Excel Crew Balance Sheet: Easy Step-by-Step Guide

Understanding how to effectively manage your business finances is crucial for ensuring long-term success. One of the most fundamental tools in financial management is the balance sheet, a snapshot of a company's financial health at any given point in time. For those managing crews or small businesses, mastering the balance sheet can provide insights into profitability, liquidity, and solvency, helping in strategic decision-making. This guide walks through the process of creating and understanding an Excel Crew Balance Sheet step-by-step.

What is a Balance Sheet?

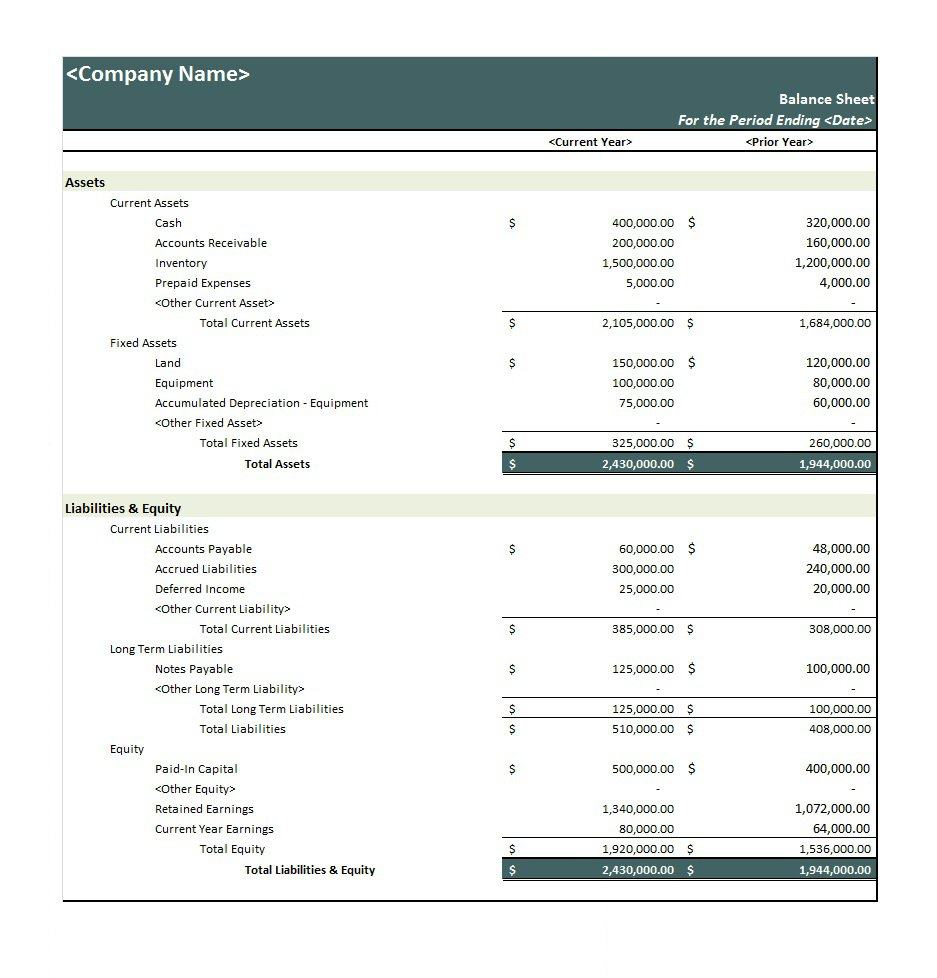

The balance sheet, often referred to as the statement of financial position, lists your company's assets, liabilities, and equity at a specific point in time. Here's a quick overview:

- Assets: What you own or are owed, including cash, inventory, equipment, and receivables.

- Liabilities: What you owe, such as loans, accounts payable, and any other financial obligations.

- Equity: The residual interest in the assets of your business after deducting liabilities, often called "owner's equity" in small businesses.

Step 1: Setting Up Your Excel Sheet

Begin by opening a new Excel workbook:

- Create three columns labeled: Assets, Liabilities, and Equity.

- Below these, list out line items that apply to your business:

- For assets: Cash, Accounts Receivable, Inventory, Equipment, etc.

- For liabilities: Accounts Payable, Loans, Accrued Expenses, etc.

- For equity: Owner's Equity, Retained Earnings, etc.

- Add rows at the bottom to calculate totals for each column.

Step 2: Entering Data

Fill in the numbers:

- In the Assets column, enter the current value of each asset line item.

- In the Liabilities column, record your current financial obligations.

- Calculate Equity as the difference between assets and liabilities, or directly enter your owner's investment and retained earnings.

✏️ Note: Ensure all data entered is up-to-date and accurate. Inaccurate data can lead to misleading financial insights.

Step 3: Formatting Your Balance Sheet

Formatting makes your balance sheet not only readable but also professional:

- Apply bold formatting to headers and totals.

- Use currency formatting for financial figures.

- Add borders or shading to enhance the visual layout.

- Ensure totals for each column align properly; the total assets should equal the sum of total liabilities and equity (A = L + E).

📊 Note: Use color coding sparingly to highlight important areas like discrepancies or crucial figures.

Step 4: Analyzing Your Balance Sheet

With your balance sheet now formatted, here are key analyses to perform:

- Liquidity Analysis: Compare your current assets to current liabilities to assess short-term financial health.

- Solvency Analysis: Evaluate your long-term financial stability by reviewing the ratio of total liabilities to total equity.

- Asset Efficiency: Check how well your assets are being utilized by calculating turnover ratios.

Step 5: Regular Updates and Review

Balance sheets are not static; they evolve with your business:

- Update your balance sheet at least monthly, if not weekly, depending on your business’s pace.

- Regularly review trends over time to understand business growth or issues needing attention.

💡 Note: Consistency in updating your balance sheet helps in tracking progress and making informed decisions.

Creating and maintaining a balance sheet in Excel provides an invaluable snapshot of your business's financial health. With these steps, you can construct a detailed picture of your company's financial status, allowing for better strategic planning and operational adjustments. By understanding what your balance sheet is telling you, you're better equipped to manage finances, ensure business stability, and plan for future growth.

Why is it important to regularly update my balance sheet?

+

Regular updates allow you to monitor your financial health, identify trends, and make timely business decisions.

What if my balance sheet doesn’t balance?

+

Check for errors in data entry, calculations, or missing entries. The balance sheet should balance as Total Assets = Total Liabilities + Equity.

How do I know what to include as an asset or liability?

+

An asset is anything of value that your business owns, whereas liabilities are obligations your business must pay. Typically, assets increase with inflows while liabilities decrease.

Can Excel handle more complex balance sheets?

+

Yes, Excel can manage complex financial statements with additional sheets, linked cells, and more advanced functions. However, for very complex scenarios, specialized accounting software might be more efficient.

What are common mistakes in creating a balance sheet?

+

Common mistakes include misclassifying assets and liabilities, not accounting for depreciation, or forgetting to include all necessary items like prepaid expenses or accrued revenues.