File Your Own Paperwork Easily: A Step-by-Step Guide

Getting started with filing your own paperwork can seem daunting, but with the right approach, it's manageable and can even be empowering. Whether you're handling personal taxes, launching a small business, or navigating complex legal documents, understanding the process can save you money and give you more control over your affairs. This guide is designed to walk you through the essentials of managing your paperwork, ensuring you're equipped to tackle any document with confidence.

The Basics of Paperwork Management

Understanding Types of Documents

Before diving into the process, let's categorize the documents you might encounter:

- Legal Documents: Includes contracts, deeds, wills, and other items that have legal implications.

- Financial Documents: Encompasses everything from tax returns to bank statements and receipts.

- Personal Records: Birth certificates, marriage licenses, and other personal identifiers.

- Business Documents: Business licenses, invoices, employee records, etc.

💡 Note: It's beneficial to keep these categories separate for easy access and reference.

Organizing Your Documents

Effective organization is key to managing paperwork efficiently. Here’s how you can do it:

- Create a Filing System: Use folders or binders, labeling each with clear descriptions. Digital tools like cloud storage or document management apps can also be effective for storing paperless documents.

- Date Everything: Keeping documents in chronological order helps in tracking changes over time.

- Electronic vs. Physical: Determine if documents can be digitized. Reduce clutter by scanning important papers and keeping digital copies.

- Set Reminders: For documents that require renewals or updates, set calendar reminders.

Legal Considerations

Filing paperwork often involves legal nuances:

- Keep Originals: Originals are essential for legal documents. Keep them safe, possibly in a fireproof safe.

- Signatures: Ensure all signatures are correctly in place as per legal requirements.

- Witness and Notarization: Some documents require witnessing or notarization. Understand when these are necessary.

Steps to File Your Paperwork

Gather Your Documents

Collect all relevant documents:

- Make a list of what you need.

- Track down any missing documents.

- Have copies made if necessary, but keep originals secure.

Verify Information

Before submission, verify:

- That all names and addresses are correct.

- All numbers, dates, and calculations are accurate.

- Documents are completed, signed, and witnessed where needed.

File Your Documents

Here’s how to file your paperwork:

- Submission Method: Determine if you need to submit documents in person, by mail, or electronically.

- Use Certified Mail: For documents requiring proof of mailing, use certified mail with a return receipt.

- Electronic Filing: If electronic filing is an option, follow the online platform’s guidelines carefully.

- Save Proof of Submission: Always keep proof of filing, whether it’s a receipt, confirmation number, or a tracking number.

Keep Records

Post-filing, maintain your records:

- Organize them chronologically.

- Create digital backups.

- Retain documents according to legal requirements (usually 3 to 7 years).

🗃️ Note: Always check the specific retention periods for different types of documents, as they can vary widely by jurisdiction and document type.

Advanced Tips for Managing Paperwork

Handling Sensitive Documents

When dealing with sensitive information:

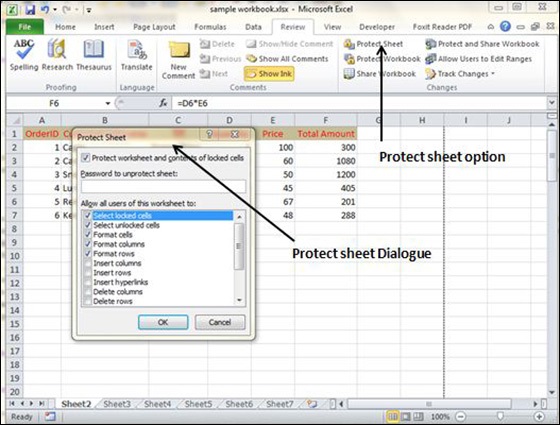

- Secure them with locks or encryption.

- Shred outdated or unnecessary documents.

- Be aware of data privacy laws when storing or sharing personal information.

Streamline Processes

Make filing paperwork simpler:

