeable Debts: Student loans, child support, and certain taxes are typically not dischargeable.

📘 Note: Understanding which debts can be discharged is crucial for planning your financial recovery.

Essential Paperwork for a Successful Chapter 7 Bankruptcy Discharge

Filing for Chapter 7 Bankruptcy requires meticulous preparation of documentation. Here's a checklist: - Income Proof: Recent pay stubs, W-2 forms, and possibly tax returns to show income levels. - List of Creditors: Names, addresses, account numbers, and balances owed to all creditors. - Property Inventory: A detailed list of all personal property, including assets like cars, jewelry, and electronics. - Monthly Expenses: Documentation of your monthly expenses, including utilities, insurance, food, etc.

| Document | Description | Why It's Important |

|---|---|---|

| Pay Stubs | Recent pay stubs for the last 6 months | Used to calculate the Means Test to determine eligibility |

| Tax Returns | Last 2 years' federal and state tax returns | To verify income and tax-related debts |

| Bank Statements | The last 6 months’ bank statements | To demonstrate your financial transactions and cash flow |

Step-by-Step Process of Filing for Chapter 7 Bankruptcy

Credit Counseling: Complete a credit counseling course from an approved agency.

- This course must be completed within 180 days before filing for bankruptcy.

- The certificate of completion is a requirement for filing your case.

Gather Financial Information: Collect all necessary documents:

- Ensure documents are accurate and recent.

- Organize documents in an easily accessible format.

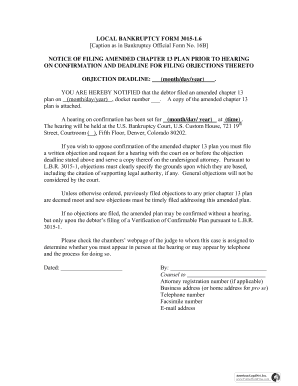

File the Petition: Submit your bankruptcy petition to the bankruptcy court:

- Include Form 101 for individuals and Form 201 for businesses.

- Schedule A/B (property), Schedule C (exemptions), Schedule D-J (debts and income), and Form 122A-1 (Means Test).

Attend the 341 Meeting: Meet with the trustee and any creditors who attend:

- Provide documents like pay stubs and bank statements.

- Answer questions truthfully about your finances.

Await Discharge: After successfully passing the Means Test and completing a debtor education course, await the discharge order from the court.

⚠️ Note: Missing deadlines or incorrect filings can significantly delay or complicate your case.

Common Pitfalls to Avoid

- Incomplete Documentation: Missing or inaccurate information can lead to dismissal of your case. - Incorrect Filing: Mistakes in forms or miscalculations can undermine your eligibility for Chapter 7. - Missing Deadlines: Failing to complete the required courses within the set timeframes can prevent discharge.

The Importance of Professional Assistance

Navigating Chapter 7 Bankruptcy can be complex. Here’s why seeking professional help might be beneficial:

- Legal Guidance: Bankruptcy attorneys can guide you through the legal maze, helping to ensure everything is done correctly.

- Court Advocacy: Representation during hearings and interactions with trustees.

- Paperwork Management: Assistance with accurate and complete filing to avoid common pitfalls.

💡 Note: While it's possible to file for Chapter 7 without an attorney, the intricacies of bankruptcy law often make professional assistance invaluable.

Summing up, Chapter 7 Bankruptcy provides a path to financial freedom by discharging unmanageable debts. Proper documentation, adherence to deadlines, and understanding the nuances of the process are key to a successful discharge. Having a professional’s expertise can significantly streamline the process, reducing stress and increasing the likelihood of a positive outcome.

What debts can’t be discharged in Chapter 7 Bankruptcy?

+

Common non-dischargeable debts include student loans, child support, alimony, certain taxes, and any debts not listed in the bankruptcy filing.

Do I need to attend any courses?

+

Yes, you must complete a credit counseling course before filing and a debtor education course post-filing to receive a discharge.

How long does a Chapter 7 Bankruptcy process take?

+

Typically, the entire Chapter 7 Bankruptcy process, from filing to discharge, can take 3 to 6 months, depending on the complexity of the case.