4 Easy Steps to Complete Your Individual 401k Paperwork

Completing your Individual 401(k) paperwork might seem daunting at first, but by breaking it down into straightforward steps, the process becomes much more manageable. Whether you're a self-employed individual or own a small business, setting up an Individual 401(k) can be an excellent way to save for retirement with significant tax benefits. Here's how to get through your paperwork without breaking a sweat.

Step 1: Gather Necessary Information

Before you start filling out forms, make sure you have all the essential documents and details at hand:

- Employer Identification Number (EIN): You’ll need an EIN for your business. If you don’t have one, apply for it on the IRS website.

- Social Security Number (SSN): This is required for the plan administrator and the IRS.

- Business Information: Name, address, and type of business entity (e.g., LLC, Sole Proprietorship).

- Bank Details: Account numbers for the bank where you’ll open your Individual 401(k).

- Plan Designation and Type: Decide on whether you want the plan to be designated as a Roth or Traditional 401(k).

- Participant Information: All details concerning the participants, including yourself and any employees, if applicable.

📝 Note: Ensure all your business financials are in order, as this information might be required during the setup process.

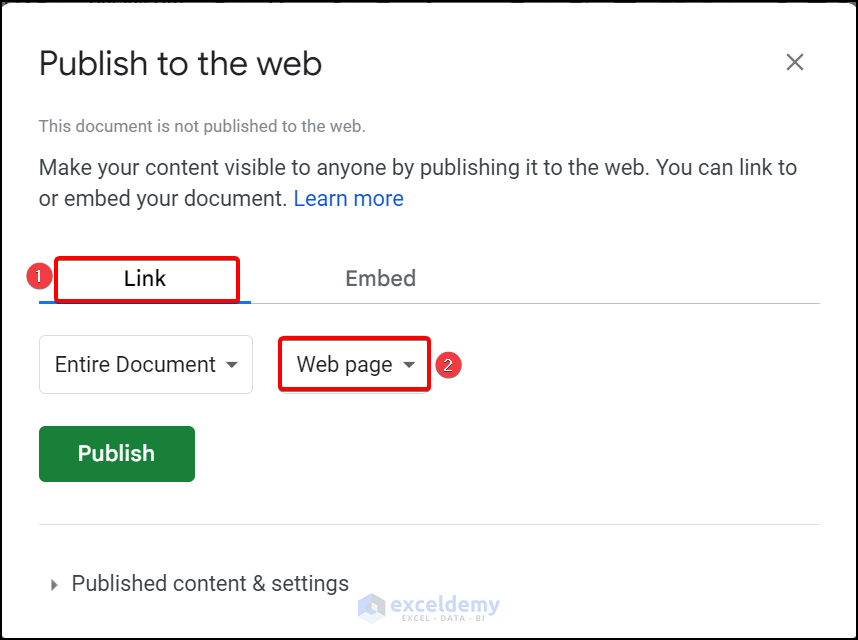

Step 2: Choose a Provider

Selecting the right financial institution or provider for your Individual 401(k) is crucial:

- Consider providers with low fees and good customer service.

- Look for investment options that align with your retirement goals.

- Check for user-friendly platforms or mobile apps for managing your account.

- Understand their policies regarding rollovers, loans, and distributions.

| Provider | Fees | Investment Options | Customer Support |

|---|---|---|---|

| Fidelity | Low | Extensive | Excellent |

| Vanguard | Low | Mutual Funds | Good |

| Charles Schwab | Competitive | Wide Range | Good |

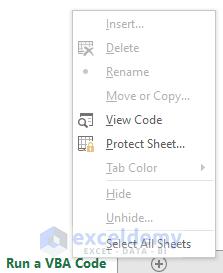

Step 3: Fill Out and Submit the Paperwork

Now comes the administrative part. Here’s what you need to do:

- Download or request the necessary forms from your chosen provider.

- Fill out each form accurately, double-checking all personal and business information.

- Sign all necessary documents; electronic signatures might be accepted by some providers.

- Submit the completed forms either online, via mail, or through your provider’s designated process.

📝 Note: If you’re unsure about any part of the application, don’t hesitate to contact your provider’s customer support for clarification.

Step 4: Fund Your Account

Once your application is approved, you can start funding your Individual 401(k):

- Set up an initial contribution, which can be through payroll deduction if you have employees or via a lump sum payment.

- Understand the contribution limits and deadlines. For 2023, the limit is 20,500, with an additional 6,500 catch-up for those over 50.

- Schedule regular contributions to benefit from dollar-cost averaging.

By following these four steps, you'll have completed your Individual 401(k) paperwork effectively, paving the way for a secure financial future. Remember, the Individual 401(k) is not just a retirement plan; it's an opportunity to invest in your business's growth and your personal wealth. Every step you take now fortifies your financial foundation, ensuring you're ready for the long haul.

What are the benefits of an Individual 401(k)?

+

An Individual 401(k) allows for higher contribution limits, potential tax deductions on contributions, tax-deferred growth on investments, and the ability to borrow from your plan if needed.

Can I set up an Individual 401(k) if I have employees?

+

Yes, but you must include all eligible employees in the plan and meet certain requirements, like covering a minimum percentage of their compensation as a contribution.

What if I make a mistake on my paperwork?

+

Most errors can be corrected. Contact your provider for guidance on how to amend the documents or redo the process if necessary.

Can I contribute both as an employee and employer in an Individual 401(k)?

+

Yes, you can make contributions as both an employee (elective deferrals) and as an employer (profit-sharing or matching contributions), subject to certain limits.