Creating a Simple Balance Sheet in Excel for Indian Businesses

Why You Need a Balance Sheet

A balance sheet is a crucial financial statement for businesses, providing a snapshot of their financial health at any point in time. For Indian businesses, having an accurate balance sheet can be particularly beneficial as it helps in:

- Understanding the company's financial stability.

- Attracting investors by showcasing financial solvency and growth potential.

- Complying with financial reporting obligations required by the Ministry of Corporate Affairs.

- Assisting in decision-making for future investments or expansions.

Steps to Create a Simple Balance Sheet in Excel

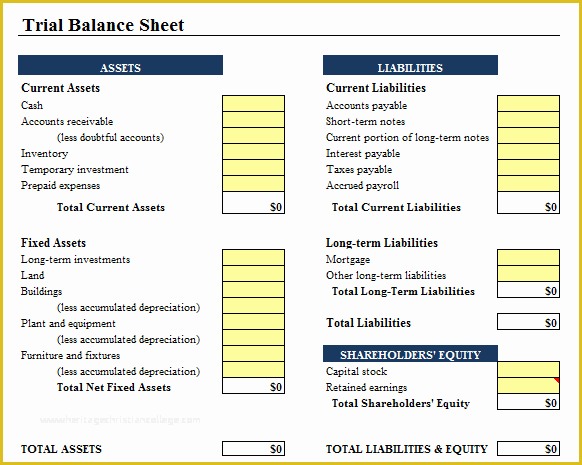

1. Understand the Components of a Balance Sheet

Before diving into Excel, understanding the basic structure of a balance sheet is essential:

- Assets: Everything your business owns of value (current and non-current).

- Liabilities: What your business owes to external parties.

- Equity: The owner’s investment and retained earnings.

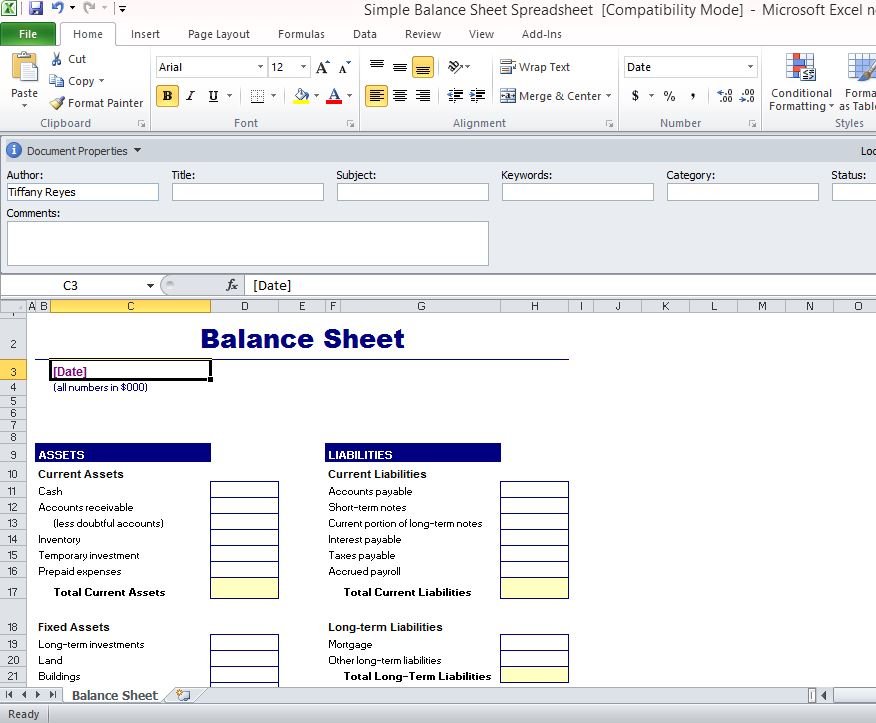

2. Setting Up Excel

Launch Microsoft Excel and set up your worksheet as follows:

- Open a new workbook.

- Name the first sheet “Balance Sheet.”

- Adjust cell sizes for readability (make columns A, B, C, and D wider).

3. Entering Data

Here’s how to input data into your balance sheet:

- Heading: In cell A1, type “Balance Sheet” and format it as a Heading 2 (use ‘h2’).

- Date: In cell A2, enter the date for which the balance sheet is prepared.

- Sections: From cell A3, create headers for Assets, Liabilities, and Equity.

Use the following layout:

| Item | Amount (INR) |

|---|---|

| Assets | |

| - Current Assets | |

| - Non-current Assets | |

| Total Assets | |

| Liabilities | |

| - Current Liabilities | |

| - Non-current Liabilities | |

| Total Liabilities | |

| Equity | |

| Total Equity | |

| Total Liabilities and Equity |

4. Calculating Values

Fill in the specific assets, liabilities, and equity items, then compute:

- Assets: Sum up current and non-current assets.

- Liabilities: Sum up current and non-current liabilities.

- Equity: Total equity (including retained earnings).

- Balance: Ensure that Total Assets equals Total Liabilities plus Equity.

5. Formatting and Styling

To make the balance sheet readable and visually appealing:

- Use bold and italic text for headings, subheadings, and important figures.

- Align numbers to the right for readability.

- Apply borders and shading to separate sections.

- Use formulas for automatic calculations to avoid manual errors.

💡 Note: Always double-check your formulas to ensure accuracy in calculations.

Wrapping Up

With these steps, you now have a basic template for a balance sheet in Excel, customized for Indian businesses. Regularly updating this sheet will provide a clear, real-time view of your financial status, aiding in strategic decision-making and compliance. Whether you’re an SME or a large corporation, maintaining an accurate balance sheet can significantly influence your business growth and sustainability.

Why is a balance sheet important for Indian businesses?

+

A balance sheet is crucial for Indian businesses as it:

- Helps in understanding the financial health of the business.

- Is required by law for filing with the Ministry of Corporate Affairs.

- Assists in attracting investors by displaying financial stability.

Can I create a balance sheet in Excel for a non-profit organization?

+

Yes, you can use Excel to create a balance sheet for non-profits, which often includes ‘Net Assets’ instead of ‘Equity.’ The process remains the same, but the terminology might differ.

How often should I update my balance sheet?

+

It’s recommended to update your balance sheet at least quarterly, or monthly if your business has high transaction volumes, to keep track of financial changes effectively.

What if my assets don’t match liabilities plus equity?

+

If your assets don’t balance with liabilities plus equity, there might be an error in the calculations or unrecorded transactions. Review your entries and check for discrepancies.