5 Steps to Create a Consolidated Balance Sheet in Excel

Creating a consolidated balance sheet in Excel involves merging the financial data from multiple entities or subsidiaries into one cohesive financial statement. This comprehensive view helps analysts, stakeholders, and decision-makers evaluate the financial health of an entire corporate group. Here's how to do it effectively:

Step 1: Gather Financial Statements

Before diving into Excel, you need to collect all necessary financial statements from each entity or subsidiary:

- Balance Sheets: Collect the latest balance sheet from each company.

- Adjustments: Ensure adjustments for intercompany transactions are noted to avoid double-counting.

Step 2: Set Up Your Excel Workbook

Open Microsoft Excel and set up a new workbook with the following steps:

- Create separate sheets for each company’s balance sheet, labeled clearly (e.g., Company A, Company B).

- Create a consolidated sheet named “Consolidated Balance Sheet.”

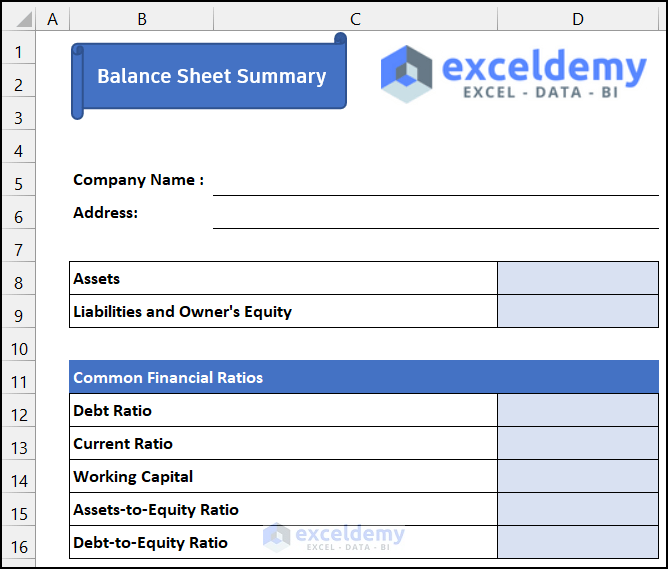

Ensure each sheet has a uniform structure with:

- Assets listed at the top, followed by Liabilities and Equity.

- A clear delineation between current and non-current items.

Step 3: Input Data and Adjust for Consolidation

Enter the financial data from each company into their respective sheets. Here’s how:

- Transcribe asset, liability, and equity items, ensuring consistency in classification.

- Make adjustments:

- Eliminate intercompany transactions, which could be receivables or payables, dividends, or equity investments.

- Use a separate sheet for these adjustments if necessary.

- Use formulas for automatic updates:

- Link data between company sheets and the consolidated sheet using functions like =

=CompanyA!A1

Table: Common Adjustments for Consolidation

| Adjustment Type | Description | Excel Formula |

|---|---|---|

| Intercompany Receivables/Payables | Remove to prevent double-counting | =-SUM(CompanyA!E35, CompanyB!E35) |

| Investment in Subsidiaries | Eliminate equity investment in consolidated entities | =CompanyA!E45-CompanyB!F45 |

⚠️ Note: Ensure that you verify all data entries for accuracy as small mistakes can lead to significant discrepancies in the consolidated financial statement.

Step 4: Combine and Format the Data

Now, you’ll consolidate the data:

- Use Excel formulas or functions like

=SUM(),=SUMIF(), or=VLOOKUP()to combine data from individual sheets. - Format your consolidated balance sheet for readability:

- Add headers, footers, and apply number formatting to financial figures.

- Highlight key figures like total assets, total liabilities, or shareholders’ equity using bold or background color.

Step 5: Review and Verify the Consolidated Balance Sheet

After combining the data:

- Accuracy Check: Ensure all numbers are consistent with source data after adjustments.

- Comparisons: Compare the consolidated sheet with previous periods to detect any inconsistencies.

- Audit: A second pair of eyes can spot discrepancies or errors you might have missed.

To wrap up this process, you’ve now created a unified view of the financial position of a group of companies. This consolidated balance sheet allows for a clearer understanding of the group’s financial health, facilitating better strategic decisions. The steps outlined provide a systematic approach to merging financial data from multiple entities into a single, coherent financial statement, enhancing transparency and accountability in financial reporting. By following these steps, you can efficiently manage and analyze financial data, ensuring stakeholders have access to accurate and comprehensive financial information.

Why do we need to adjust for intercompany transactions?

+

Intercompany transactions are adjusted to eliminate any double-counting of assets, liabilities, or equity which could skew the consolidated financial statements.

Can I use a different software than Excel for creating a consolidated balance sheet?

+

Yes, while Excel is very popular due to its widespread availability and ease of use, other software like Google Sheets, SAP, or specialized accounting software can also be used to create consolidated financial statements.

What are the most common mistakes in consolidation?

+

The most common mistakes include:

- Overlooking intercompany transactions.

- Using incorrect consolidation methods.

- Data entry errors.

- Not considering minority interests or non-controlling interests correctly.