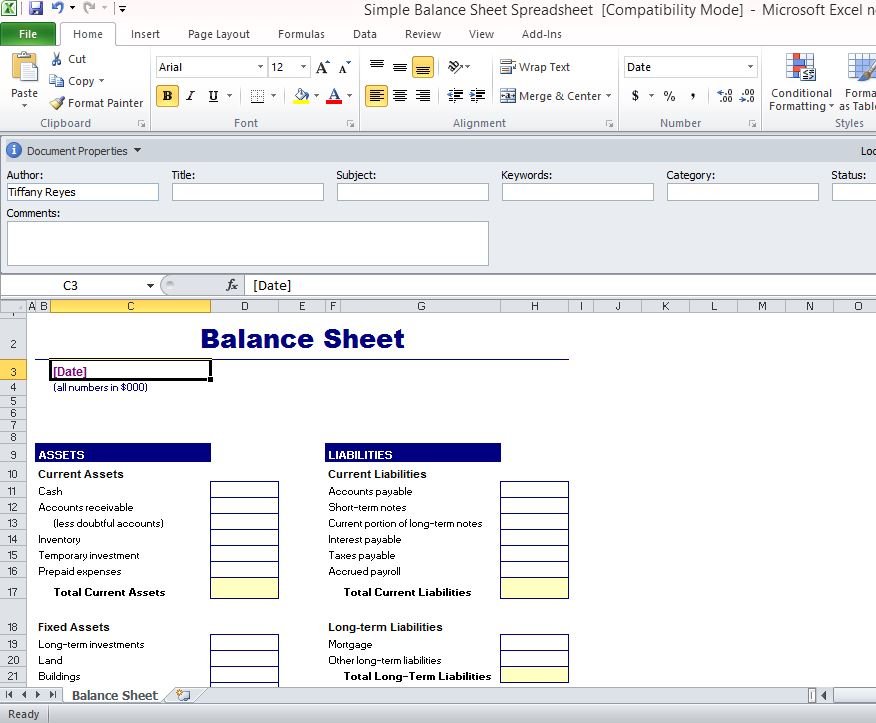

Create a Simple Balance Sheet in Excel 2010

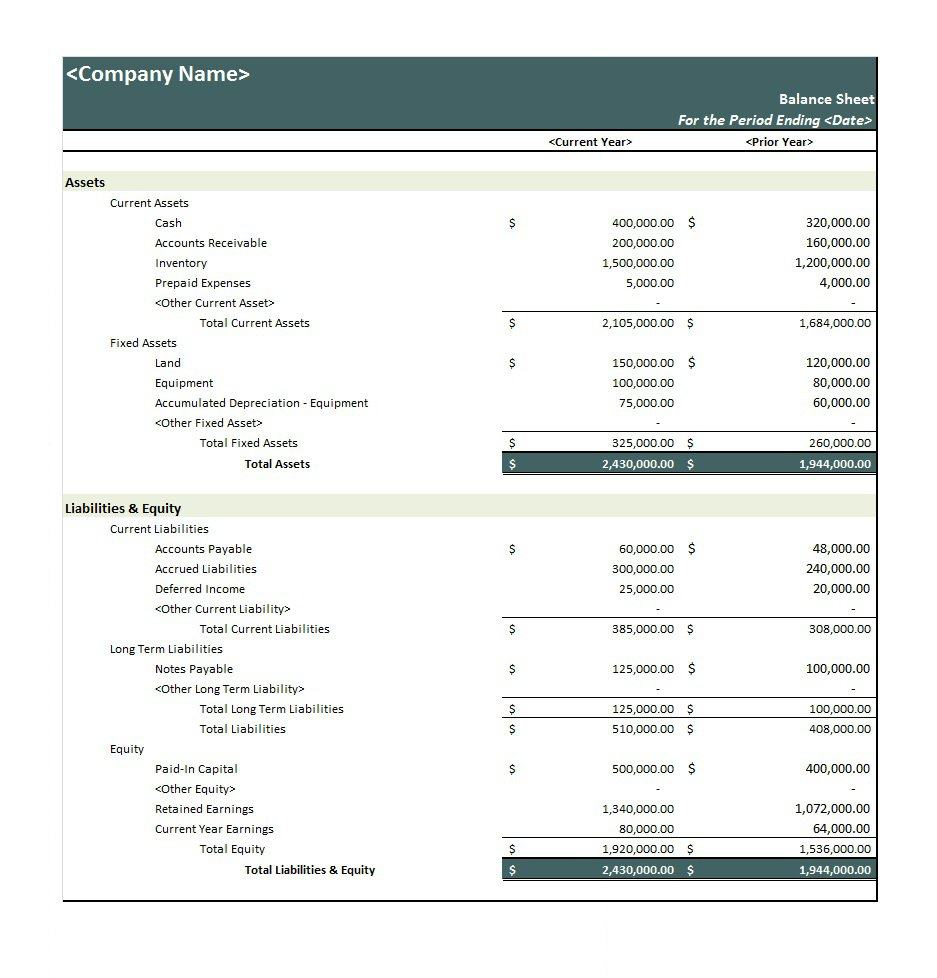

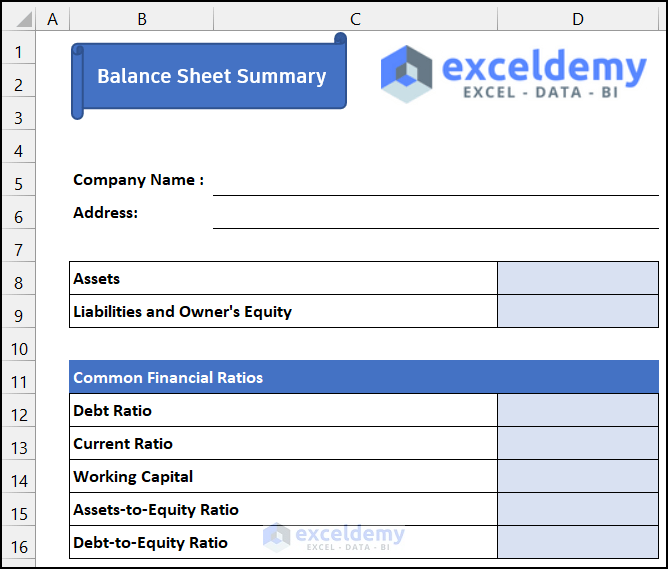

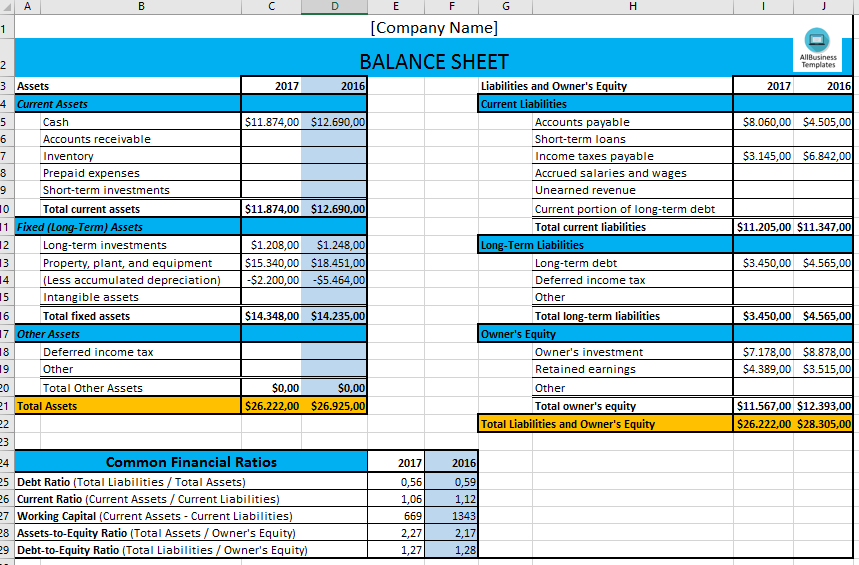

To manage your finances effectively, creating a balance sheet is a fundamental step. This tool provides a snapshot of your financial health by listing out your assets, liabilities, and equity. Here's how you can create a simple balance sheet using Excel 2010.

