5 Ways to Create Excel Salary Sheet with Formulas

Using Microsoft Excel for Payroll

Payroll processing can be a daunting task for many businesses. However, with Microsoft Excel, you can simplify and automate this process, ensuring accuracy and efficiency. In this guide, we will explore five ways to create an Excel salary sheet using formulas to manage payroll effectively.

1. Basic Salary Calculation

The foundation of any payroll is the basic salary calculation. Here's how to set it up:

- Employee Details: Add columns for Employee ID, Name, Designation, and Basic Salary.

- Formula: For the basic salary, you can simply enter the fixed amount or reference it from a lookup table if there's a standard pay scale.

| Employee ID | Name | Designation | Basic Salary |

|---|---|---|---|

| 1001 | John Doe | Manager | =VLOOKUP(A2, LookupTable, 2, FALSE) |

⚠️ Note: The basic salary should be verified regularly to ensure compliance with the minimum wage laws in your region.

2. Deductions and Contributions

After calculating the basic salary, you need to account for various deductions and contributions:

- Taxes: Use a tax table or formula like

=IF(A2="Single", (B2-10000)*20%, IF(A2="Married", (B2-20000)*15%, "N/A"))for simplified tax calculations. - Health Insurance: Fixed amount or percentage of salary.

- Social Security: Typically a percentage of the salary.

- Retirement Funds: Also, often a percentage.

💡 Note: Ensure all deductions are compliant with legal requirements and provide opt-outs or adjustments where applicable.

3. Overtime Pay

Overtime can significantly impact an employee's salary. Here's how to manage it:

- Calculate Total Hours: Use

=IF(Hours<=40, Hours, (Hours-40)*OvertimeRate+40)to handle regular and overtime hours. - Overtime Rate: Typically time-and-a-half or double time.

Remember to update the formula regularly to reflect changes in company policy or labor laws.

4. Bonuses and Incentives

Bonuses and incentives can boost employee morale and productivity:

- Performance-Based Bonuses: Use conditional formatting or formulas like

=IF(TotalSales>100000, 5000, 0)to award sales-based bonuses. - Attendance Bonus: Calculate bonuses for perfect attendance using

=IF(AttendanceCount=30, 200, 0).

Consider the timing of these payments and their impact on cash flow.

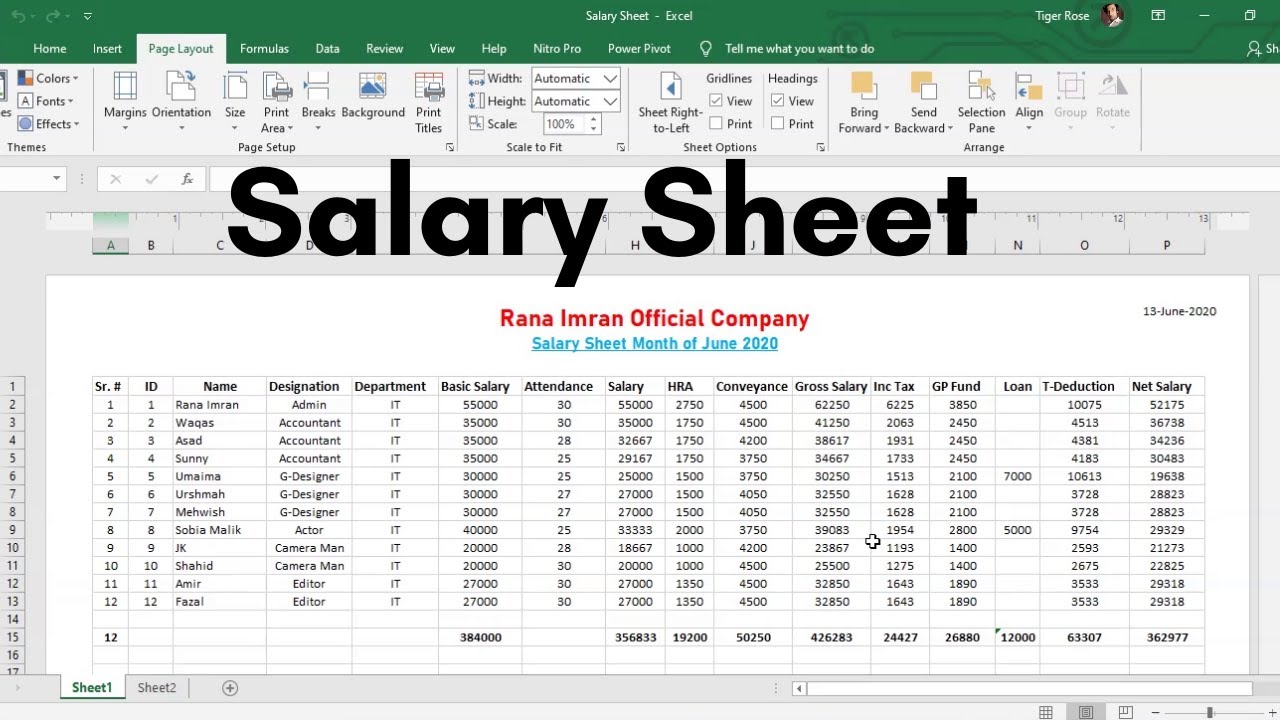

5. Comprehensive Salary Sheet

Now, let's integrate all the above elements into a comprehensive salary sheet:

- Header Row: Include all relevant columns for personal details, earnings, deductions, and net pay.

- Formulas: Combine all previous calculations into a single formula for the net pay like

=BasicSalary+A11-B11-C11-D11+E11where:- A11: Basic Salary

- B11: Tax Deductions

- C11: Health Insurance

- D11: Social Security

- E11: Overtime Pay or Bonuses

💼 Note: Regularly review and update formulas to account for changes in regulations or company policies.

By utilizing Excel's powerful formula capabilities, businesses can streamline payroll processes, reduce errors, and save time. Moreover, Excel allows for flexibility in handling different types of employee compensations, from basic salary to complex bonuses and incentives. Ensuring all these elements are correctly computed is key to maintaining trust with employees and complying with legal standards.

How often should I update the salary sheet?

+

Salary sheets should be updated monthly or as frequently as payroll is processed. Ensure to reflect changes in company policy, tax laws, or employee details promptly.

Can I automate payroll with Excel?

+

Yes, Excel can automate much of the payroll process with formulas and macros, reducing manual entry errors and speeding up payroll preparation.

What should I do if my company’s payroll is complex?

+

For complex payroll scenarios, you might consider using specialized payroll software or integrating Excel with other HR systems to manage diverse compensation structures.

Is Excel secure enough for storing sensitive employee data?

+

Excel does offer password protection for spreadsheets. However, for enhanced security, consider using cloud-based solutions or HR systems with built-in security features.

How do I ensure payroll accuracy in Excel?

+

To ensure accuracy, use cross-check formulas, perform regular audits, and keep all data up-to-date. Additionally, train staff on Excel best practices for payroll management.