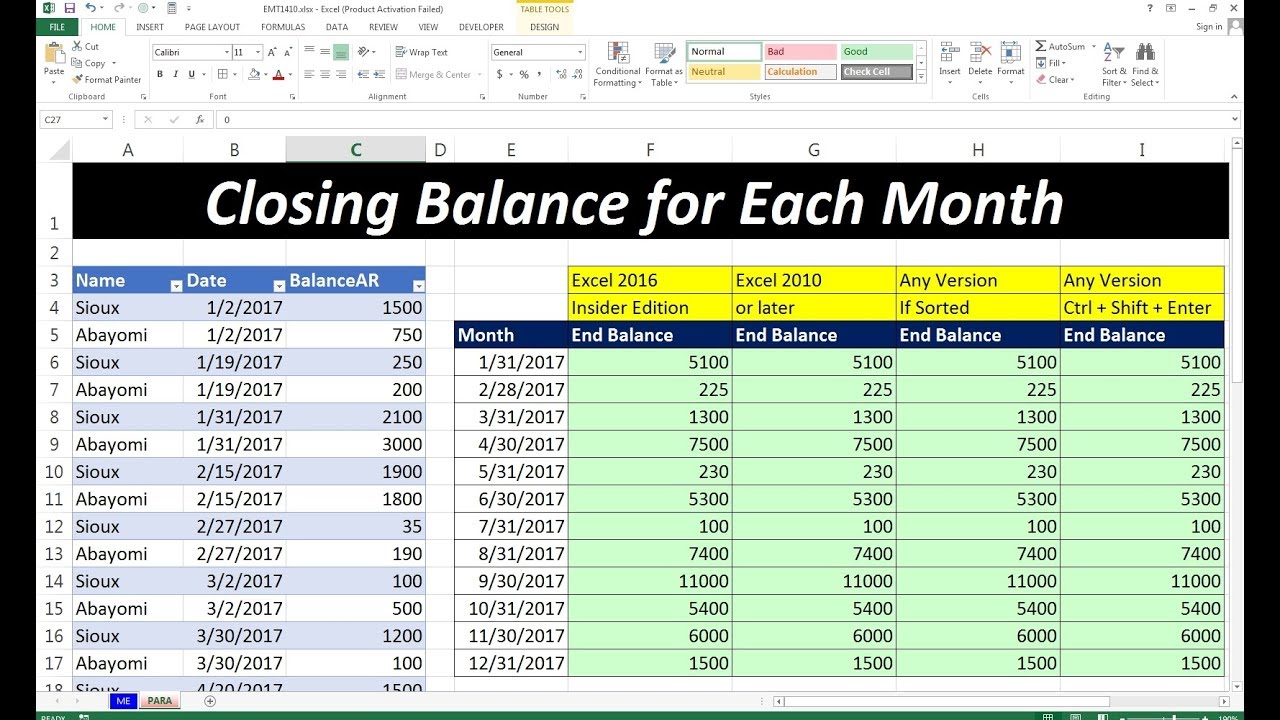

5 Easy Steps to Craft a Balance Sheet in Excel 2010

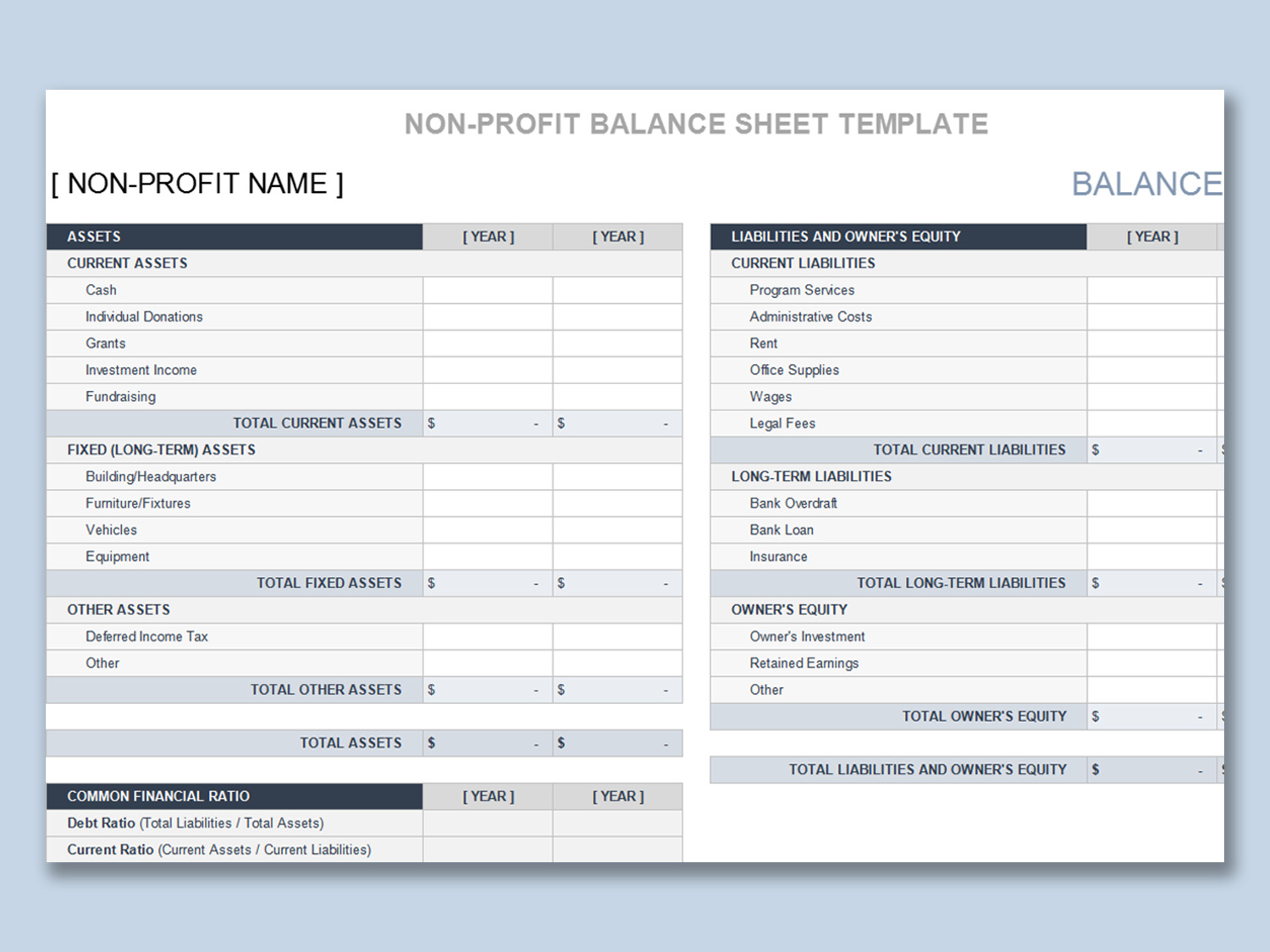

When it comes to understanding the financial health of your business, few tools are as vital as the balance sheet. This document provides a snapshot of your company's assets, liabilities, and equity at any given moment. For entrepreneurs and business owners, crafting an accurate and insightful balance sheet can be pivotal for decision-making. Here, we'll guide you through five easy steps to create a balance sheet using Microsoft Excel 2010.

Step 1: Setting Up the Spreadsheet

Start with a blank Excel spreadsheet:

- Open Excel 2010.

- Create three sections named ‘Assets’, ‘Liabilities’, and ‘Equity’ in columns.

| Assets | Liabilities | Equity |

|---|---|---|

| [Your Assets Here] | [Your Liabilities Here] | [Your Equity Here] |

Organizing your data into these sections will give you a clear, structured format for entering your financial details.

Step 2: Entering Assets

Assets are everything of value your business owns. Here’s how to list them:

- Begin with current assets like cash, accounts receivable, and inventory.

- Follow with fixed assets like land, buildings, and equipment.

⚠️ Note: Be meticulous when categorizing your assets. Incorrect categorization can lead to misinterpretation of financial health.

Step 3: Adding Liabilities

Liabilities are what your business owes. Here’s how to input them:

- Start with current liabilities, which are debts due within a year.

- Then, list long-term liabilities, debts due over a longer period.

Step 4: Calculating Equity

Equity represents the ownership interest in your business. To calculate:

- Total Assets - Total Liabilities = Equity

Ensure all your figures are correct because equity directly reflects the financial stability of your business.

Step 5: Formatting and Review

Now, it’s time to make your balance sheet both readable and professional:

- Use bold and italic text for headers and section titles.

- Apply borders and different shades to visually separate sections.

- Summarize totals using formulas to ensure accuracy.

📝 Note: Review your balance sheet for any errors or discrepancies. Accurate financial reporting is crucial for business integrity.

To wrap up, creating a balance sheet in Excel 2010 is a straightforward process, but it requires attention to detail to reflect your business's financial health accurately. By following these five steps, you've learned to organize and format your financial data, categorize assets and liabilities, and calculate equity. Each element is critical in portraying a clear financial picture of your business, aiding in future planning and decision-making.

Can I use these steps for Excel versions other than 2010?

+

Yes, these steps are generally applicable to most versions of Excel. However, there might be slight variations in user interface and features depending on the version you’re using.

How often should I update my balance sheet?

+

It’s recommended to update your balance sheet at least quarterly or annually, depending on the size and needs of your business.

What if my numbers don’t balance out?

+

If your totals don’t balance, review your entries for any mistakes in asset or liability classification, data entry errors, or formula inaccuracies.