Discover If You're Owed PPI Without Paperwork

Millions of people across the UK might have been mis-sold Payment Protection Insurance (PPI) over the past few decades, leading to massive payouts from banks and financial institutions. However, what if you suspect you've been mis-sold PPI but you've misplaced or lost all the relevant paperwork? Fear not, as there are still several ways to discover if you're owed PPI compensation even without the necessary documents. Here's how you can proceed:

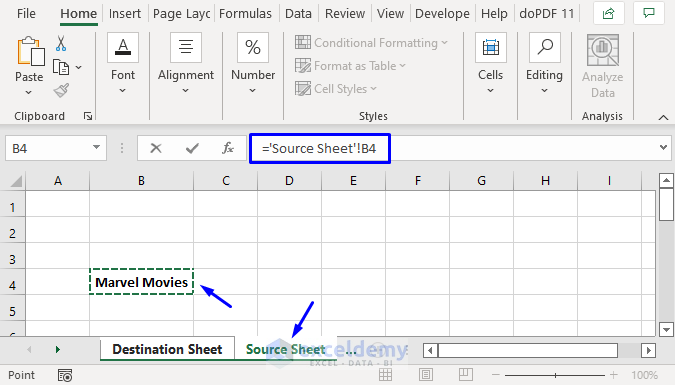

1. Utilize Online Tools and Websites

Several platforms have been developed to help consumers check if they have PPI on existing or past loans or credit cards:

- Bank Websites: Many banks now have tools or sections on their websites where you can log in or enter basic information to check for PPI.

- Third-Party Checkers: There are reputable websites that allow you to enter limited information and they’ll search databases to see if you might have PPI.

Remember, while these tools can give you an initial indication, they are not a substitute for a professional check.

2. Contact the Lender Directly

If online tools don’t provide conclusive evidence, you should reach out to your lenders or banks. Here’s what to do:

- Phone Calls: Ask if there’s any record of PPI on your accounts or loans. Use account numbers if available.

- Email or Mail: If phone calls are not your preference, formal requests in writing can sometimes yield detailed responses.

Note that companies have to keep records, even if they’ve lost their paperwork, they might still have electronic records.

🔍 Note: Always keep a record of your communications with lenders for future reference.

3. Check Credit Reports

Your credit report can serve as a record of your financial history:

- Credit Reference Agencies: Agencies like Experian, Equifax, or TransUnion provide reports that might mention past or existing PPI policies.

By reviewing these reports, you can identify any loans or credit products where PPI might have been sold.

4. Seek Professional Help

If the above methods do not provide clear answers, consider:

- PPI Claim Companies: These firms have access to databases and information not available to the public and can check for PPI on your behalf.

- Financial Advisors: Some financial advisors specialize in PPI claims and can provide a professional audit of your financial history.

Be cautious, however, as these services often come with fees or take a percentage of your compensation.

🔍 Note: Always research any company before handing over personal information or making payments.

5. Review Bank Statements

If you have old bank statements:

- Look for PPI Charges: Charges for PPI might appear as separate monthly payments or might have been included in the cost of your loan.

Keep in mind, sometimes PPI was added as a lump sum at the outset, making it harder to detect.

6. Remember Key Information

Even without documents, these might help:

- Names of Banks: Knowing which banks you’ve dealt with can be a good starting point.

- Loan or Credit Card Details: Account numbers, even partial, can be very helpful.

- Approximate Times: When you took out loans or applied for credit cards can jog your memory or provide clues.

Even small details can assist in tracking down PPI coverage.

7. Legal Assistance

If your claim faces obstacles or you’re unsure about how to proceed:

- Citizens Advice Bureau: They can provide free advice on how to proceed with PPI claims.

- Law Firms: Some specialize in consumer finance and can guide or take on your case, often on a ‘no win, no fee’ basis.

Seeking legal advice can be beneficial, especially if your claim is denied or you're met with resistance from the lender.

Navigating the PPI maze without paperwork can seem daunting, but it's entirely possible to find out if you're owed compensation. With the availability of online tools, direct communication with lenders, and even legal support, the process has become more straightforward for consumers. Remember that lenders must retain records, and there's often more information available than you might initially think. Stay proactive, persistent, and don't hesitate to seek help when needed. Your journey towards reclaiming what might be rightfully yours doesn't end with missing documents; it's just the beginning of a more thorough investigation.

Can I still claim PPI if I’ve lost all my paperwork?

+

Yes, you can still make a PPI claim without paperwork. Many people are in the same situation. Contact the lender, use online tools, or seek help from a professional service.

How long do banks keep records of PPI?

+

Banks must keep customer records for at least six years. However, some have kept records for much longer due to the ongoing nature of PPI claims.

What should I do if my PPI claim is rejected without paperwork?

+

If your claim is rejected, gather as much evidence as you can about your dealings with the lender. Seek help from Citizens Advice or consider legal assistance to escalate your claim.