5 Simple Steps to Send Home Loan Paperwork

Embarking on the journey to secure a home loan can seem daunting, especially when it comes to the paper-intensive aspect of the process. Whether you're a first-time home buyer or looking to upgrade, understanding how to send home loan paperwork effectively can make a world of difference. Here, we outline a straightforward guide on navigating through this crucial step of your homeownership dream.

Simplify the Document Collection

Before diving into sending your loan paperwork, it’s essential to collect all necessary documents ahead of time. Here’s what you need:

- Proof of Identity: Photo ID like a driver’s license or passport.

- Proof of Income: Recent pay stubs, W-2 forms, and tax returns for the past two years.

- Bank Statements: For all accounts to verify your assets.

- Employment Verification: A letter from your employer or HR department.

- Credit Report: Recent report for your creditworthiness.

🔍 Note: Make sure all documents are up-to-date and clearly show all required details.

Organize and Review Your Documents

Once you have the documents, the next step is to organize and review:

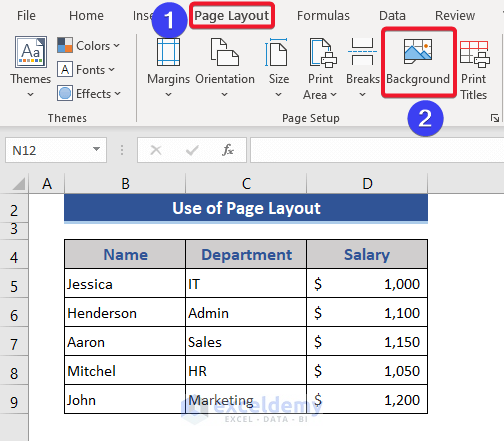

- Sort documents into categories, i.e., Identity, Income, Assets.

- Review each document for completeness and accuracy. Missing or incorrect information can delay your loan approval.

- If you’re unsure about a document’s sufficiency, contact your lender.

📁 Note: Having everything in one place reduces the chance of missing documents.

Understand Your Lender’s Submission Requirements

Each lender might have their unique process for home loan paperwork submission:

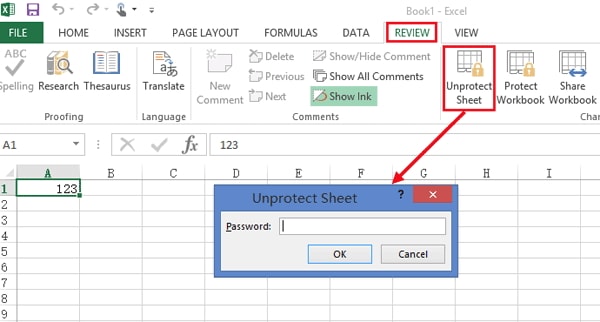

- Some might allow electronic submissions through secure portals.

- Others might require physical mailing or even in-person submission.

- Check if documents need to be notarized or if any specific format is required.

👓 Note: Following the lender’s submission guidelines can expedite the review process.

Safely Send Your Documents

When it’s time to send your paperwork:

- Secure Portal: Use the lender’s provided online portal to upload documents if available. This is the safest and fastest method.

- Physical Submission: If mailing, use certified or tracked mail with an insurer to guarantee delivery.

- Email: Use secure email attachments, possibly with encryption.

Track and Follow-Up

After you’ve sent your documents:

- Follow up with your lender to confirm receipt and processing status.

- Use tracking numbers for mailed documents or email confirmations for electronic submissions.

- Be proactive in responding to any requests for additional information or clarification.

⏰ Note: Being attentive to your loan application’s progress can help ensure timely approvals.

In summary, navigating the process of sending home loan paperwork involves understanding what you need to submit, how to submit it, and how to track its progress. By following these steps, you ensure a smoother path towards securing your home loan. The right preparation, organization, and follow-through can make the difference in achieving homeownership successfully and efficiently.

What happens if I miss sending a document?

+

Your lender will notify you if they’re missing any documents, allowing you to submit them promptly. Delays can occur if documents are not provided in time.

Can I send documents through email?

+

Yes, many lenders accept documents via secure email. However, check your lender’s policy for specific requirements regarding email submissions.

How can I ensure my documents are sent securely?

+

Use encrypted email attachments, secure online portals, or physical mailing with tracking and insurance for security during document transmission.