5 Easy Steps to Create Your Personal Budget in Excel

The process of managing finances can be quite daunting, yet with the right approach, it becomes manageable. Using Microsoft Excel to create a personal budget is an effective method for tracking your income and expenses, ensuring you maintain control over your financial life. Here's how you can set up your personal budget in just 5 simple steps.

Step 1: Gather Your Financial Data

The first step in creating a budget involves collecting all relevant financial information. Here’s what you should do:

- List all sources of income: This includes salary, freelance earnings, investments, etc.

- Record monthly expenses: From fixed costs like rent to variable expenses such as entertainment.

- Track debts and loans: Include credit card payments, student loans, car payments, and any other liabilities.

- Check for any irregular or annual expenses: Think of insurance premiums, taxes, or holiday gifts.

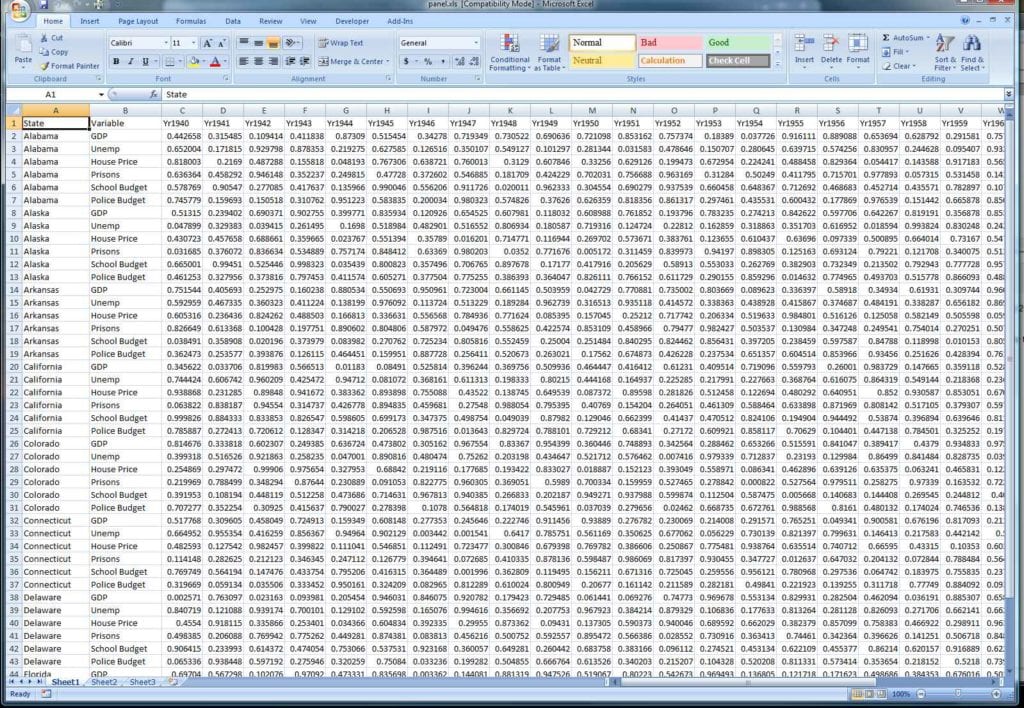

Step 2: Set Up Your Excel Spreadsheet

Open Excel and set up your workbook as follows:

- Create a new workbook and label the first sheet “Monthly Budget.”

- Set up columns for: Date, Income Source, Expense Category, Description, and Amount.

- Use the top row for headers to organize your data neatly.

Step 3: Enter Your Data

Once your spreadsheet is formatted, it’s time to populate it with your financial data:

- Under the “Income Source” column, list all your income types and enter their respective amounts.

- In the “Expense Category” column, categorize your expenses (e.g., housing, utilities, groceries).

- Next to each expense, write a brief description and the associated cost under “Amount.”

Step 4: Calculate Your Totals and Allocate Funds

With your data entered, now you can:

- Sum up your total income using Excel’s formula:

=SUM(F2:F[last_row]). - Calculate total expenses similarly:

=SUM(H2:H[last_row]). - Compare income and expenses to understand your net cash flow:

- Set budget limits for categories by inputting the formula:

=D[Expense_Category] * [Percentage_of_Income]. - Automate savings by subtracting budgeted expenses from income:

=F2-SUM(H2:H[last_row]).

💡 Note: Using percentage-based budgeting can help in adjusting to fluctuating income.

Step 5: Review and Adjust Regularly

Financial planning isn’t static; it requires periodic reviews and adjustments:

- Set a monthly reminder to update your budget with actual income and expenses.

- Compare your actual spending against the budgeted amounts to identify any discrepancies.

- Adjust your budget categories or limits based on changes in income, expenses, or financial goals.

A well-maintained budget offers numerous benefits:

| Benefits | Description |

|---|---|

| Financial Control | Gain a clear overview of your financial situation. |

| Savings Automation | Set up automatic transfers to savings accounts. |

| Debt Management | Strategically plan how to reduce or eliminate debts. |

| Goal Achievement | Work towards financial goals like buying a home or funding education. |

In conclusion, creating a personal budget in Excel provides you with the tools to manage your finances effectively. With these five steps, you’ll be able to track your financial health, make informed decisions, and steer your financial journey towards stability and growth. Regular updates to your budget ensure it remains relevant, keeping you in control of your financial destiny.

How often should I update my budget?

+

It’s recommended to review your budget monthly to reflect any changes in your financial situation. However, life events like a job change, a raise, or unexpected expenses might require you to adjust your budget more frequently.

What if my expenses exceed my income?

+

Excessive expenses signal the need for adjustments. Consider cutting back on discretionary spending, increasing income through side gigs, or re-evaluating fixed costs for savings.

Can I use Excel for long-term financial planning?

+

Absolutely! Excel can help with long-term financial planning. You can create separate sheets for different goals, like retirement, home purchase, or funding education, and project your financial growth over time.