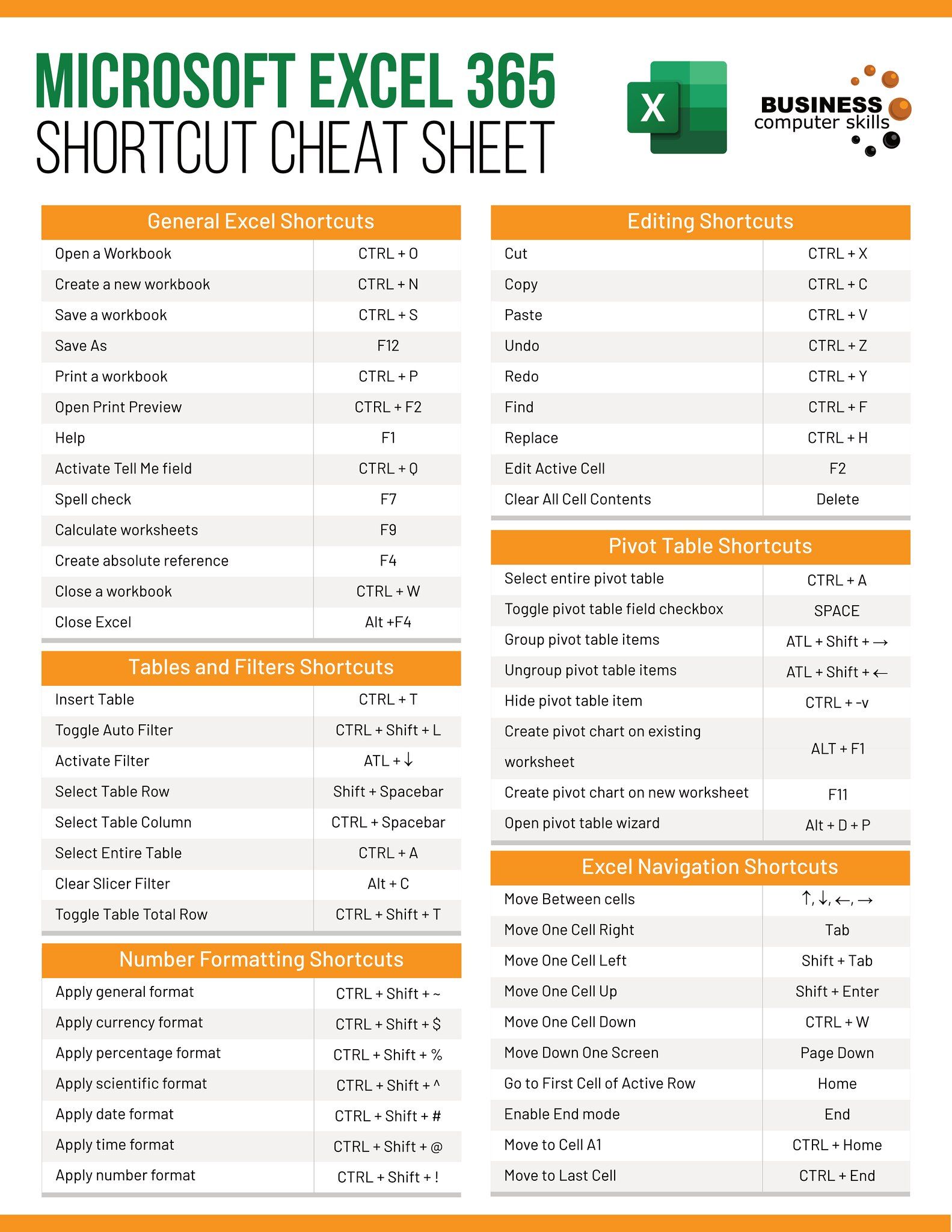

- Automate: Use software for repetitive tasks like tax calculations or reminders.

- Delegation: If managing paperwork is overwhelming, consider hiring services or delegating to trusted professionals.

- Stay Informed: Keep updated on changes in laws or regulations that might affect your documents.

By following these steps and tips, you can simplify the task of filing your own paperwork, making it less of a chore and more of a manageable, even enjoyable, part of your life. This approach not only ensures compliance but also empowers you to take control of your documents, reducing stress and potentially saving you from future headaches.

The Emotional and Practical Benefits of Filing Your Own Paperwork

Managing your paperwork independently has several benefits beyond simply keeping your records in order:

- Empowerment: You gain a better understanding of your financial and legal situation, leading to better decision-making.

- Time and Cost Efficiency: Over time, you'll find that handling your paperwork saves both time and money, avoiding mistakes and the costs of hiring professionals.

- Privacy: Keeping sensitive information in-house reduces the risk of data breaches.

In closing, mastering the art of filing your own paperwork is not just about managing documents. It’s about taking control, understanding your rights and obligations, and making informed decisions. With this guide, you're now better prepared to approach paperwork with confidence, ensuring you're organized, compliant, and in control of your personal and professional life.

How long should I keep financial documents?

+

Most financial documents like bank statements, credit card statements, and paid utility bills should be kept for at least three years. Tax returns, supporting documentation for tax filings, and receipts for major purchases should typically be kept for seven years, in case of an audit. Legal documents or records related to property should be retained indefinitely.

Can I file my taxes without hiring an accountant?

+

Yes, you can file your taxes independently. Many individuals do so successfully using tax preparation software or online tax filing services. These tools guide you through the process, ensuring you meet all necessary requirements. However, if your tax situation is complex or if you are unsure about deductions or credits, consulting with an accountant might be advisable.

What is the best way to dispose of sensitive documents?

+

To dispose of sensitive documents securely, shred them. Use a cross-cut shredder for the highest level of security as it cuts paper into very small pieces, making it difficult to reconstruct. Alternatively, professional shredding services can handle large volumes of documents securely.