5 Ways to Excel in Profit and Expense Sheets

Understanding how to manage and excel in your profit and expense sheets is crucial for financial growth, especially in today's competitive business environment. Here are five detailed methods to help you gain better control and insight into your financial performance:

1. Set Clear Objectives

Before diving into the numbers, define what you’re aiming to achieve with your profit and expense tracking:

- Identify Goals: Are you looking to increase profit margins, reduce expenses, or achieve a specific return on investment?

- Set Financial KPIs: Establish Key Performance Indicators like revenue growth rate, gross margin, and net profit margin.

📝 Note: Objectives should be SMART (Specific, Measurable, Achievable, Relevant, and Time-bound).

2. Implement Comprehensive Expense Tracking

A meticulous approach to expense tracking will give you a clearer picture of where your money is going:

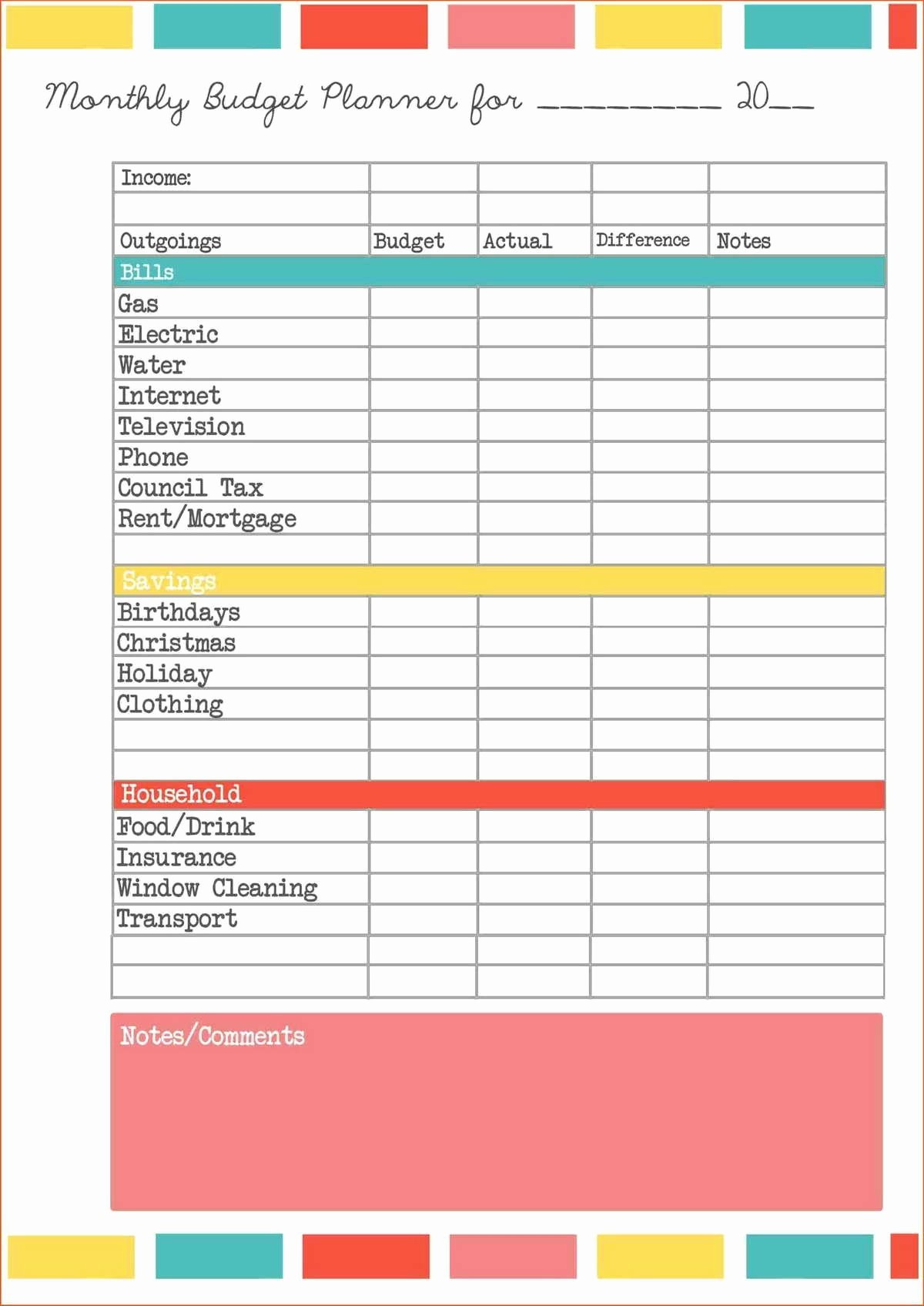

- Categorize Expenses: Organize your expenses into categories such as office supplies, payroll, utilities, marketing, etc.

- Use Cloud-Based Software: Tools like QuickBooks or Xero can automate data entry and provide real-time insights.

🔔 Note: Ensure all expenses are captured; small costs can accumulate over time.

3. Regular Financial Analysis

Analyzing your financial statements regularly is key to understanding your business’s health:

- Conduct Monthly Reviews: Analyze variances between actual and budgeted figures, investigate discrepancies, and make necessary adjustments.

- Track Trends: Look for patterns over several months or years to forecast future financial needs.

4. Optimize Cost Structure

To boost profitability, focusing on cost optimization is essential:

- Negotiate with Vendors: Use your purchasing power to negotiate better terms or bulk discounts.

- Implement Lean Operations: Reduce waste by streamlining processes and eliminating unnecessary expenditures.

💡 Note: Cost-cutting should not compromise product or service quality, as it might lead to long-term losses.

5. Educate and Empower Your Team

Your team’s financial literacy can greatly impact the company’s financial outcomes:

- Hold Workshops: Regular financial training can help employees understand the impact of their decisions on company profitability.

- Encourage Budget Adherence: Make sure departments stay within their budgeted limits, fostering a culture of accountability.

These five methods provide a solid foundation for managing and excelling in profit and expense sheets. By setting clear financial objectives, tracking expenses meticulously, analyzing financial data regularly, optimizing costs, and educating your team, you can enhance your company's financial health. In the journey towards financial mastery, each step plays a critical role in ensuring sustainable growth and stability.

How often should I review my profit and expense sheets?

+

Monthly reviews are standard, but depending on the size and scale of your business, weekly reviews might be more beneficial during periods of significant change or growth.

What should I do if expenses exceed my expectations?

+

Analyze the reasons for the overrun, adjust your budget forecasts, and consider renegotiation with suppliers or cutting non-essential expenses. If necessary, implement stricter control measures.

Can outsourcing help in managing expenses?

+

Yes, outsourcing can lower costs by reducing the need for in-house staff for specific tasks or processes. However, ensure that the quality remains consistent with your standards to avoid future expenses due to subpar performance.