Setting Up Your Excel Worksheet

Start by opening a new spreadsheet in Excel 2010. The first step is to set up the structure:

- Assets: What you own

- Liabilities: What you owe

- Equity: The value of your ownership interest in assets after accounting for liabilities

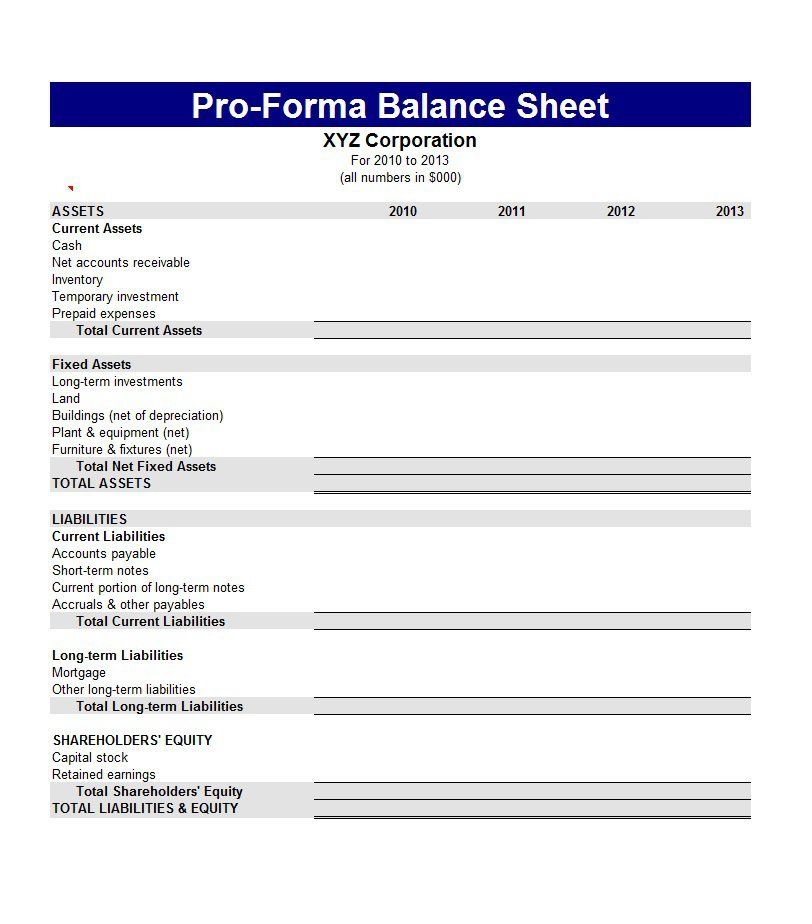

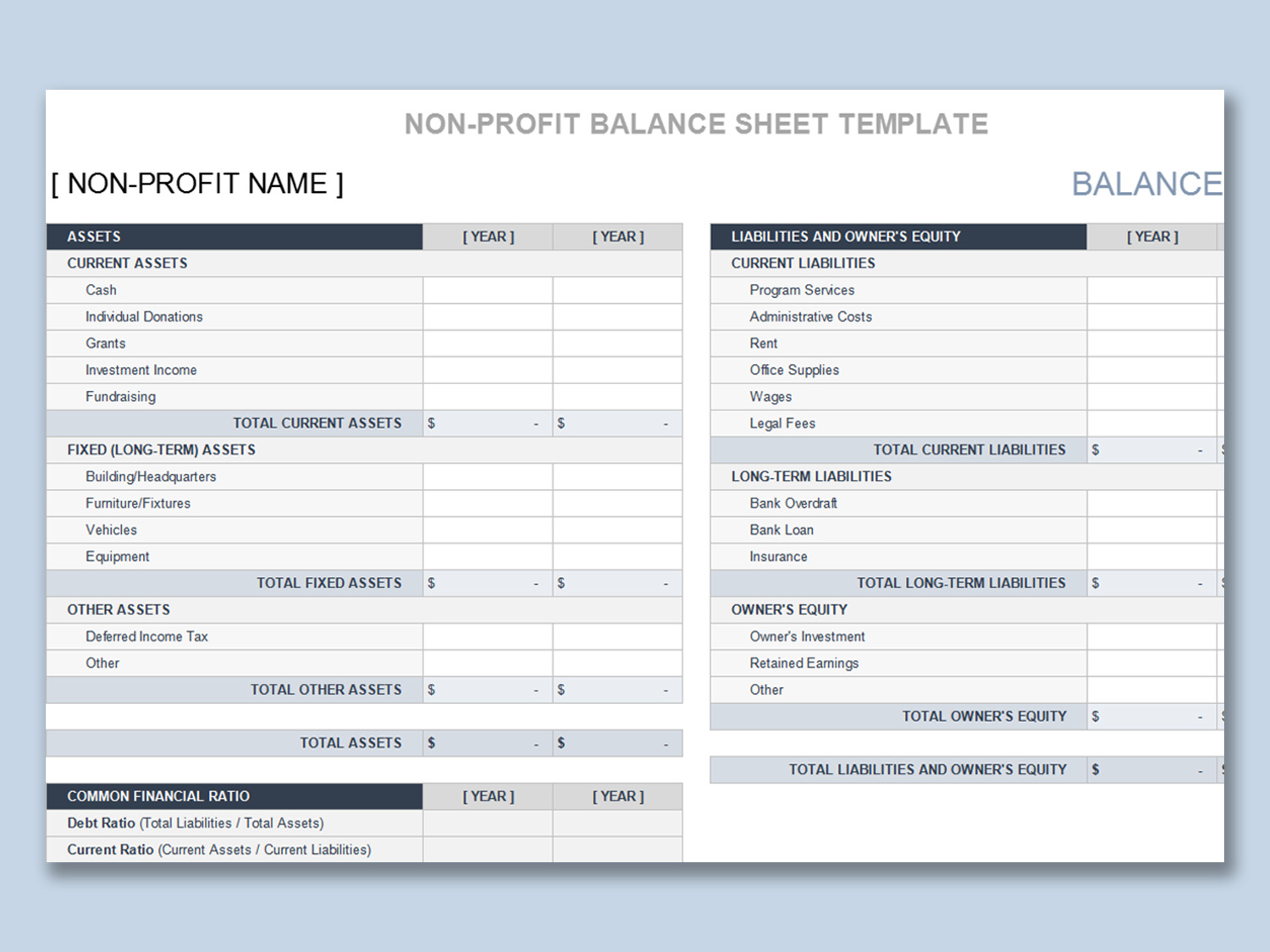

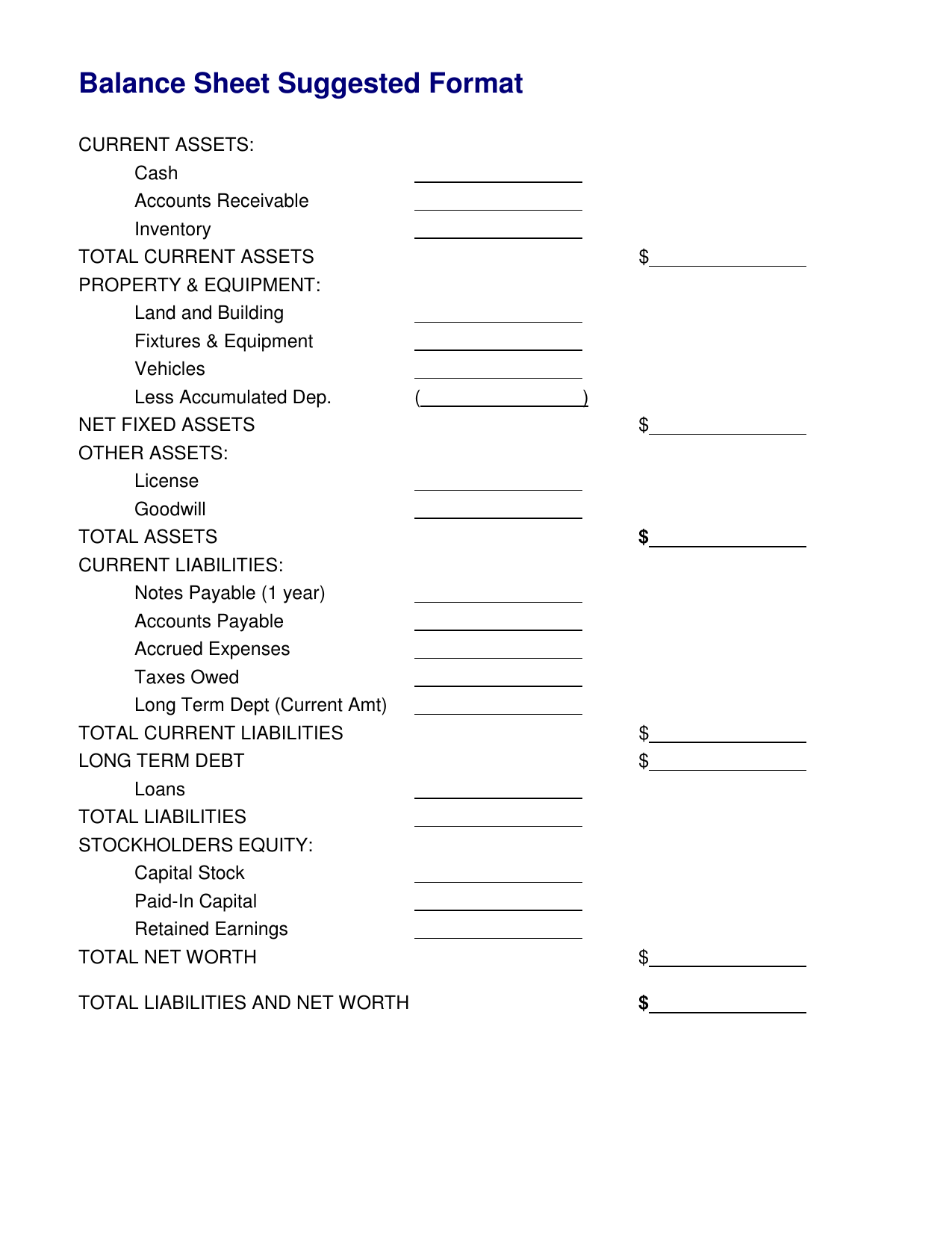

Inputting Data for Assets

Under the “Assets” header, you’ll list various assets:

- Cash in hand

- Bank savings

- Accounts receivable

- Inventory

- Property and equipment

Create columns:

