5 Steps to Obtain Your Bankruptcy Paperwork

The journey through bankruptcy can be daunting, but having the right paperwork in order is crucial. This guide outlines the essential steps to gather and prepare your bankruptcy paperwork, ensuring a smoother legal process. Whether you're facing Chapter 7 or Chapter 13 bankruptcy, the following steps will help you navigate the paperwork maze.

Step 1: Understand What Documents You Need

The first step in organizing your bankruptcy paperwork is understanding what documents are necessary. Here's a checklist of common documents:

- List of Creditors: Names and addresses of all creditors.

- Income Statements: Pay stubs or income verification for the past six months.

- Bank Statements: Last six months of statements for all accounts.

- Tax Returns: The last two years of federal and state tax returns.

- Property Information: Deeds, titles, or mortgage statements for any property owned.

- Personal Property: Inventory of valuables like jewelry or vehicles.

- Financial Records: Monthly budget, outstanding loans, and debts.

📝 Note: Ensure you keep both physical and digital copies of these documents for your attorney.

Step 2: Collect Necessary Financial Documents

Begin by collecting all financial documents that will detail your current financial state:

- Bank Statements: Access online banking or visit your bank for paper copies.

- Pay Stubs: Contact your employer or access your HR system.

- Tax Returns: Retrieve from IRS or state tax agency or your personal records.

- Investment Accounts: Statements from all brokerage accounts.

- Retirement Funds: 401(k), IRA statements, etc.

Step 3: Compile Evidence of Income and Expenses

Your attorney will need a comprehensive overview of your financial life. Here's how to gather the data:

- Income: Collect all sources of income from the past 6-12 months.

- Expenses: Monthly bills, utility payments, grocery receipts, and other regular expenses.

| Expense Category | Examples |

|---|---|

| Housing | Rent, mortgage, utilities |

| Transportation | Car payments, gas, insurance |

| Living Expenses | Food, clothing, medical costs |

Step 4: Assemble Credit and Debt Information

Borrowers and lenders play a significant role in bankruptcy proceedings. Here's how to gather these details:

- Credit Reports: Pull reports from all three bureaus - Experian, Equifax, and TransUnion.

- Loan Statements: Collect statements from car loans, student loans, and personal loans.

- Proof of Payment: Any receipts or agreements for recent payments made to creditors.

Step 5: Organize and Review with Your Attorney

Once you've gathered all required documents:

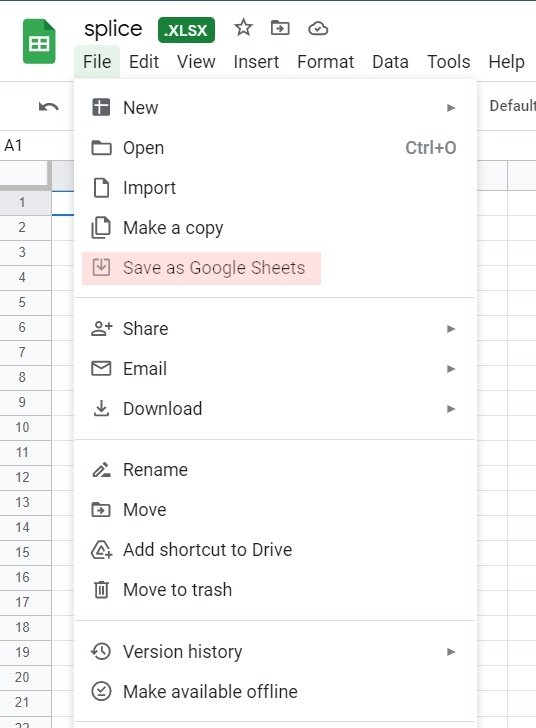

- Create organized digital folders for each category.

- Print out necessary documents or ensure easy access to digital copies.

- Schedule a meeting with your bankruptcy attorney to review everything.

Having a thorough and organized set of documents not only speeds up the bankruptcy process but also helps in proving your financial status to the court. Be sure to include all relevant documents, as missing or incomplete paperwork can delay the process.

While collecting and organizing bankruptcy paperwork might seem overwhelming, breaking it down into steps makes the task more manageable. Remember, bankruptcy attorneys are well-versed in the required documents and can provide guidance throughout this process. By following these steps diligently, you'll be well-prepared for what lies ahead, ensuring a smoother legal proceeding and potentially better outcomes in your bankruptcy case.

How long does it take to gather all bankruptcy paperwork?

+

The time required can vary significantly based on your financial situation. However, with organized records, it might take a few days to a week to gather all documents.

What should I do if I’ve lost some important financial documents?

+

Contact your bank, employer, or the IRS for copies of lost documents. In some cases, your attorney might be able to request these for you.

Can I file for bankruptcy without an attorney?

+

Yes, you can file for bankruptcy without an attorney, but it’s generally not recommended due to the complexity of the process. Legal representation can significantly increase your chances of a favorable outcome.