3 Ways to Find Your EIN on Paperwork

Introduction

Discovering your Employer Identification Number (EIN) can sometimes feel like searching for a needle in a haystack, especially when you're inundated with piles of paperwork. An EIN, assigned by the IRS, is a vital number for your business, used for tax purposes, employment, and other legal transactions. This blog post will guide you through three different methods to locate your EIN on various documents to ease your search. Whether you're a new entrepreneur or managing a well-established business, understanding where to find this crucial number is key for your administrative tasks.

Method 1: Your EIN Confirmation Letter

If you've recently applied for an EIN, the most straightforward way to find it is through the IRS confirmation letter:

- Look for Letter CP-575: This is your EIN confirmation letter. It's sent by the IRS to the business address after you apply for an EIN.

- Details to Check: Ensure you're looking at the correct letter by verifying the business name, address, and the EIN itself. This letter contains your EIN on the right side of the page.

💡 Note: Misplacing this letter is common. Keep a digital or hard copy for future reference.

Method 2: Your Business Bank Account Statements

If you've opened a business bank account or have ongoing banking transactions, your EIN might be there:

- Check Statements: Banks often require an EIN to open a business account, so your statements or account documents are potential sources.

- Verify with Your Bank: If your statements don't list it, contact your bank's customer service for verification or access to archived documents.

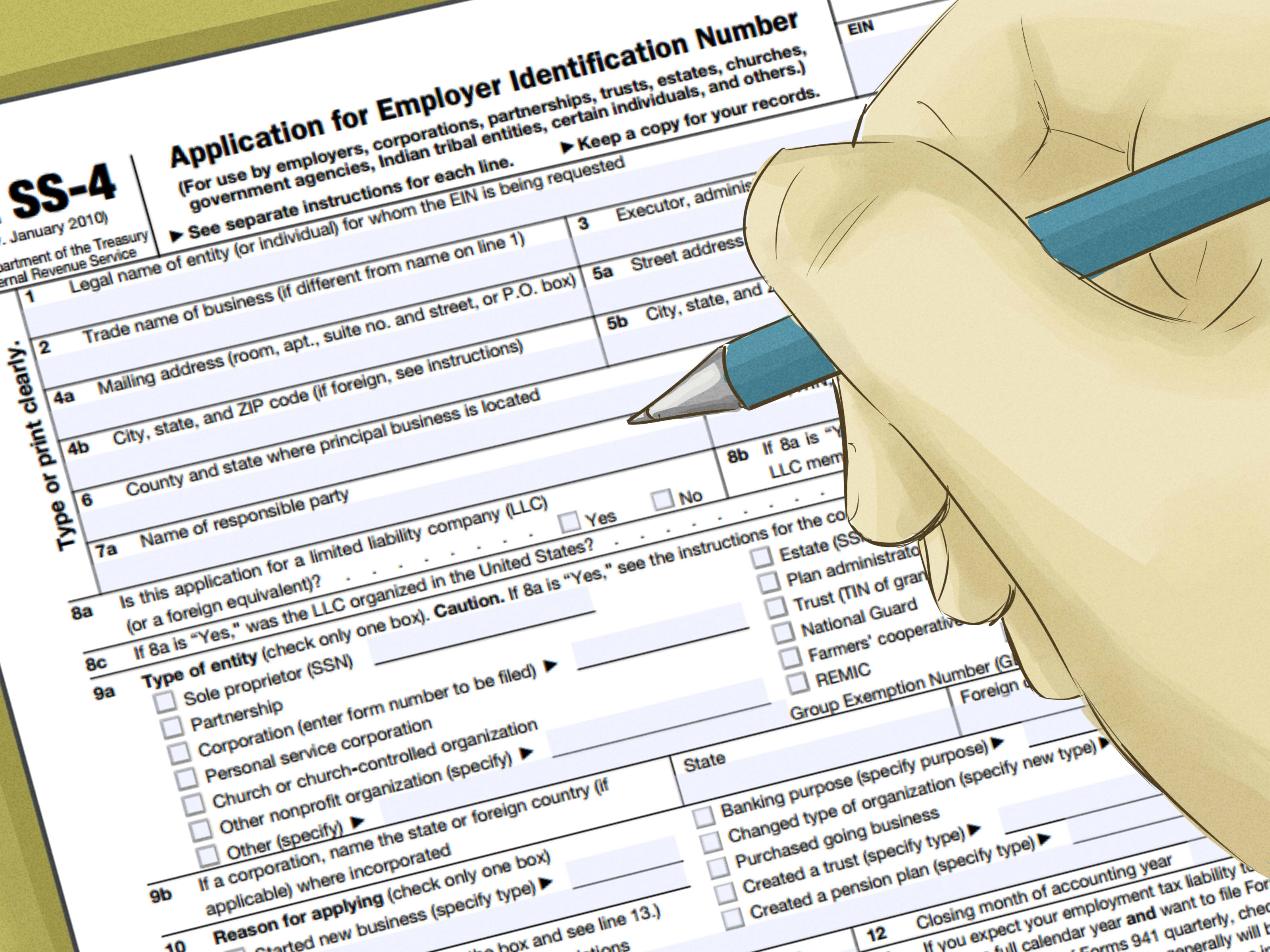

Method 3: Your Company Tax Returns

Every business entity files an annual tax return, making it another excellent source for finding your EIN:

- IRS Form 941: This form for employer’s quarterly federal tax return has your EIN on the top.

- IRS Form 1120/1120S: For corporations, these forms list your EIN near the top.

- Locate Your Returns: Check recent filings or contact your accountant for access to past returns.

📝 Note: Always keep your EIN confidential for security reasons.

| Document | Where to Find the EIN |

|---|---|

| Confirmation Letter CP-575 | Right side of the page |

| Business Bank Statements | Account setup documents or within statements |

| IRS Tax Returns | Top of the form (Form 941, 1120, or 1120S) |

In summary, your EIN is crucial for your business operations, and knowing where to find it can simplify your administrative duties. The three methods highlighted here—your IRS confirmation letter, business bank account statements, and company tax returns—are practical ways to locate this important number. Keeping track of these documents ensures you can access your EIN whenever needed.

Can I use a Social Security Number instead of an EIN for my business?

+

If you’re a sole proprietor or single-member LLC with no employees, you can initially use your SSN. However, obtaining an EIN for business separation, privacy, and growth is advisable.

What should I do if I’ve lost my EIN?

+

You can contact the IRS Business & Specialty Tax Line or your accountant for help in recovering your EIN if lost. Alternatively, use the methods discussed above.

How often do I need to use my EIN?

+

Your EIN is used for various purposes, including opening bank accounts, filing taxes, applying for business licenses, hiring employees, and more, so keeping track of it is beneficial.