| Item | Value |

|---|---|

| Cash | 3000 |

| Savings | 5000 |

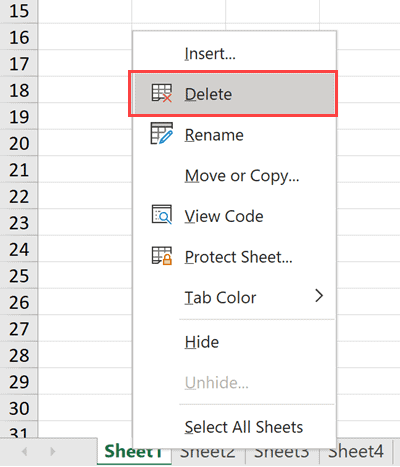

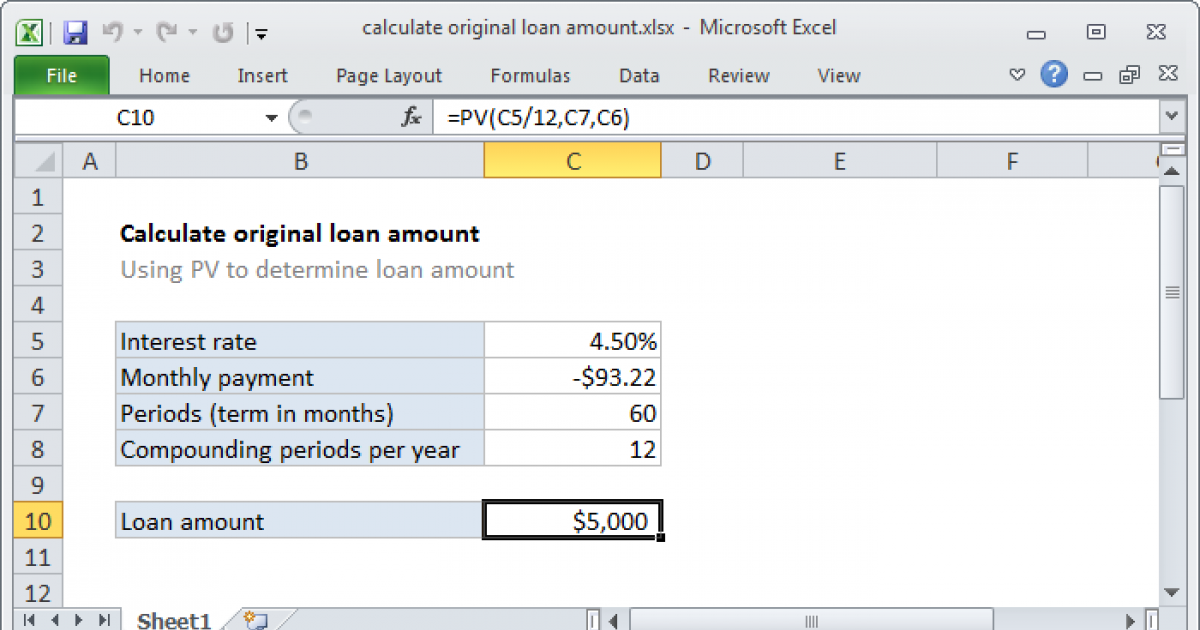

Calculating Total Assets

Use the SUM function to calculate the total assets:

=SUM(B2:B6)💡 Note: Ensure you double-check the cell references for accuracy in calculations.

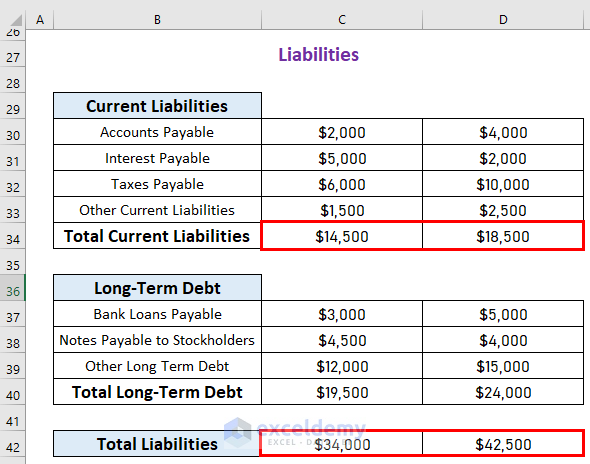

Entering Liabilities

Below the assets, list your liabilities:

- Short-term debt

- Accounts payable

- Long-term debt

Format this similarly to the assets:

| Item | Value |

|---|---|

| Short-term Loans | 1500 |

| Credit Card Debt | 2000 |

Calculating Total Liabilities

Sum up all your liabilities using the same SUM function:

=SUM(B10:B12)Determining Equity

Equity, also known as owner’s equity or net worth, is calculated using the following formula:

Equity = Total Assets - Total LiabilitiesHere’s how to implement it:

=B7 - B13Formatting and Styling

To make your balance sheet visually appealing and more readable:

- Use bold fonts for headers

- Highlight totals with color

- Apply borders to separate sections

Adjust cell alignment and use conditional formatting for better visualization:

📘 Note: For optimal readability, consider using Table Styles in Excel.

Creating a simple balance sheet in Excel 2010 offers a clear view of your financial status. By understanding the basic structure and accurately inputting your data, you'll have a practical tool for assessing your financial health, tracking changes over time, and making informed decisions. This guide covers the essentials, from setting up your worksheet, entering and formatting financial data, to ensuring accuracy in your calculations.

What is the purpose of a balance sheet?

+

A balance sheet provides a snapshot of your financial health at a specific point in time, showing what you own (assets), what you owe (liabilities), and the equity or net worth of your business or personal finances.

Can I include intangible assets like brand value in the balance sheet?

+

While intangible assets like brand value are not typically included in a simple balance sheet, you can list them under the assets if they are quantifiable or have a recognized value in financial reporting.

How often should I update my balance sheet?

+

It is recommended to update your balance sheet at least quarterly or whenever there is a significant change in your financial situation to keep your financial overview current and relevant.